US Mutual Fund Market Overview, Industry Growth Rate, Research Report 2025-2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Mutual Fund Market - US

✍️ Do you know how SIPs use the concept of rupee cost averaging? Our explainer on mutual fund SIPs shows how small, regular investments lower risk and build wealth steadily over time.

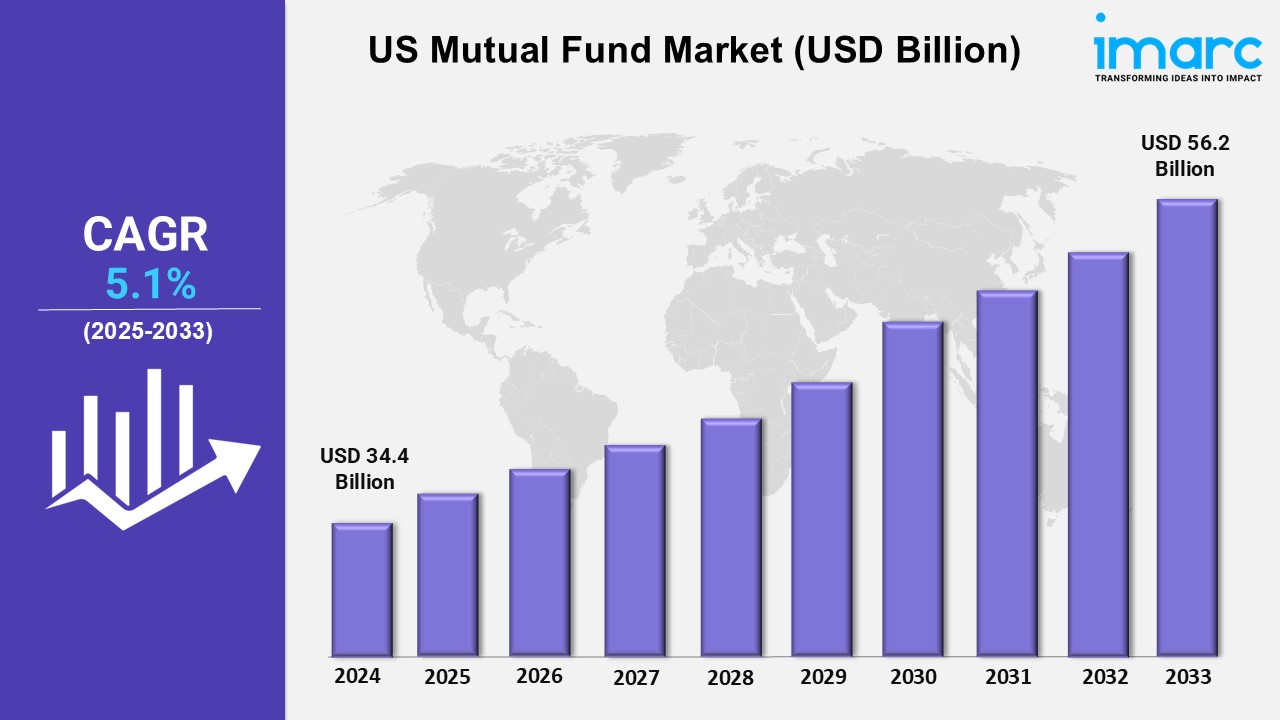

Market Statistics

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 34.4 Billion

Market Size in 2033: USD 56.2 Billion

Market Growth Rate (CAGR) 2025-2033: 5.1%

According to IMARC Group's report titled "US Mutual Fund Market Report and Forecast 2025-2033," the market reached USD 34.4 billion in 2024. Looking forward, IMARC Group expects the market to reach USD 56.2 billion by 2033, exhibiting a growth rate (CAGR) of 5.1% during 2025-2033.

US Mutual Fund Market Trends and Drivers:

- The US mutual fund market is undergoing dynamic change driven by multiple factors reshaping the investment space and investor sentiments.

- Rising individual incomes and increased discretionary spending have boosted investor participation, supported by a strong economic environment and growing market liquidity.

- Rapid digitalization of financial services is enhancing accessibility through advanced online portals and mobile applications, facilitating research, trading, and portfolio management.

- The shift toward passive investment strategies and index funds is driving massive inflows into low-cost mutual funds, emphasizing cost efficiency and long-term performance.

- Evolving regulatory frameworks and stricter transparency requirements are strengthening investor confidence by ensuring compliance with high portfolio management standards.

- Advances in big data analytics and AI are improving risk evaluation, asset allocation optimization, and personalized investment guidance, enhancing the overall mutual fund value proposition.

- Growing interest in socially responsible and sustainable investing is reshaping fund strategies, integrating ESG factors into portfolio construction and performance assessment.

- Increasing global economic integration and international market expansion are offering diversified investment opportunities, reducing risks and enhancing growth potential.

- Competitive pressures in the asset management industry are fostering innovation and efficiency, with fund sponsors refining products and marketing strategies to attract and retain investors.

- The rise of robo-advisory services is complementing traditional mutual fund channels, providing cost-effective automated investment solutions for tech-savvy investors seeking data-driven financial advice.

- The overall transition toward a technology-driven and investor-centric financial system is fostering a vibrant ecosystem for mutual funds, ensuring the US mutual fund market remains a vital part of the investment landscape while adapting to evolving market conditions and investor preferences.

US Mutual Fund Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest US mutual fund market share. It includes forecasts for the period 2025-2033 and historical data from 2019-2024 for the following segments.

Fund Type Insights:

- Equity

- Bond

- Hybrid

- Money Market

Investor Type Insights:

- Households

- Institutions

Channel of Purchase Insights:

- Discount Broker/Mutual Fund Supermarket

- Distributed Contribution Retirement Plan

- Direct Sales from Mutual Fund Companies

- Professional Financial Adviser

Regional Insights:

- Northeast

- Midwest

- South

- West

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2019-2024)

- Market Outlook (2025-2033)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services.

IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.