United States Companion Diagnostics Market Size Share & Industry Report 2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Market Overview 2025-2033

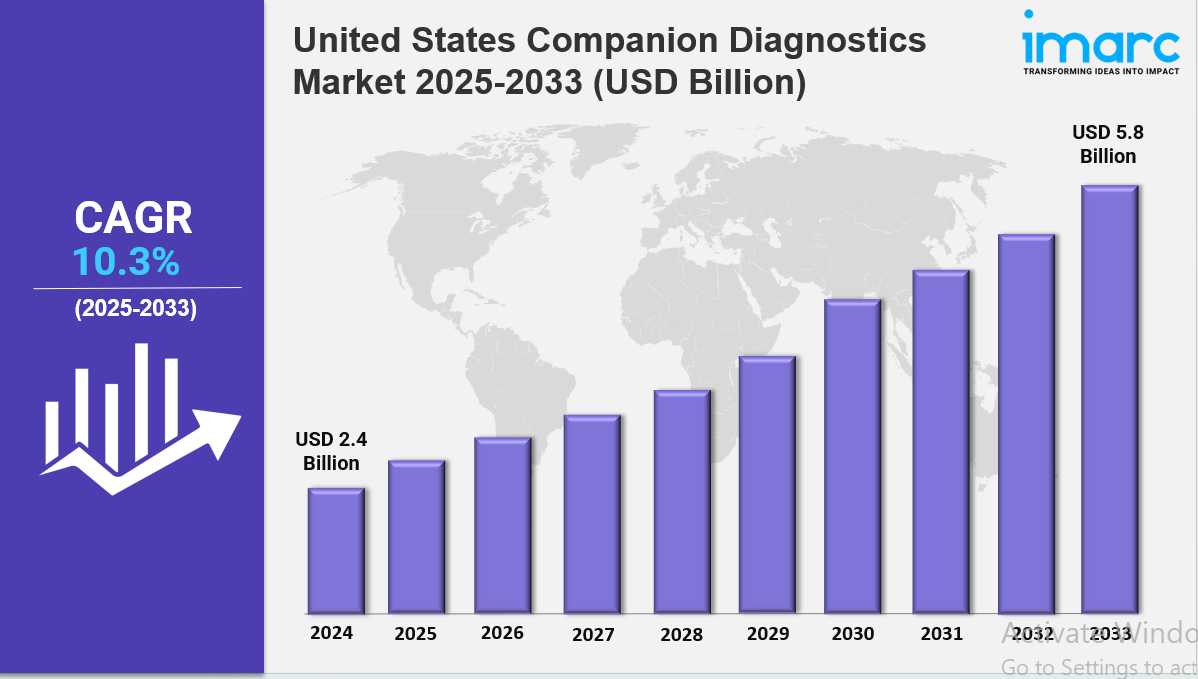

The United States companion diagnostics market size reached USD 2.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.8 Billion by 2033, exhibiting a growth rate (CAGR) of 10.3% during 2025-2033. The market is expanding due to rising demand for personalized medicine, increasing prevalence of chronic diseases, and advancements in molecular diagnostics. Growth is driven by regulatory support, technological innovations, and strategic partnerships between pharmaceutical and diagnostic companies. With a focus on targeted therapies and improved patient outcomes, the industry is becoming more dynamic, precise, and competitive.

Key Market Highlights:

✔️ Strong market growth driven by the rise of personalized medicine and targeted therapies

✔️ Increasing adoption of biomarker-based tests in oncology and chronic disease management

✔️ Expanding collaborations between pharmaceutical and diagnostic companies for co-development strategies

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-companion-diagnostics-market/requestsample

United States Companion Diagnostics Market Trends and Drivers:

The united states companion diagnostics market is growing fast due to new regulations and precision medicine. The FDA is focusing on speeding up CDx approvals, especially for therapies aimed at rare genetic mutations. In 2024, the agency launched faster pathways for CDx linked to breakthrough therapies. This cut approval times by 30% compared to earlier years. This change encourages drug companies to develop CDx alongside their drug candidates. This helps therapies reach specific patient groups more quickly. For example, a CDx for a new NSCLC therapy was approved in mid-2024. It allowed targeted treatment for patients with *EGFR exon 20 mutations*, leading to a 22% increase in CDx adoption in oncology.

