Website Copy Makeover – Turn Visitors into Buyers Instantly!

Website Copy Makeover – Turn Visitors into Buyers Instantly!

AAV Contract Development and Manufacturing Organizations Market Demand and Forecast by 2032

Written by stanley huds » Updated on: June 17th, 2025

Global AAV Contract Development and Manufacturing Organizations Industry: Key Statistics and Insights in 2024-2032

Summary:

- The global AAV contract development and manufacturing organizations market size reached US$ 675.1 Million in 2023.

- The market is expected to reach US$ 2,500.3 Million by 2032, exhibiting a growth rate (CAGR) of 15.66% during 2024-2032.

- North America leads the market, accounting for the largest AAV contract development and manufacturing organizations market share.

- Adherent culture represents the largest segment owing to its widespread use in producing high-quality viral vectors in controlled environments.

- Cell and gene therapy development holds the biggest market share, as it relies on AAV vectors for targeted and effective treatments.

- Many rare diseases, which often lack effective treatments, are caused by genetic mutations that can be addressed through gene therapy.

- Advances in bioprocessing, such as improved cell lines, optimized production systems, and enhanced purification techniques, are increasing the efficiency and yield of AAV vector production.

Industry Trends and Drivers:

- Growing Focus on Rare Disease Treatment Pipelines:

Many rare diseases, which often lack effective treatments, are caused by genetic mutations that can be addressed through gene therapy. Adeno-associated virus (AAV) vectors, with their ability to deliver therapeutic genes to target cells, are at the forefront of these innovative treatments. Pharmaceutical and biotech companies are prioritizing the development of gene therapies for rare diseases due to the medical needs and the market exclusivity provided by orphan drug status. This focus is driving the demand for AAV vectors, necessitating the expertise and capabilities of specialized contract development and manufacturing organizations (CDMOs).

● Technological Advancements in AAV Production:

Advances in bioprocessing, such as improved cell lines, optimized production systems, and enhanced purification techniques, are increasing the efficiency and yield of AAV vector production. These technological improvements enable CDMOs to produce higher quality vectors at larger scales and lower costs, meeting the rigorous demands of commercial and clinical applications. Innovations in upstream and downstream processes, including the use of advanced chromatography and scalable single-use systems, are streamlining production workflows. Furthermore, developments in automation and digitization are enhancing process control, consistency, and traceability. This technological progress not only improves production capacity but also ensures compliance with stringent regulatory standards.

● Growing Investments and Partnerships:

Pharmaceutical companies, biotech firms, and venture capitalists are investing in AAV technology, driven by the promising therapeutic potential of gene therapies. These investments are directed towards expanding manufacturing capabilities, acquiring state-of-the-art equipment, and enhancing research and development (RD) activities. Collaborations between pharmaceutical companies and CDMOs are rising, aiming to leverage specialized expertise and infrastructure. These partnerships facilitate the acceleration of drug development timelines and the scaling up of production processes, ranging from clinical to commercial stages. Additionally, government funding and grants for gene therapy research and manufacturing infrastructure are strengthening the market growth.

Request for a sample copy of this report: https://www.imarcgroup.com/aav-contract-development-manufacturing-organizations-market/requestsample

AAV Contract Development and Manufacturing Organizations Market Report Segmentation:

By Workflow:

- Upstream Processing

- Downstream Processing

Downstream processing (purification and fill finish) exhibits a clear dominance in the market attributed to its critical role in purifying viral vectors to meet the high-quality standards required for therapeutic applications.

By Culture Type:

- Adherent Culture

- Suspension Culture

Adherent culture represents the largest segment owing to its widespread use in producing high-quality viral vectors in controlled environments.

By Application:

- Cell and Gene Therapy Development

- Vaccine Development

- Biopharmaceutical and Pharmaceutical Discovery

- Biomedical Research

Cell and gene therapy development holds the biggest market share, as it relies on AAV vectors for targeted and effective treatments.

