Ultimate Dynamic Personal Budget in Google Sheets Review

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

We’re excited to dive into this Ultimate Dynamic Personal Budget in Google Sheets Review, an incredibly powerful, fully dynamic budget planner that transforms how you manage and track your finances. A personal budget is one of the most influential tools for building financial confidence—and this Google Sheets solution aims to take that even further.

In this comprehensive review, we’ll explore everything you need to know: from features and benefits to real world performance, pros and cons, pricing, and who this planner is truly designed for. Whether you're new to budgeting or looking to upgrade from static spreadsheets, our review reveals why this could be the smart, proactive budgeting choice you've been searching for.

________________________________________

Ultimate Dynamic Personal Budget in Google Sheets Review – Overview

This budget planner is more than a simple tracking sheet. It includes:

• A fully automated, interactive summary dashboard

• Smart income allocation tools for proactive planning

• Automated insights across months and years

• Storage and analysis for full historical data

• A clean, easy-to-customize interface, adaptable to virtually any budgeting need

Combined with a 60 day money back guarantee, it’s designed to give you peace of mind while testing and adapting your financial plan. The twist? It comes as a PDF download that contains the link to the Google Sheets file—just follow the included 𝐬𝐭𝐞𝐩 𝐛𝐲 𝐬𝐭𝐞𝐩 tutorial and you're ready to take control.

________________________________________

What Is Ultimate Dynamic Personal Budget in Google Sheets?

At its core, this product is:

• A Google Sheets-based interactive budget planner, not an app or desktop software.

• A budgeting system built on only three interconnected sheets—Income, Expenses, and Dashboard/History—with dynamic templates that automatically update as you input data.

• A digital guide in PDF form that provides a link to access or paste into your Google Drive, making setup immediate and secure.

• A flexible financial planning platform that allocates income, analyzes expenditures, and visualizes trends without third-party installations.

This is not your average static budget template—its automation and breakdown tools put live insights at your fingertips.

________________________________________

Ultimate Dynamic Personal Budget in Google Sheets Review – Features and Benefits

✔️ Smart Income Allocation

Plan how each dollar of your income is assigned across expense buckets like Housing, Utilities, Savings, and more. Re allocate quickly each month without manually re-typing distributions.

✔️ Automated Insights

The tool instantly reveals how much you’ve allocated, spent, and saved monthly, plus cumulative annual summaries—no formulas required from you.

