Biodegradable Biocides See Growing Adoption in Household Products

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

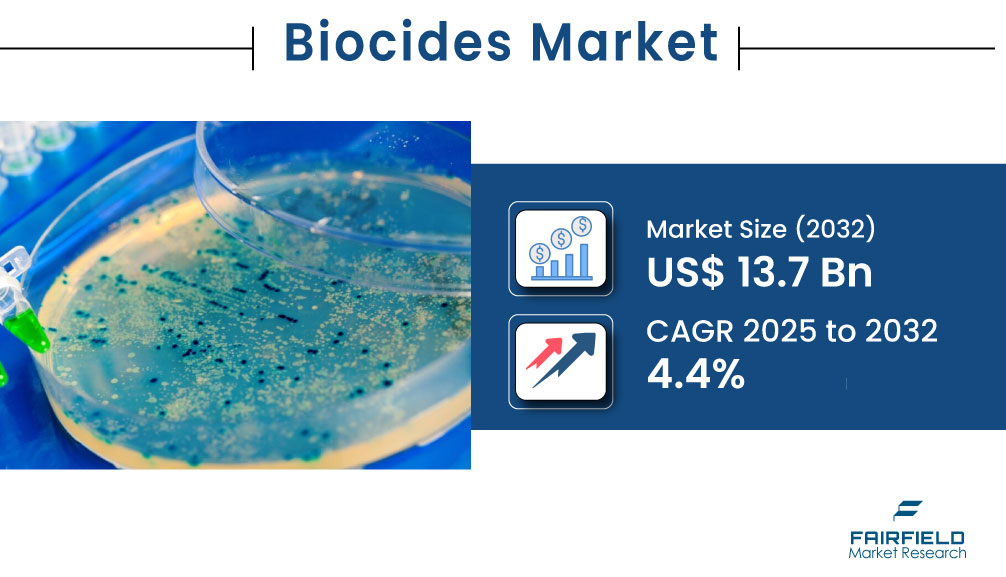

The global biocides market is poised for steady expansion, projected to grow from US$10.1 billion in 2025 to US$13.7 billion by 2032, registering a CAGR of 4.4% during the forecast period. This growth trajectory reflects increasing investments in water treatment infrastructure, rising demand for industrial hygiene, and the accelerated adoption of eco-friendly biocidal formulations across end-use industries.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.fairfieldmarketresearch.com/report/biocides-market

According to a recent market analysis by Fairfield Market Research, expanding municipal and industrial water treatment systems remain at the heart of biocide consumption, while healthcare and food processing sectors are rapidly adopting advanced antimicrobial technologies to meet evolving safety and regulatory standards.

Strong Demand for Quaternary Ammonium Compounds in Healthcare and Institutional Cleaning

One of the major trends reshaping the biocides market is the rising use of quaternary ammonium compounds (QACs), particularly in healthcare and institutional settings. With their broad-spectrum antimicrobial activity and regulatory approvals, QACs such as benzalkonium chloride are being widely used in surface disinfectants, sanitizers, and hospital-grade cleaning solutions.

The U.S. Environmental Protection Agency (EPA) has approved QAC-based disinfectants for use against high-risk pathogens including SARS-CoV-2, strengthening their presence in clinical environments. The global health crisis has amplified awareness around hygiene and infection control, driving institutional purchases and positioning QACs as a cornerstone of the market's growth.

Water Treatment Applications Fuel Halogen-Based Biocides Demand

Halogen compounds such as chlorine and chlorine dioxide are witnessing renewed interest due to the surge in water treatment projects worldwide. In 2022 alone, biocides used for water treatment generated revenues exceeding US$2 billion globally. Municipal water systems are increasingly adopting halogen biocides to eliminate microbial contaminants and ensure safe drinking water for urban populations.

Leading companies like Clariant, Nouryon, and DuPont are scaling up their production capacities and investing in sustainable halogen technologies. Notably, Clariant’s expansion of bromine-based biocides aligns with the global trend toward ensuring water security and public health, especially across emerging economies facing water stress.