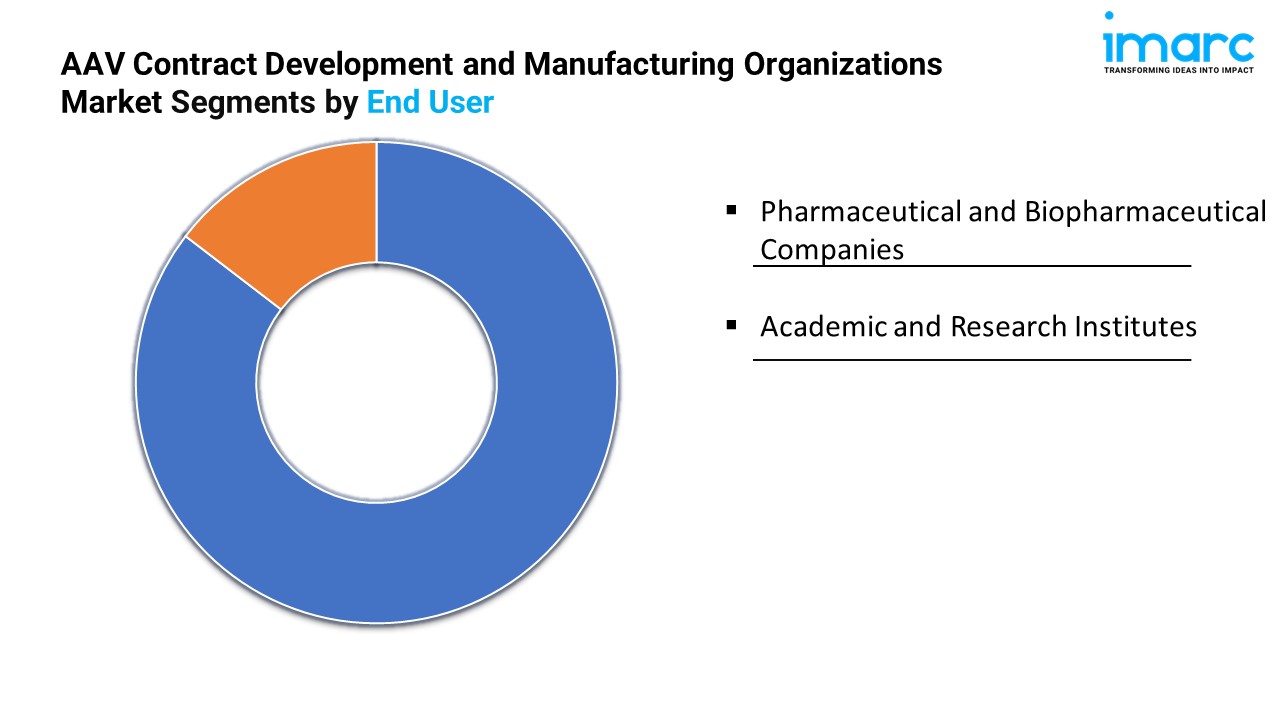

By End User:

- Pharmaceutical and Biopharmaceutical Companies

- Academic and Research Institutes

Pharmaceutical and biopharmaceutical companies account for the majority of the market share due to their extensive investments and RD efforts in developing advanced therapeutics using AAV vectors.

Regional Insights:

- North America (United States, Canada)

- Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

- Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

- Latin America (Brazil, Mexico, Others)

- Middle East and Africa

North America dominates the market, driven by the rising advances in biotechnology, strong research infrastructure, and notable funding for gene therapy projects.

Top AAV contract development and manufacturing organizations Market Leaders: The AAV contract development and manufacturing organizations market research report outlines a detailed analysis of the competitive landscape, offering in-depth profiles of major companies. Some of the key players in the market are:

- ABL Manufacturing (Institut Mérieux)

- Asklepios BioPharmaceutical Inc. (Bayer AG)

- Anlongbio

- Belief Biome Inc.

- Catalent Inc.

- Charles River Laboratories International Inc.

- Creative Biogene

- GenScript ProBio (GenScript Biotech Corporation)

- Merck KGaA

- Oxford Biomedica

- TFBS Bioscience Inc.

- Thermo Fischer Scientific Inc.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145 | United Kingdom: +44-753-713-2163

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

Copyright © 2019-2025 IndiBlogHub.com. All rights reserved. Hosted on DigitalOcean for fast, reliable performance.