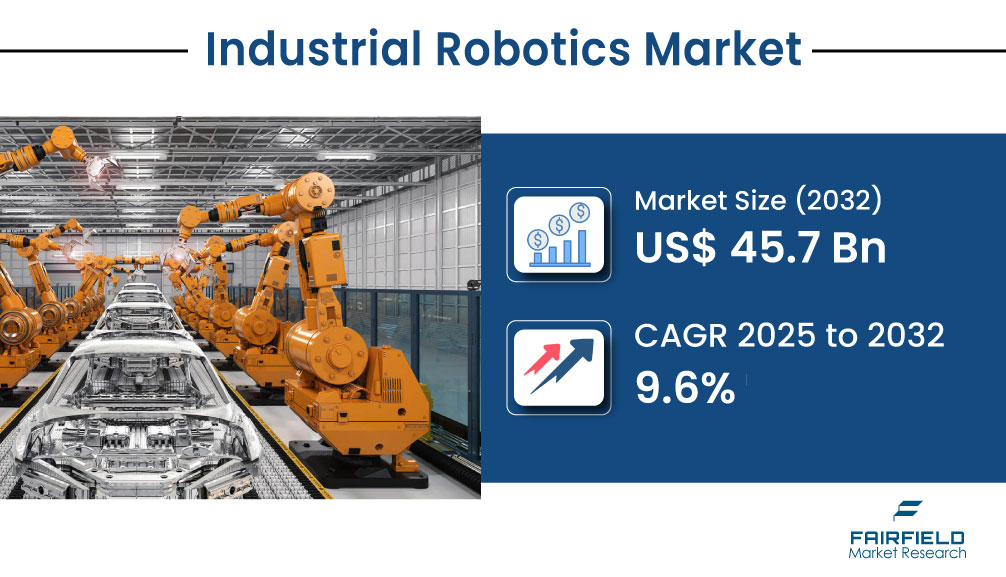

Automation Revolution Fuels Global Industrial Robotics Market Toward US$ 45.7 Billion by 2032

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

A newly published report from Fairfield Market Research reveals that the global industrial robotics market is set to grow from US$ 24.1 billion in 2025 to US$ 45.7 billion by 2032, registering a strong compound annual growth rate (CAGR) of 9.6%. The growth reflects a global shift toward intelligent automation, driven by labor challenges, smart factory initiatives, and the integration of artificial intelligence into robotic systems.

𝐂𝐥𝐢𝐜𝐤 𝐇𝐞𝐫𝐞 𝐅𝐨𝐫 𝐌𝐨𝐫𝐞: https://www.fairfieldmarketresearch.com/report/industrial-robotics-market

Market Overview

Industrial robots are no longer just an advantage—they’re becoming essential in today’s high-speed manufacturing world. Used widely across sectors such as automotive, electronics, metals, and logistics, robots now support production tasks once reliant on manual labor. Articulated robots continue to dominate due to their flexibility and precision, while collaborative robots (cobots) are rapidly expanding their presence in small and mid-sized manufacturing setups.

As manufacturing operations scale up digital transformation, robots are being embedded deeper into value chains, improving output, minimizing downtime, and delivering operational consistency across global facilities.

What’s Driving Growth

The rise in automation adoption stands out as the core driver of the market’s upward trajectory. With global labor shortages and rising wage costs, companies are shifting to robotic systems to maintain productivity and meet rising demand. Robotics offers precision, round-the-clock operation, and long-term cost efficiency.

Smart manufacturing and digital transformation trends are pushing for robotics that go beyond simple programming. AI-powered robots—equipped with machine vision, learning algorithms, and real-time feedback systems—are now capable of self-optimization and adaptive task execution, enhancing factory agility and product quality.

Barriers Slowing Adoption

Despite high growth potential, market expansion faces key challenges. Technical complexity and a shortage of skilled workers remain serious concerns. Many companies, especially SMEs, lack the in-house capability to deploy and manage robotics effectively. This drives up costs through reliance on system integrators.

Furthermore, high upfront investment, integration difficulties with legacy systems, and concerns over cybersecurity and maintenance hinder adoption in cost-sensitive industries or developing markets.

Key Opportunities and Trends

The transition to smart factories is opening new growth frontiers for industrial robotics. AI-enabled robots are redefining how production lines function—using predictive maintenance, adaptive process control, and real-time data to improve manufacturing outcomes. These innovations are helping manufacturers reduce scrap, shorten lead times, and better respond to demand fluctuations.

Another promising area is Robot-as-a-Service (RaaS), which allows companies to lease robotics systems on demand. This model eliminates high capital costs, making robotics more accessible for startups and mid-sized enterprises.

The growing role of collaborative robots (cobots) is also transforming workplaces. Cobots operate safely alongside human workers and are ideal for repetitive or ergonomically challenging tasks. Their ease of use and cost-effectiveness make them highly attractive across diverse industries, from electronics to packaging and medical device manufacturing.

Segment Performance

Articulated robots hold the lion’s share of the market due to their versatility and ability to handle multi-axis movements. These robots dominate in heavy-duty applications such as welding, painting, assembly, and material handling.

Other robot types—including SCARA, Cartesian, and parallel robots—cater to specific needs like high-speed pick-and-place, electronics testing, and food packaging. Increasing customization across industries is driving demand for hybrid and application-specific robotic solutions.

Regional Insights

Asia Pacific leads the global market, driven by aggressive automation adoption in China, Japan, and South Korea. China dominates both consumption and production of industrial robots, bolstered by government incentives and its strategic “Made in China 2025” initiative. Japan remains a global leader in robotics R&D and exports, while South Korea continues to push forward with robotics in electronics and shipbuilding.

Emerging economies like India, Vietnam, and Thailand are gaining attention for their growing manufacturing bases and favorable investment climates. These nations are turning to automation to boost export capacity and reduce production bottlenecks.

Europe remains strong with Germany at the forefront due to its highly industrialized economy and smart manufacturing capabilities. Italy and France are also scaling up robotic deployments in sectors such as pharmaceuticals, food and beverage, and high-end machinery.

North America is advancing rapidly, with the United States seeing increased adoption in aerospace, electronics, and life sciences. Meanwhile, Mexico is becoming a strategic automation hub for the continent due to its growing role in global supply chains.

Competitive Landscape

The market remains highly competitive, with global giants like ABB Ltd., FANUC Corporation, KUKA AG, Yaskawa Electric Corporation, and Mitsubishi Electric Corporation continuing to lead. These players are focused on next-gen robotics that leverage AI, machine learning, and connectivity to deliver smarter, safer, and more scalable solutions.

Recent strategic moves include:

ABB’s acquisition of Sevensense and Meshmind, enhancing its position in AI-driven navigation and machine vision.

Mitsubishi Electric’s investment in Realtime Robotics, aimed at improving robotic motion planning and adaptability for agile manufacturing environments.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.