Australia Carbon Credit Market | Size, Share, Trends, Growth and Industry Outlook | 2025-2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

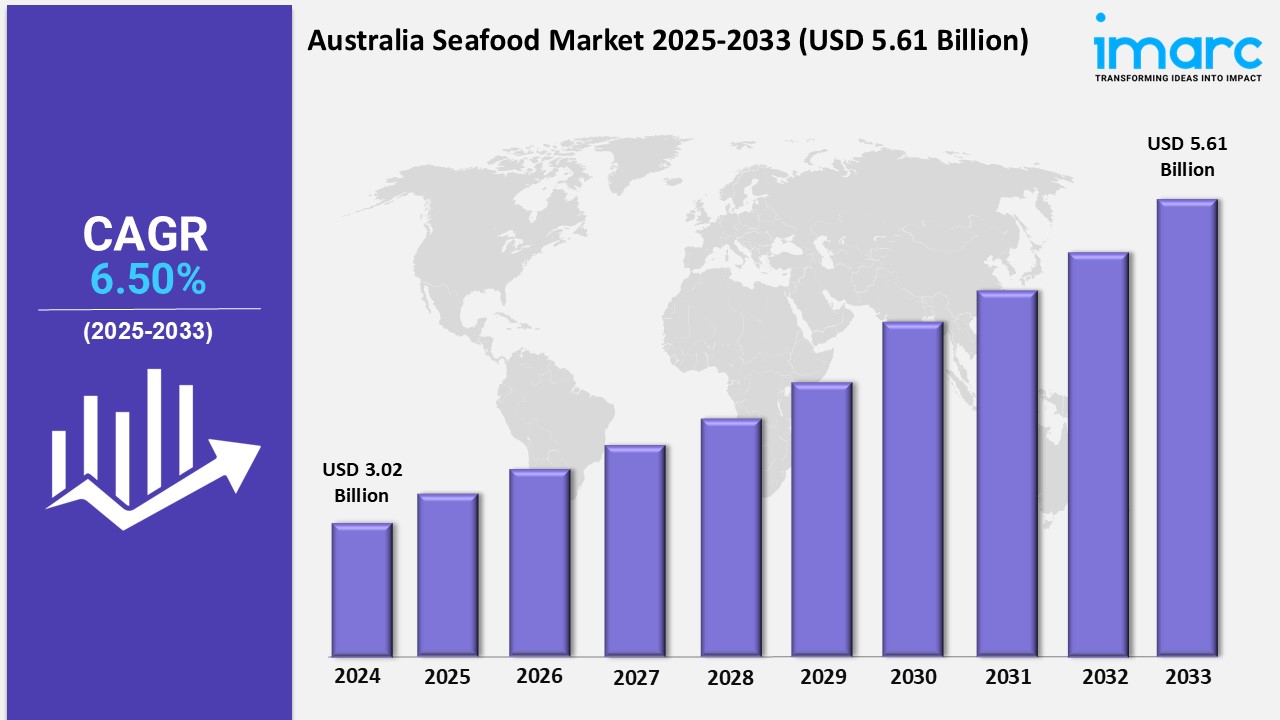

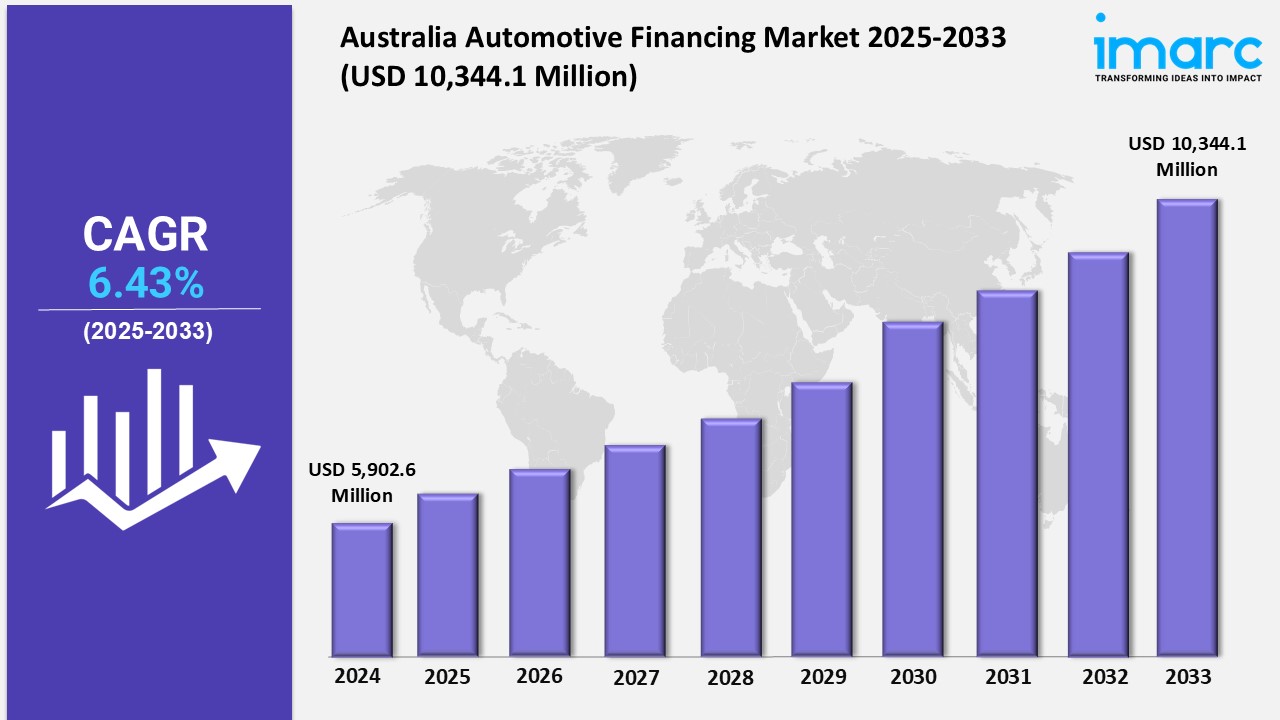

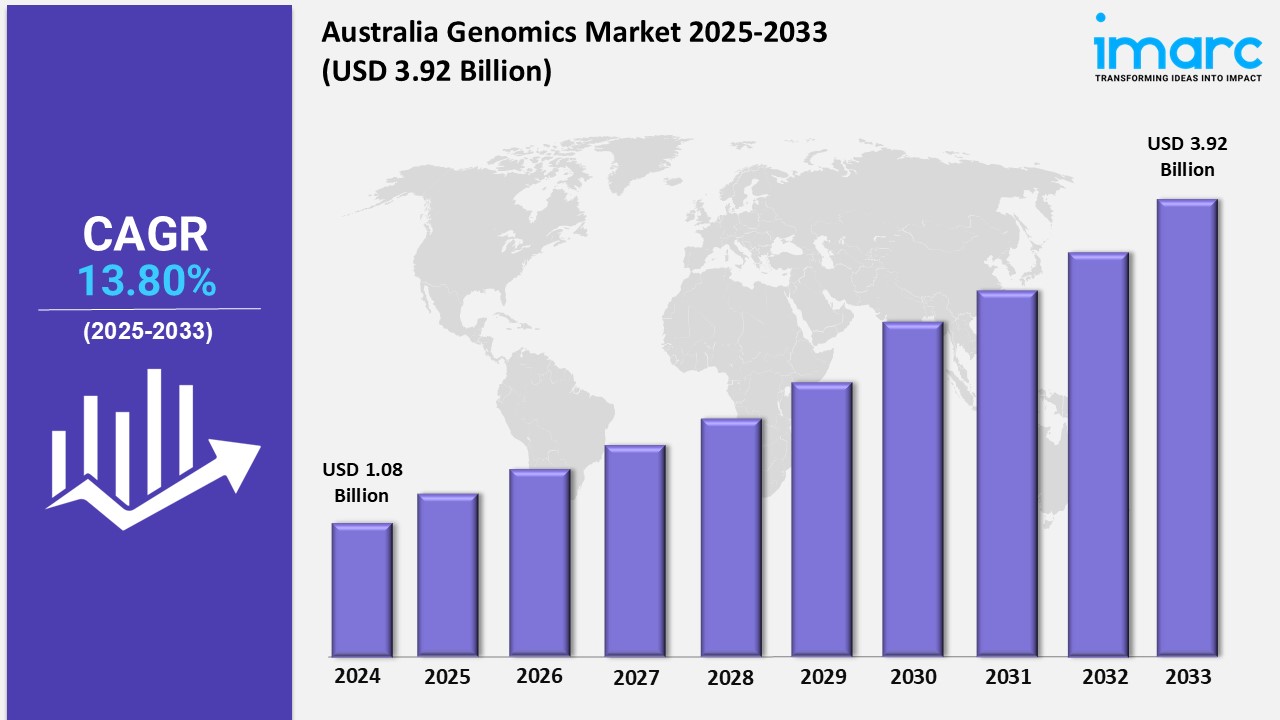

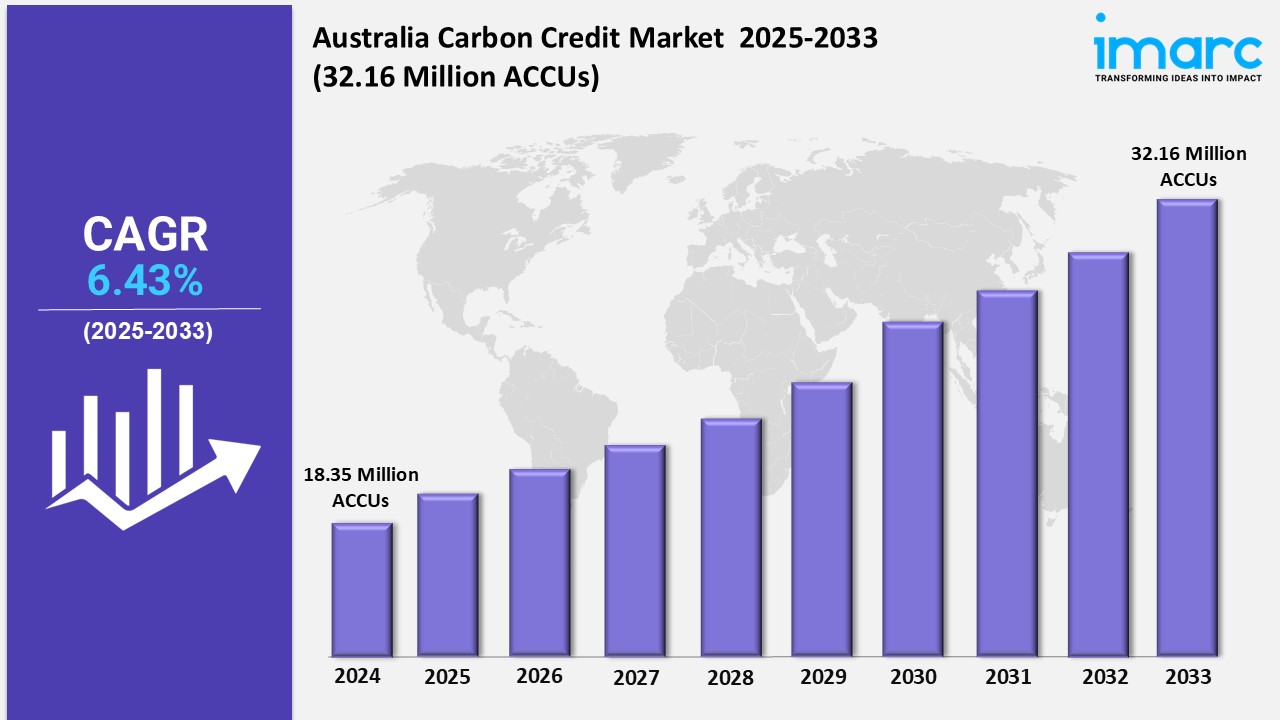

The latest report by IMARC Group, “Australia Carbon Credit Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033,” provides an in-depth analysis of the Australia carbon credit market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia carbon credit market size reached 18.35 Million ACCUs in 2024. Looking forward, IMARC Group expects the market to reach 32.16 Million ACCUs by 2033, exhibiting a growth rate (CAGR) of 6.43% during 2025-2033.

Report Attributes and Key Statistics:

• Base Year: 2024

• Forecast Years: 2025-2033

• Historical Years: 2019-2024

• Market Size in 2024: 18.35 Million ACCUs

• Market Forecast in 2033: 32.16 Million ACCUs

• Market Growth rate CAGR (2025-2033): 6.43%

Australia Carbon Credit Market Overview:

The Australia carbon credit market is extending as organizations are progressively receiving carbon offsetting techniques to meet administrative prerequisites and maintainability objectives. Companies are contributing in renewable energy, reforestation, and emanation diminishment ventures to create tradable credits. Government arrangements supporting the move to a low-carbon economy are empowering advertise support. Innovative progressions are moving forward credit confirmation and exchanging stages, making the showcase more open and straightforward for partners.