Eco-Friendly and Biodegradable Biocides Open New Market Frontiers

Sustainability is becoming a key differentiator in the global biocides market. Consumers and regulators alike are placing growing emphasis on biodegradable and non-toxic formulations, creating lucrative opportunities in cleaning products and household care segments. Nouryon’s recent launch of a biodegradable chelates plant in the Netherlands and Unilever’s probiotic-based surface cleaner Cif Infinite Clean are prime examples of the industry’s shift toward green innovation.

Products like Kalaguard SB, a sodium benzoate-based preservative, are gaining traction for their nature-identical properties, receiving approval under green-label certifications. These developments illustrate a broader movement among manufacturers toward sustainable product lines that align with circular economy goals, especially in Europe and North America.

Industrial HVAC and Boiler Systems Amplify Biocide Integration

Industrial infrastructure growth is bolstering demand for biocides in HVAC and boiler maintenance. Biofouling and microbial contamination in these systems can reduce operational efficiency by up to 30%, prompting preventive biocidal treatments to maintain energy performance and extend equipment life.

The U.S. Department of Energy has highlighted that poor HVAC hygiene can increase energy usage by over 20%, underscoring the need for antimicrobial interventions. With rising air quality standards across hospitals, commercial buildings, and data centers, biocide applications in this segment are anticipated to experience accelerated growth.

North America Leads Metallic Biocide Demand with Oil & Gas Expansion

In North America, especially the U.S., metallic compound-based biocides are gaining traction due to their role in enhanced oil recovery (EOR) initiatives. With CO₂ flooding becoming a major technique in oilfield operations, biocides like copper- and zinc-based products are critical in preventing microbial corrosion.

The federal 45Q tax incentive and robust EOR activity in the Permian Basin are strengthening the region’s biocide consumption, with North America accounting for more than 50% of global oil & gas biocide revenue. Companies such as Occidental and ExxonMobil are investing in biocide-supported infrastructure to ensure corrosion resistance in high-value pipelines and recovery wells.

Europe’s Circular Economy Boosts Biocides in Paints & Coatings

Europe is emerging as a leader in sustainable biocide adoption, particularly in paints and coatings. With over 1,100 EU Ecolabel-certified paints and a strong push for non-toxic surface treatments, demand for biodegradable biocides in coatings is rising. Major players like LANXESS are showcasing low-VOC and sustainable biocidal additives at international coatings expos to align with evolving regulations and green building standards.

Backed by the EU Green Deal and €3.83 billion in circular economy investments, the region is expected to maintain its leadership in eco-friendly biocide applications, particularly for antimicrobial paints used in hospitals, schools, and commercial facilities.

Asia Pacific Emerges as a High-Growth Zone in Food Sanitation

The Asia Pacific region, led by countries like India and China, is witnessing surging demand for biocides in the food and beverage sector. The market for processed food and beverages exceeded US$130 billion in 2024, necessitating strict sanitation protocols. Biocides are essential in maintaining surface hygiene in large-scale food production facilities to prevent microbial contamination and prolong shelf life.

Manufacturers such as Kemin Bio Solutions are expanding operations in Asia, providing specialized antimicrobial solutions for meat, dairy, and packaged food processors. This trend is expected to position Asia Pacific as a dominant regional contributor to global biocides revenue through 2032.

Competitive Landscape: Strategic Collaborations and Sustainability at the Forefront

The global biocides market remains highly competitive, marked by continuous innovation and strategic alliances. Major companies such as BASF, Ecolab, LANXESS, and AkzoNobel are focusing on sustainability by introducing low-toxicity and biodegradable formulations. Collaborations, such as Lanxess’s acquisition of microbial control assets from IFF and Univar Solutions’ partnership with Arxada, are strengthening market access and portfolio depth.

Explore More Reports:

https://www.fairfieldmarketresearch.com/report/biomethane-market

https://www.fairfieldmarketresearch.com/report/alkaline-battery-market

https://www.fairfieldmarketresearch.com/report/bauxite-market

Expert insights suggest that increasing regulatory scrutiny, complex industrial requirements, and supply chain risks are pushing companies toward digital monitoring solutions and regional manufacturing hubs. These strategic shifts will shape future biocide development and market resilience.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.