United States Healthcare Discount Plan Market Size, Share, Trends, Industry Analysis, Report 2025-2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Market Overview 2025-2033

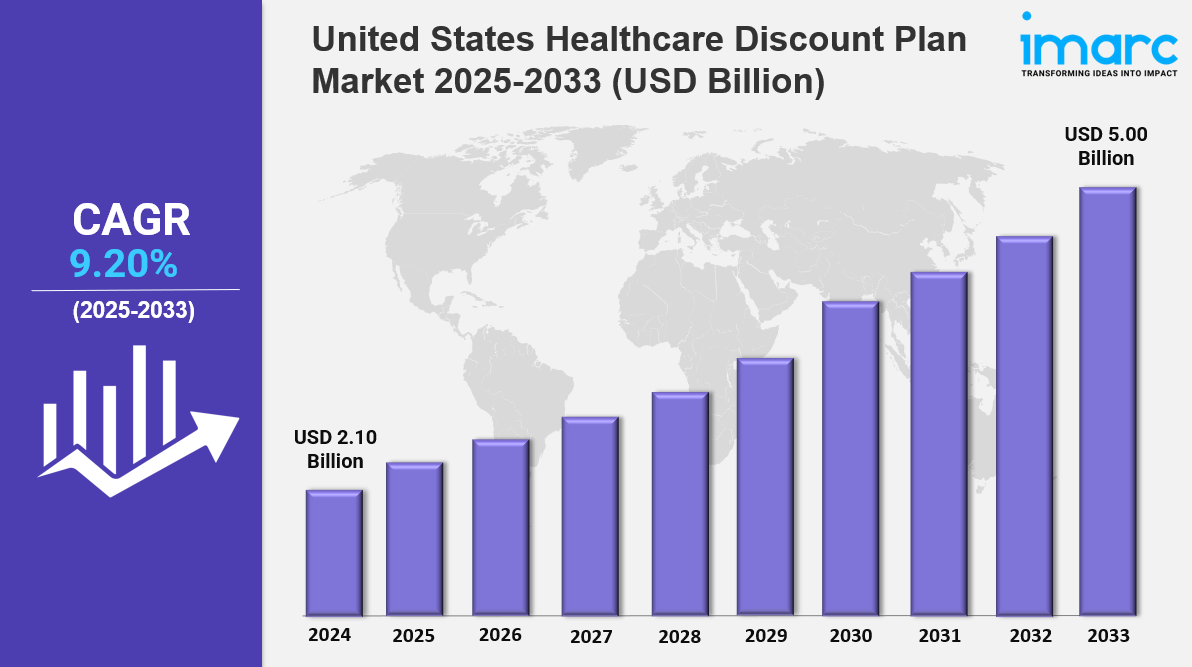

The United States healthcare discount plan market size reached USD 2.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.00 Billion by 2033, exhibiting a growth rate (CAGR) of 9.20% during 2025-2033. The market is expanding due to rising healthcare costs, increasing demand for affordable medical services, and growing consumer awareness. Digital platforms, employer-sponsored plans, and regulatory support are key factors driving industry growth.

Key Market Highlights:

✔️ Strong market growth driven by rising healthcare costs and demand for affordable medical services

✔️ Increasing adoption of subscription-based discount plans for dental, vision, and prescription services

✔️ Expanding partnerships between healthcare providers and discount plan networks

Request for a sample copy of the report: https://www.imarcgroup.com/united-states-healthcare-discount-plan-market/requestsample

United States Healthcare Discount Plan Market Trends and Drivers:

The United States healthcare discount plan market is experiencing consistent growth, fueled by rising healthcare expenses and increasing gaps in traditional insurance coverage. With premiums, deductibles, and copayments continuing to climb, a growing number of middle-income families, gig workers, and uninsured individuals are seeking cost-effective alternatives to manage medical expenses. According to the 2024 Kaiser Family Foundation report, nearly 43% of adults under 65 reported difficulty paying medical bills—underscoring the urgent need for accessible, affordable healthcare solutions and highlighting the relevance of the U.S healthcare discount plan market.

