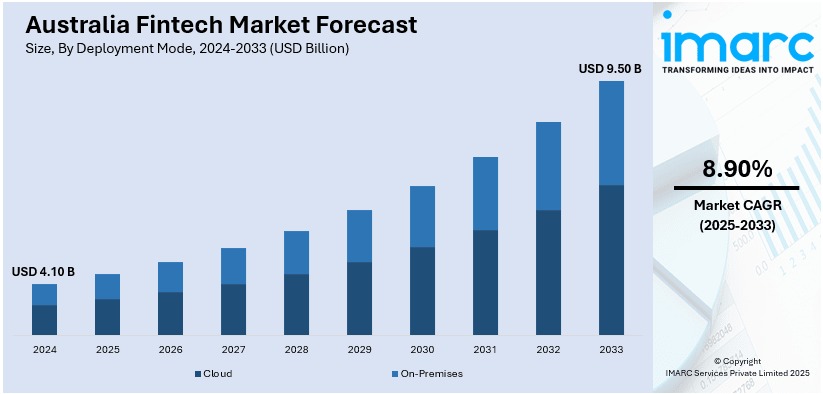

Australia Fintech Market Projected to Reach USD 9.5 Billion by 2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

The latest report by IMARC Group, titled “Australia Fintech Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025–2033,” offers a comprehensive analysis of the Australia fintech market growth. The report includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia fintech market size reached USD 4.10 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.50 Billion by 2033, exhibiting a growth rate (CAGR) of 8.90% during 2025–2033.

• Base Year: 2024

• Forecast Years: 2025–2033

• Historical Years: 2019–2024

• Market Size in 2024: USD 4.10 Billion

• Market Forecast in 2033: USD 9.50 Billion

• Market Growth Rate 2025–2033: 8.90%

Australia Fintech Market Overview

Australia's fintech market is growing quickly because more people are using digital banking, open banking through the Consumer Data Right, mobile wallets, and online payment systems that are always available. Regulations that support innovation and teamwork among different parts of the financial ecosystem are helping new fintech ideas keep coming up. Big companies are investing in technologies like blockchain, AI, and cybersecurity, which are making services like robo-advisors, new lending options, digital banks, and decentralized finance (DeFi) more common. With many people having smartphones and internet access, more are using these services. Also, better security and following rules are helping build trust among customers.

Request For Sample Report:

https://www.imarcgroup.com/australia-fintech-market/requestsample

Australia Fintech Market Trends

• Open Banking: With nearly 175 open banking services live by May 2024, APIs are enabling data-driven financial services.

• Crypto & Blockchain: Approx. 31% of adults owned cryptocurrency in April 2025, fueling demand for crypto trading, blockchain payments, and DeFi.

• AI & Automation: Fintechs are integrating AI/ML, RPA for credit decisions, fraud detection, and customer service solutions.

• Institutional Investment: Venture capital and partnerships are driving fintech scale-up across payments, lending, robo-advisory, insurance, and wealth management.

Australia Fintech Market Segmentation

1. By Deployment Mode:

• Cloud

• On Premises

2. By Technology:

• API

• AI

• Blockchain

• Data Analytics

• RPA

• Others

3. By Application:

• Payments & Fund Transfer

• Loans

• Insurance & Personal Finance

• Wealth Management

• Others

4. By End User:

• Banking

• Insurance

• Securities

• Others

5. By State:

• New South Wales

• Victoria

• Queensland

• Western Australia

• South Australia & Tasmania

• Others

Browse Full Report with TOC & List of Figures:

https://www.imarcgroup.com/australia-fintech-market

Latest Australia Fintech Market News

• March 2025: The report emphasizes growing demand for convenient digital financial services and regulatory collaboration.

• May 2024: Crypto ownership among 31% of adults reflects growing consumer acceptance and fintech innovation.

Key Highlights of the Australia Fintech Market Report

1. Market Performance (2019–2024)

2. Market Outlook (2025–2033)

3. COVID 19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current, and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information not currently within the scope of the report, customization is available.

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=6065&flag=E

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create lasting impact. The company provides a comprehensive suite of market entry and expansion services, including market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals, licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: (D) +91 120 433 0800

United States: +1 631 791 1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.