Why Financial Statement Spreading Is Key for Lenders

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

How do lenders make confident decisions in a financial environment where time, accuracy, and risk mitigation are everything? The answer lies in the power of financial statement spreading—a foundational process that turns raw financial data into structured, actionable insights. It’s crucial to credit analysis, underwriting, and loan decision-making, especially in 2025’s evolving digital lending landscape.

This blog explores the importance of financial statement spreading for lenders, detailing how it supports risk assessment, ensures compliance, and enables faster, data-driven decisions. Whether you're in commercial lending, banking, or alternative finance, this is a process you can’t afford to ignore.

Understanding Financial Statement Spreading

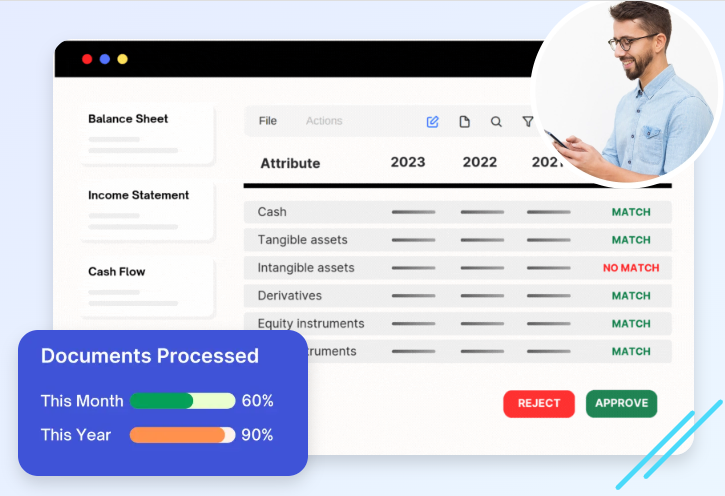

At its core, financial statement spreading refers to extracting financial information from a borrower’s financial statements—typically balance sheets, income statements, and cash flow statements—and standardizing it into a format that allows for analysis.

This structured format makes it easier to calculate key financial ratios, analyze trends, and compare performance across multiple borrowers or periods. Without this process, reviewing unstructured PDFs, Excel files, or scanned documents would take significantly longer and be more prone to errors.

Why Spreading Matters in Modern Lending

In 2025, lenders are pressured to deliver decisions faster without sacrificing accuracy. Manual processes can't keep up with market expectations. That’s why spreading financial statements plays a key role—transforming time-consuming analysis into streamlined, accurate evaluation.

By converting raw data into normalized financial formats, lenders can easily run consistent ratio analyses and risk models. Standardized spreads allow for apples-to-apples comparisons and clearer insights into borrower risk, whether evaluating a small business loan or a large commercial line of credit.

Supporting Better Credit Risk Assessment

Lenders face the constant challenge of identifying creditworthy borrowers while minimizing risk. Financial spreads help achieve this by providing consistent, quantifiable metrics reflecting a borrower’s repayability.

Key ratios derived from financial statement spreading—such as debt service coverage, current ratio, and net profit margin—offer valuable insights into a borrower’s liquidity, solvency, and operational efficiency. These indicators help underwriters identify potential red flags early, ensuring risk is thoroughly evaluated before credit is extended.

Streamlining the Underwriting Process

Traditional underwriting is labor-intensive, often requiring analysts to sift through dozens of documents per application. Spreading financials automates much of this review, reducing processing time and accelerating approvals.

With faster data access and clearer formats, underwriters can focus on decision-making rather than data entry. This improves productivity, reduces turnaround times, and enhances the borrower experience. In competitive markets, faster approvals can differentiate between winning or losing a client.

Ensuring Regulatory Compliance and Auditability

Lending is a heavily regulated industry. Every financial decision must be backed by consistent documentation and audit trails, from internal credit policies to external compliance frameworks.

Spreading financial statements ensures that all data used for analysis is traceable, consistent, and aligned with regulatory standards. By automating calculations and creating a digital audit trail, lenders can demonstrate due diligence during audits and reduce the risk of non-compliance penalties.

Scaling Lending Operations with Confidence

As lenders grow their portfolios, manual processes become increasingly unsustainable. Adding more analysts isn't always feasible or cost-effective. That’s where automation and standardized spreading can create true operational leverage.

Spreading financial statements allows a small team to manage more loan applications without sacrificing quality. With scalable systems in place, organizations can serve more clients, enter new markets, and respond quickly to changing demand—all without increasing overhead.

Improving Internal Collaboration and Communication

Lending decisions often involve multiple stakeholders, from analysts to credit officers and senior executives. Spreadsheets filled with inconsistent data can lead to confusion, rework, and delays.

Spreading financial statements into a consistent format makes it easier to share, interpret, and present financial findings. It ensures everyone on the team works with the same metrics, reducing miscommunication and increasing alignment in the loan approval process.

Enabling Smarter Portfolio Management

The value of financial spreads doesn't end after a loan is approved. They also play a vital role in ongoing portfolio monitoring. By periodically updating financial spreads with new data, lenders can track borrower performance over time and detect early signs of financial distress.

This enables proactive risk management, allowing teams to engage borrowers early, adjust terms, or restructure agreements before default becomes a real threat. In this way, spreading financial statements becomes a tool for onboarding and lifecycle risk control.

Integration with Modern Financial Systems

Today’s financial ecosystems are driven by technology. Lenders rely on CRM platforms, risk engines, and loan origination systems that demand consistent, structured data.

Spreading solutions can often integrate with these systems via APIs, enabling seamless data flow from document intake to decision dashboards. This speeds up operations and improves data accuracy and consistency across platforms.

Lenders create a unified, intelligent decision-making environment by connecting financial statements and spreading them with other parts of the tech stack.

Conclusion

In today’s high-stakes, fast-paced lending environment, financial clarity is everything. Financial statement spreading equips lenders with structured data to assess risk, meet regulatory requirements, and serve clients efficiently.

From underwriting to portfolio management, every stage of the credit lifecycle benefits from the accuracy, speed, and insight of financial spreads. As automation continues to transform the industry, spreading remains the essential foundation for smart lending.

For lenders aiming to grow confidently, spreading financial statements isn’t just helpful—it’s mission-critical.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.