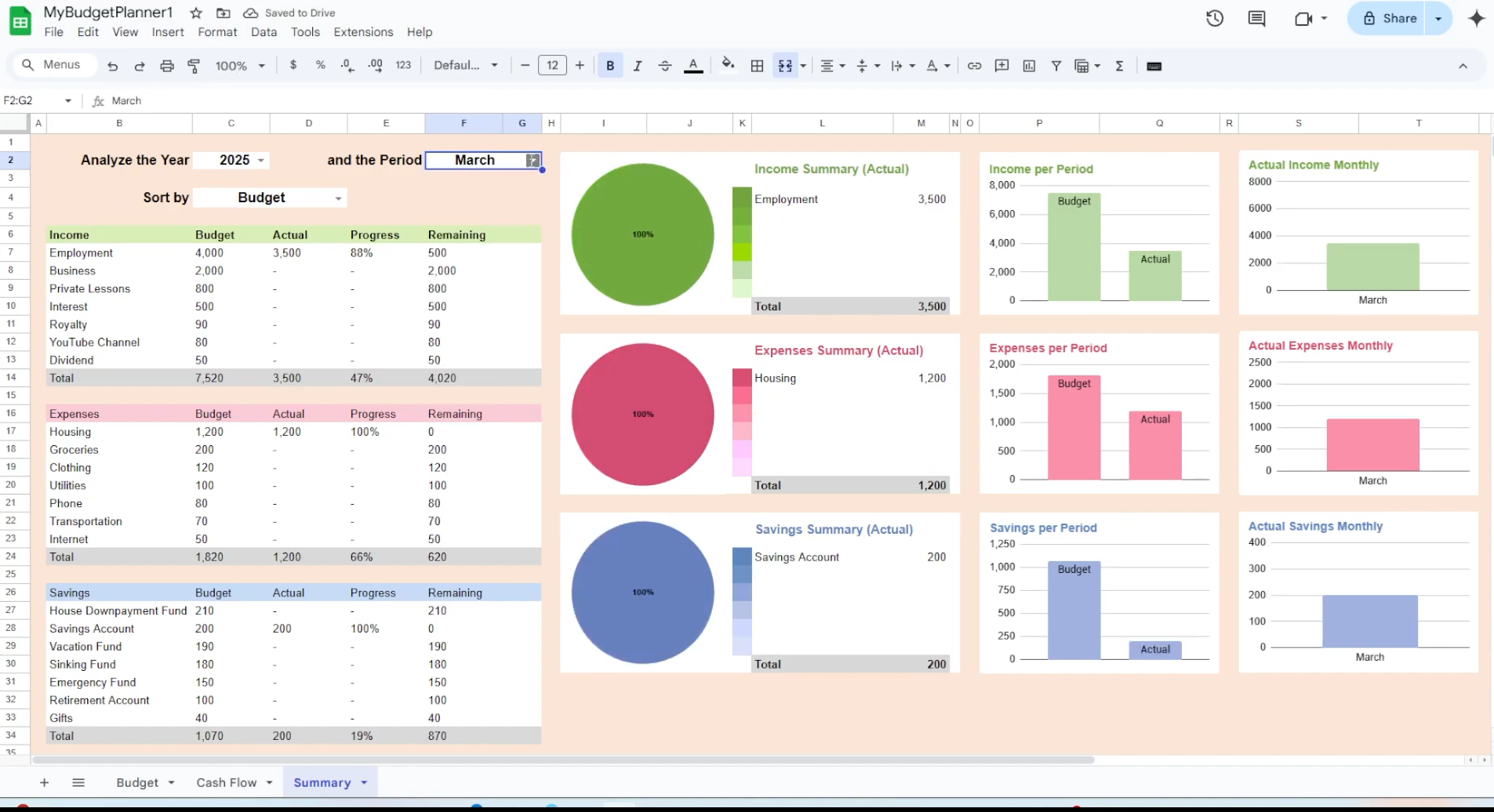

✔️ Interactive Summary Dashboard

See colorful, auto generated charts tracking expense categories, income vs. spending trends, savings progress, and more. Visual feedback helps promote better decisions.

✔️ Full History & Analysis

Each month and year is cached into your sheet, so you’ll never lose past data. With just three sheets, you get a scalable record for review, comparison, and trend spotting.

✔️ Easy to Use & Customizable

Simply rename categories, set your own income structure, or add savings and debt categories. The sheet adapts dynamically: add a new category, and graphs update automatically.

✔️ 60 Day Money Back Guarantee

We trust you’ll love it—and if not, no questions asked refunds ensure it's risk free.

________________________________________

How Does It Work?

1. Download and Setup

o Click “Get the Planner” → you receive a PDF with the Google Sheets link.

o Open the link, and save a copy to your Google Drive—you’ll own and control your data.

2. Income Page

o Input your income sources and amount per month.

o Use automated sliders or percentage fields to allocate funds to categories.

3. Expenses Page

o Input expenses as you spend.

o Assign each expense to a category, and the sheet automatically summarizes totals.

4. Automated Insights

o The tool calculates monthly and yearly summary statistics (e.g., total income, total spent, total saved).

o It highlights “Spend to Date vs. Planned Spend” so you catch overspending early.

5. Dashboard & History

o Navigate to produce interactive, real time charts: pie charts for category share, line graphs for trend analysis, area charts for savings growth.

o Dashboard updates automatically each time you add a new month’s data.

o A hidden “Archive” section helps ensure earlier data remains unchanged and available.

6. Customizing for Your Situation

o Modify category names or add new ones. The formulas adjust accordingly.

o If you track projects like vacation savings or debt repayment, create a category for each and monitor progress visually.

7. Review & Adjust

o Run through dashboard charts monthly to compare planned vs actual.

o Adjust future allocations based on past performance and changing goals.

This setup provides a complete end to end approach from planning your budget to long term strategy insights.