Discount healthcare plans have gained traction by offering reduced rates on essential services such as prescription drugs, dental care, vision checkups, and telehealth consultations. Companies like GoodRx and Careington International have seen membership growth surge by 22% in 2024, a clear indicator of increased consumer trust and rising participation. This momentum is directly contributing to the expansion of the United States healthcare discount plan market share, especially among populations underserved by conventional insurance models.

A notable shift within the industry involves traditional insurers like Aetna and Cigna, which are integrating discount networks into high-deductible health plans. This move represents a broader evolution toward hybrid healthcare models that blend insurance coverage with value-driven services. As these discount plans become a core part of the mainstream benefits ecosystem, their role in shaping the future of the United States healthcare discount plan market is becoming undeniable.

Technology is also accelerating market development. AI-powered platforms from innovators like HealthAxis and WellWallet now offer personalized plan suggestions, bundling discounts for prescriptions, mental health services, and dental visits based on user health data. These advancements are not only improving customer experience but also strengthening the United States healthcare discount plan market share by making discount memberships more useful and efficient.

Telehealth continues to be a vital offering within discount plans, with over half now including virtual consultations—a shift confirmed by a 2024 McKinsey survey. As patients seek on-demand care with reduced costs and minimal friction, this feature has become central to United States healthcare discount plan market trends. However, the digital boom also brings challenges. The Department of Health and Human Services reported a 31% increase in data breaches involving discount plan platforms in Q2 2024, prompting calls for enhanced cybersecurity.

Regulatory oversight is evolving to support the market's growth. Following a series of Federal Trade Commission actions against deceptive marketing, 28 states have introduced new laws mandating pricing transparency and outcome clarity. The National Association of Insurance Commissioners is also working on an accreditation framework to help consumers identify reputable discount plans—an important step in shaping a trustworthy U.S healthcare discount plan market.

Financial policy changes are helping too. The IRS's decision to recognize discount plan memberships as Qualified Medical Expenses under Health Savings Accounts (HSAs) has elevated the status of these plans within personal financial strategies. This development is particularly significant for individuals focused on long-term, tax-advantaged healthcare planning.

Large healthcare organizations are adjusting accordingly. UnitedHealthcare’s Surest division is emphasizing compliance and innovation, reflecting how discount plans are shifting from niche offerings to mainstream solutions. A recent JAMA study revealed that 29% of ACA marketplace enrollees now use discount memberships to avoid being underinsured. Additionally, around 41% of mid-sized U.S. employers have started offering discount plans as voluntary benefits to attract and retain talent without inflating healthcare premiums.

Regionally, the United States healthcare discount plan market is expanding most rapidly in states like Texas and Florida, where high rates of uninsured residents and aging populations are fueling demand. These Sun Belt regions now account for 37% of national growth, positioning them as focal points in ongoing United States healthcare discount plan market trends.

Looking ahead, strategic partnerships with major retailers like CVS and fintech companies offering HSA-integrated platforms will likely define the next phase of the market. As healthcare costs continue to rise, the United States healthcare discount plan market outlook remains highly optimistic, offering Americans flexible, affordable options to bridge coverage gaps and improve access to essential care.

United States Healthcare Discount Plan Market Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest United States healthcare discount plan market report. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

Study Period:

Base Year: 2024

Historical Year: 2019-2024

Forecast Year: 2025-2033

Breakup by Service:

- Health Advocate

- Virtual Visits

- Alternative Medicines

- Prescription Drugs

- Dental Care

- Vision Care

- Hearing Aids

- Chiropractic Care

- Nurse Services

- Vitamins and Supplements

- Wellness Plans

- Podiatry Plans

- Others

Breakup by Region:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The market research report offers an in-depth analysis of the competitive landscape, covering market structure, key player positioning, top winning strategies, a competitive dashboard, and a company evaluation quadrant. Additionally, detailed profiles of all major companies are included.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.