What Is Automated Invoice Capture Software and How Does It Work?

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Introduction

Businesses are searching more and more for methods to improve efficiency and streamline operations in the fast-paced business world of today. Invoice management is one area where companies can achieve notable progress. One crucial tool that helps businesses save time and cut down on errors in this area is automated invoice capture software. However, what is it and how does it operate? Let's dissect it.

What Is Automated Invoice Capture Software?

A technology called automated invoice capture software was created to assist companies in automatically gathering, processing, and managing invoices. This software quickly and accurately extracts important information from invoices using cutting-edge technologies rather than manual data entry. The objective is to increase overall productivity by streamlining and speeding up the invoicing process and removing human error.

Businesses of all sizes, from start-ups to multinational corporations, can benefit greatly from this solution if they want to increase operational efficiency.

How Does Automated Invoice Capture Software Work?

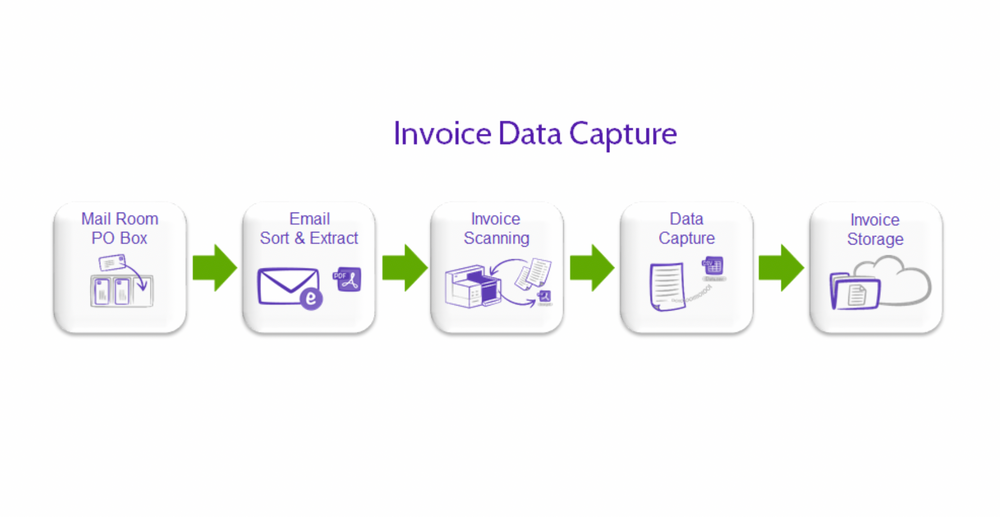

To expedite the invoicing process, automated invoice capture software combines a number of technologies, such as machine learning, optical character recognition (OCR), and data extraction algorithms. Here is a thorough, step-by-step breakdown of how it operates:

1. Invoice Receipt

When invoices in different formats, such as paper documents, PDFs, or email attachments, are received, the process starts. Any kind of incoming invoice, digital or physical, can be processed by automated invoice capture software.

2. Recognition and Scanning

OCR technology scans and transforms the images on paper invoices into legible text. Important information such as the invoice number, vendor details, date, and total amount is identified by the software. Even handwritten text can be recognized by OCR technology, though how well it does so depends on the handwriting's quality.

3. Data Extraction

Once the invoice has been scanned, the software retrieves important information like:

Vendor Name: The business or person that sent the bill.

Invoice Number: The invoice number is a special identification number for the invoice.

Date of Invoice: The day the invoice was sent out.

Total Amount: The entire amount owed.

Due Date: The day on which the payment is due.

For additional processing, the software arranges this data in a digital format.

4. Verification of Data

The software compares the extracted data with the company's current records. This guarantees the accuracy of the data and confirms the invoice's legitimacy. For instance, it verifies that the invoice amount corresponds with the terms that were agreed upon and that the vendor name matches those of an existing supplier.

5. Approval Workflow

The invoice moves into the approval workflow once the data has been confirmed. Managers or other authorized staff can examine the invoice details in this step and decide whether to accept or reject payment. Reminders may be sent by automated software to make sure no invoice is missed during this approval procedure.

6. Processing Payments

The software transfers the data to the business's accounting system for processing payments after the invoice has been approved. Additionally, a lot of systems have direct integrations with payment platforms, allowing companies to promptly pay invoices from within the program.

7. Reporting and Archiving

The software saves a digital copy of the invoice and associated information for later use after payment has been processed. This guarantees that companies keep well-organized records for future research, taxation, and audits. The program can also produce reports that offer information on unpaid invoices, payment patterns, and other important financial indicators.

Benefits of Automated Invoice Capture Software

Using automated invoice capture software has several advantages that can significantly improve company operations.

Saving Time

Processing invoices by hand takes a lot of time and is prone to mistakes. Automated software expedites the process, freeing up staff members to concentrate on more strategic duties while the program takes care of the tedious work.

Precision

Manual data entry is prone to human error, particularly when dealing with large numbers of invoices. By drastically lowering the possibility of errors, automated invoice capture software guarantees precise data entry and more trustworthy financial records.

Cutting Expenses

Businesses can reduce labor expenses and steer clear of expensive errors like overpaying invoices or missing payment deadlines by increasing accuracy and reducing manual labor.

Enhanced Cash Flow

Processing invoices more quickly results in on-time payments, which improves cash flow. In order to avoid late fees and preserve good vendor relations, the software also reminds users of impending deadlines.

Improved Record-Keeping and Compliance

Businesses can readily comply with tax laws and audits when all invoices and associated data are kept in a single, centralized system. Additionally, it makes it easier to retrieve previous invoices for reference when needed.

Scalability

The number of invoices that businesses receive increases as they expand. A flexible option for companies of all sizes, automated invoice capture software scales easily to handle growing workloads without requiring extra resources.

Conclusion

Nowadays, efficiency is more crucial than ever in the business world. An effective way to process invoices fast and precisely is with automated invoice capture software. It helps companies avoid expensive mistakes and expedites the invoicing process by utilizing technologies like OCR and machine learning.

It's hardly surprising that more businesses are using automation to streamline their financial operations given its advantages in terms of time savings, cost savings, and improved accuracy. Investing in this software can greatly enhance your operations and financial results, regardless of how big or small your company is.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.