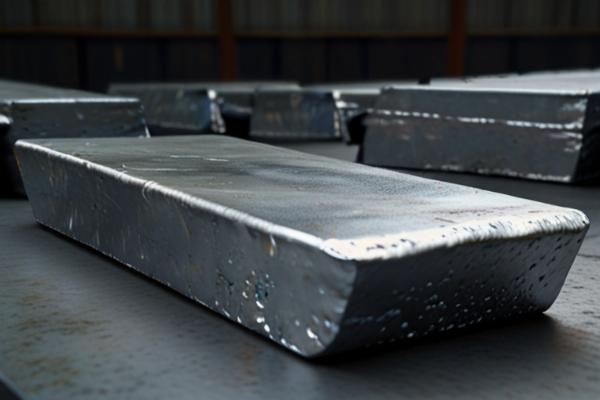

Zinc Ingot Price Chart, News, Analysis and Demand

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

The latest report by IMARC Group, titled “Zinc Ingot Pricing Report 2024: Price Trend, Chart, Market Analysis, News, Demand, Historical and Forecast Data,” provides a thorough examination of the price trend. This report delves into the Price of Zinc Ingot in Korea globally, presenting a detailed analysis, along with an informative Zinc Ingot Price Chart. Through comprehensive price analysis, the report sheds light on the key factors influencing these trends. Additionally, it includes historical data to provide context and depth to the current pricing landscape. The report also explores the demand, analyzing how it impacts market dynamics. To aid in strategic planning, the Price Forecast section provides insights into price forecasting, making this price report an invaluable resource for industry stakeholders.

Zinc Ingot Prices Last Quarter:

- Japan: 2733 USD/MT (Zinc Ingot (SHG-99% Pure))

- Germany: 3861 USD/MT (99.9%)

Report Offering:

- Monthly Updates: Annual Subscription

- Quarterly Updates: Annual Subscription

- Biannually Updates: Annual Subscription

The study delves into the factors affecting zinc ingot price variations, including alterations in the cost of raw materials, the balance of supply and demand, geopolitical influences, and sector-specific developments.

The report also incorporates the most recent updates from the market, equipping stakeholders with the latest information on market fluctuations, regulatory modifications, and technological progress. It serves as an exhaustive resource for stakeholders, enhancing strategic planning and forecast capabilities.

Request For a Sample Copy of the Report: https://www.imarcgroup.com/zinc-ingot-pricing-report/requestsample

Key Details About the Zinc Ingot Price Trend- Last Quarter

The global zinc ingot market is experiencing a dynamic phase, primarily driven by a confluence of supply constraints and robust industrial demand. As mining outputs dwindle, particularly in key zinc-producing regions, the market faces tightening supply conditions. This reduction in production not only limits availability but also propels prices upwards as manufacturers scramble to secure necessary raw materials for production processes. Concurrently, industrial demand for zinc, especially from sectors such as construction and automotive, remains strong. This demand is particularly pronounced in emerging economies where infrastructure development and manufacturing activities are accelerating. Furthermore, macroeconomic factors like interest rate adjustments by central banks influence market sentiment, impacting commodity prices, including zinc ingots. As financial markets anticipate these changes, investments in base metals like zinc fluctuate, adding another layer of complexity to market dynamics. The interplay between reduced supply and sustained demand, alongside economic policies and global market conditions, is shaping the trajectory of the zinc ingot market, pushing it towards an upward pricing trend.

Zinc Ingot Price Analysis - Last Quarter

In North America, the zinc ingot market witnessed an upward pricing trajectory throughout the first quarter of 2024. The region's market dynamics were influenced by a decrease in mining and production rates, which constricted supply and heightened competition among buyers. Despite challenges in the automotive sector, increased demand from other industrial sectors buoyed the market. Additionally, market sentiment was affected by the anticipation of monetary policy adjustments, which led to speculative trading behaviors. Seasonal variations and geopolitical tensions also played minor roles, contributing to price volatility within the quarter. The combination of these factors ensured a generally positive yet fluctuating pricing environment in the North American zinc ingot market.

The Asia-Pacific region displayed a largely stable but volatile pricing environment for zinc ingots. Japan, in particular, experienced significant fluctuations due to reduced demand from the automotive industry and broader economic uncertainties. These challenges were compounded by geopolitical concerns, which made buyers more cautious, impacting demand negatively. Seasonal trends also influenced the market, with the first half of the quarter seeing lower prices, which slightly recovered towards the end. Overall, the market in the Asia-Pacific was marked by a negative trend with pockets of stability and slight recovery influenced by adjustments in production and inventory management.

Europe's zinc ingot market faced a downturn in the first quarter of 2024, particularly in Germany, where the impact was most pronounced. The primary factors driving this trend were a slowdown in production and a surplus supply exacerbated by diminished demand from downstream sectors. The broader European economy's downturn further dampened the market sentiment, leading to continuous price declines. Seasonal impacts were minimal but contributed to slight fluctuations in pricing between the halves of the quarter. Overall, the market environment in Europe remained negative and stable, with significant declines from previous periods, reflecting persistent challenges in the regional zinc ingot sector.

Regional Price Analysis:

- Asia Pacific: China, India, Indonesia, Pakistan, Bangladesh, Japan, Philippines, Vietnam, Thailand, South Korea, Malaysia, Nepal, Taiwan, Sri Lanka, Hongkong, Singapore, Australia, and New Zealand

- Europe: Germany, France, United Kingdom, Italy, Spain, Russia, Turkey, Netherlands, Poland, Sweden, Belgium, Austria, Ireland, Switzerland, Norway, Denmark, Romania, Finland, Czech Republic, Portugal and Greece

- North America: United States and Canada

- Latin America: Brazil, Mexico, Argentina, Columbia, Chile, Ecuador, and Peru

- Middle East & Africa: Saudi Arabia, UAE, Israel, Iran, South Africa, Nigeria, Oman, Kuwait, Qatar, Iraq, Egypt, Algeria, and Morocco

Note: The current country list is selective, detailed insights into additional countries can be obtained for clients upon request.

About Us:

IMARC is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic, and technological developments for pharmaceutical, industrial, and high-technology business leaders. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology, and novel processing methods are at the top of the company’s expertise.

Our offerings include comprehensive market intelligence through research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.