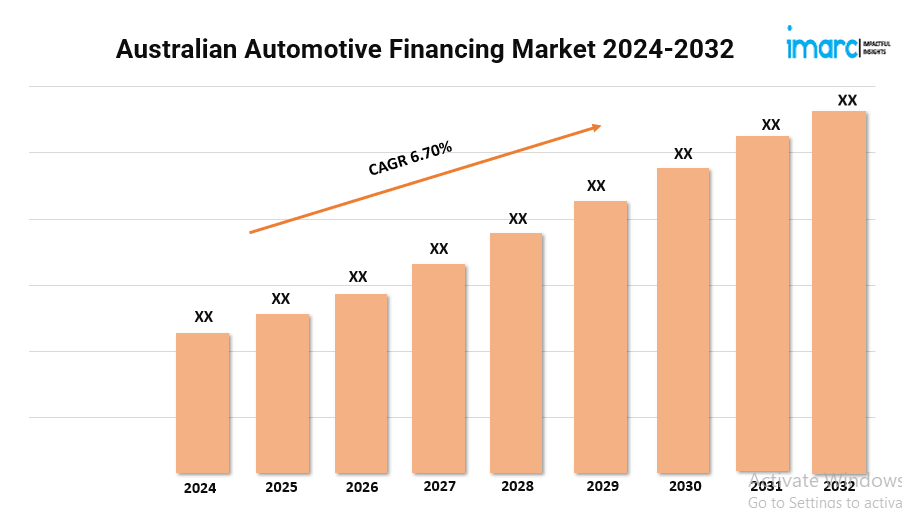

Australian Automotive Financing Market is Growing at a CAGR of 6.70% During the Forecast Period 2024-2032

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Australian Automotive Financing Market Overview

Base Year: 2023

Historical Years: 2018-2023

Forecast Years: 2024-2032

Market Growth Rate: 6.70% (2024-2032)

The Australian automotive financing market is undergoing significant transformation on account of economic, technological, and consumer behavior changes. The market is projected to exhibit a growth rate (CAGR) of 6.70% during 2024-2032.

Download sample copy of the Report: https://www.imarcgroup.com/australian-automotive-financing-market/requestsample

Australian Automotive Financing Industry Trends and Drivers:

The Australian automotive financing market is undergoing significant transformation on account of economic, technological, and consumer behavior changes. One of the major trends is the increasing adoption of electric vehicles (EVs). As Australia is moving towards greener and more sustainable transportation, the demand for EVs is rising in the country. This shift is influencing financing options, with lenders offering specific loans tailored for EV purchases, often with lower interest rates or additional incentives to encourage eco-friendly choices. Moreover, the integration of digital technologies and fintech solutions is revolutionizing the automotive financing landscape. Online platforms and mobile applications are making it easier for customers to access financing options, compare interest rates, and get approval for loans. The use of artificial intelligence (AI) and machine learning (ML) for credit scoring and risk assessment is streamlining the loan approval process, making it quicker and more efficient.

People are increasingly seeking flexible financing options that suit their individual needs and financial situations. This includes options like balloon payments, novated leases, and personal contract purchases (PCP). These flexible solutions allow individuals to manage their finances more effectively, with terms that can be adjusted based on their preferences and circumstances. In addition, the fluctuation of interest rates, influenced by the Reserve Bank of Australia's monetary policies, has a direct impact on automotive financing. Lower interest rates make borrowing cheaper, which can boost car sales and financing activities. Conversely, higher interest rates can dampen consumer spending and borrowing, affecting the market dynamics. Besides this, changing consumer preferences, especially among younger generations, are influencing the market in the country. There is a noticeable shift towards preferring car subscriptions and sharing services over traditional ownership. This trend is driving innovation in financing models to cater to these new preferences, including subscription-based financing options. Government incentives and stimulus packages are also providing support to the market, helping to stabilize the overall demand. Furthermore, the regulatory environment is also a key factor. Changes in lending regulations and consumer protection laws are shaping how automotive financing is structured and offered. Financial institutions must adapt to these regulations to ensure compliance while also meeting consumer needs.

Australian Automotive Financing Industry Segmentation:

The market report offers a comprehensive analysis of the segments, highlighting those with the largest Australian automotive financing market share. It includes forecasts for the period 2024-2032 and historical data from 2018-2023 for the following segments.

The report has segmented the market into the following categories:

Type Insights:

- New Vehicle

- Used Vehicle

Source Type Insights:

- OEM

- Banks

- Credit Unions

- Financial Institution

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Key highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- COVID-19 Impact on the Market

- Porter’s Five Forces Analysis

- Strategic Recommendations

- Historical, Current and Future Market Trends

- Market Drivers and Success Factors

- SWOT Analysis

- Structure of the Market

- Value Chain Analysis

- Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.