Request For Sample Report: https://www.imarcgroup.com/australia-carbon-credit-market/requestsample

Australia Carbon Credit Market Trends and Drivers:

The market is seeing a rise in blockchain-based arrangements for following and confirming carbon credits. Organizations between enterprises and natural organizations are driving large-scale counterbalanced ventures. The integration of carbon credits into corporate ESG (Natural, Social, and Administration) procedures is getting to be standard hone. Government motivating forces and universal assentions are forming market growth. The drift toward deliberate carbon markets is empowering businesses to proactively address their carbon impressions.

The selection of progressed observing and detailing innovations is improving advertise straightforwardness. Administrative systems commanding outflow diminishments are compelling companies to take part in carbon exchanging. Expanded mindfulness of climate alter and partner weight are propelling organizations to contribute in balanced ventures. The advancement of standardized strategies for credit issuance is guaranteeing advertise validity. Money related motivations and worldwide request for carbon-neutral items are advance driving market expansion.

Australia Carbon Credit Key Growth Drivers:

• Stringent government regulations on emissions

• Corporate sustainability initiatives

• Technological advancements in credit verification

• Expansion of voluntary carbon markets

• International climate agreements

Australia Carbon Credit Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, project type, and end-use.

By Project Type:

• Renewable Energy

• Reforestation

• Energy Efficiency

• Others

By End User:

• Power Generation

• Industrial

• Transportation

• Residential

• Others

By Distribution Channel:

• Direct

• Indirect

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

• South Pole Group

• GreenCollar

• Climate Friendly

• Tasman Environmental Markets

• Carbon Neutral

• Greening Australia

• Australian Carbon Traders

Australia Carbon Credit Market News:

• January 2025: Leading energy company launched a new reforestation project to generate high-quality carbon credits.

• March 2025: Partnership announced between a major corporation and an environmental NGO to implement large-scale emission reduction initiatives.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=24733&flag=C

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel. No.: (D) +91 120 433 0800

Americas: +1 631 791 1145 | Asia: +91 120 433 0800 | UK: +44 753 714 6104

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.