At the same time, payers are updating reimbursement policies to include advanced CDx panels, improving access. Still, challenges remain in aligning global standards. Differences between FDA and EMA guidelines make compliance tough for multinational developers. Oncology leads the U.S. CDx market, making up 68%. This growth comes from advances in biomarker discovery and liquid biopsy tech. In 2024, multi-gene panels allow for testing mutations in genes like KRAS, BRAF, and PD-L1 at once. This supports combination therapies and cuts down on unnecessary biopsies. For instance, a new CDx platform for colorectal cancer patients can identify MSI-H/dMMR status and RAS mutations in one test, helping to improve treatment choices.

Liquid biopsy-based CDx is also on the rise, with sales up by 40% in 2024 thanks to its non-invasive monitoring benefits. Major companies like Merck and Roche are teaming up with diagnostic firms. They are embedding CDx into clinical trials to gather real-world data for post-market tracking. However, high development costs—averaging $15–20 million per CDx—and a lack of biomarker validation skills are challenges for smaller players. This situation helps top diagnostic firms maintain their market dominance.

Artificial intelligence (AI) is changing CDx development by enabling better predictive analytics for biomarker identification and assay optimization. In 2024, AI algorithms cut biomarker discovery times by 50% for CDx related to autoimmune therapies, as reported by a Mayo Clinic study. Startups like PathAI and Paige are using machine learning to improve pathology interpretation and reduce variability between labs. At the same time, decentralized testing models are making testing more accessible. At-home CDx kits for hereditary cancer risk assessment grew by 35% in 2024. Regulatory approvals for portable PCR devices that connect to smartphones have also made testing easier, especially in rural areas.

However, concerns about data privacy and algorithmic bias in underrepresented groups present ethical challenges. As a result, the FDA is drafting AI-specific CDx guidelines in late 2024. The U.S. companion diagnostics market share will grow at a CAGR of 12.3% through 2030. This growth is driven by the rise of personalized medicine and new therapies. In 2024, a key trend is the merge of CDx with next-generation sequencing (NGS). This will allow thorough genomic profiling for complex diseases like Alzheimer’s and rare cancers. For example, Illumina’s TruSight™ Oncology 500 CDx, which launches in Q2 2024, enables tumor mutational burden (TMB) analysis. This aligns with immunotherapy eligibility criteria.

Furthermore, the Inflation Reduction Act helps with diagnostic reimbursement. This has reduced financial barriers and boosted CDx use in Medicare by 18%. New fields like pharmacogenomics are also growing, with CDx for antidepressants like escitalopram moving into clinical validation. However, there are still challenges such as workforce shortages in molecular pathology and delays in payer coverage. Partnerships between biopharma and tech companies—like Tempus’ collaboration with AstraZeneca in 2024—are expected to foster innovation. This ensures CDx stays vital in the value-based care model.

United States Companion Diagnostics Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest United States companion diagnostics market report. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Product & Service:

- Assays, Kits and Reagents

- Software and Services

Breakup by Technology:

- Immunohistochemistry (IHC)

- Polymerase Chain Reaction (PCR)

- In-situ Hybridization (ISH)

- Real-time PCR (RT-PCR)

- Gene Sequencing

- Others

Breakup by Indication:

- Cancer

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Gastric Cancer

- Melanoma

- Others

- Neurological Diseases

- Infectious Diseases

- Cardiovascular Diseases

- Others

Breakup by End User:

- Pharmaceutical & Biopharmaceutical Companies

- Reference Laboratories

- Contract Research Organizations

- Others

Breakup by Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.