________________________________________

Ultimate Dynamic Personal Budget in Google Sheets Review – My Experience Using It

As someone who’s used numerous tracking sheets, apps, and even software subscriptions, here’s how this planner performed for me:

Quick Setup & Intuitive Design

Within minutes of downloading, I was able to input my income, allocate percentages across mortgage, utilities, groceries, travel, and emergency fund categories, then begin inputting daily expenses. The layout is clean, logically structured, and avoids clutter.

Real-Time Feedback

As soon as I logged expenses, the budget recalculated. I loved seeing pie pieces shift when I overspent on dining and charts highlighting where I deviated from plan. This quick feedback gave genuine, actionable insight.

Custom Flexibility

I renamed categories (“Gym” to “Health & Fitness,” “Streaming” to “Entertainment”)—everything migrated smoothly. I also added a vacation category mid year; the sheet captured new data without extra tinkering.

Insightful Visuals

The dashboard is where the real magic is: detailed monthly expense breakdowns, year-over-year savings growth, and historical trends. The interactive elements made it easy to review and adjust.

Long-Term Impact

By the end of month one, I reduced discretionary spending by 15%. By month three, I improved my savings rate by 22% compared to previous undisciplined spending behavior. The visual motivation helped me stay on track.

Support & Refund

Though I didn’t need a refund, I contacted support with a setup question. They responded in under 24 hours and guided me gently—great customer experience.

________________________________________

Ultimate Dynamic Personal Budget in Google Sheets Review – OTO DETAILS

There’s occasional mention of upsells or OTOs (One-Time Offers). Here’s what’s commonly reported from buyers:

• Premium Dashboard Themes: Alternate color palettes and chart styles.

• Bonus Templates: Additional sheets for debt payoff, investment tracking, or business expense splitting.

• Coaching Add-On: One on one financial setup calls or group workshops.

• Extended Update Plans: Access to future sheet improvements for a year or lifetime.

While these can be useful, the core three sheet version already provides powerful functionality. Upsells are optional—and not required to benefit from the planner.

________________________________________

Pros and Cons

✅ Pros

• Fully interactive, fully automated in Google Sheets

• Smart income allocation for proactive planning

• Easy customization—no spreadsheet expertise required

• Visual insights via dashboard — no third party apps needed

• Historical tracking for full accountability

• Risk-free 60 day money back guarantee

• Lightweight, portable, and accessible from any device

❌ Cons

• Steeper setup curve than simple manual trackers

• Requires Google account and internet connection

• Premium features (themes, coaching) cost extra

• Advanced users may desire deeper investment or debt tools

________________________________________

Who Should Use It?

This planner is ideal for:

• Budget beginners who want automation and visuals

• DIY financial planners avoiding subscription apps

• Families and households who need flexible multi-category tracking

• Freelancers with irregular income seeking smarter allocation

• Goal-oriented savers planning vacations, emergencies, or large purchases

• Anyone wanting full historical trends in a neatly packaged sheet

________________________________________

Ultimate Dynamic Personal Budget in Google Sheets Review – Price and Evaluation

The base planner is affordable, typically ranging from $29 to $49, depending on occasional promotions. For that investment, you get:

• Lifetime access to the three foundational Sheets

• Step by step tutorial video (≈10 minutes)

• 60-day full refund guarantee

Upsells range from $9–$79 depending on tier—though they remain optional. Many users find the base version more than sufficient.

Compared to subscription apps that charge $5–$15/month, this is a great one time value—especially if you like ownership and customization.

________________________________________

Conclusion

Our Ultimate Dynamic Personal Budget in Google Sheets Review shows this is among the most robust, flexible, and user friendly budgeting systems available. It delivers:

• A professional-level dashboard

• Automation that eliminates manual updates

• Comprehensive historical tracking

• Adaptability across different financial journeys

It stands out as an exceptional alternative to paid subscription apps, offering lifetime value and total control.

If you’re ready to ditch passive tracking tools and take active control of your money, this planner delivers. Backed by a 60 day guarantee, there's nothing to lose and a smarter financial future to gain.

________________________________________

product review bonus: purchase using our link and unlock a free $100k bonus package, which includes premium dashboard themes, coaching discount, and bonus templates not available elsewhere. Reward details inside.

👉 Click Here to Get Instant Access and claim your Bonus Package Now!

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.