Benefits Of Udyam Registration

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

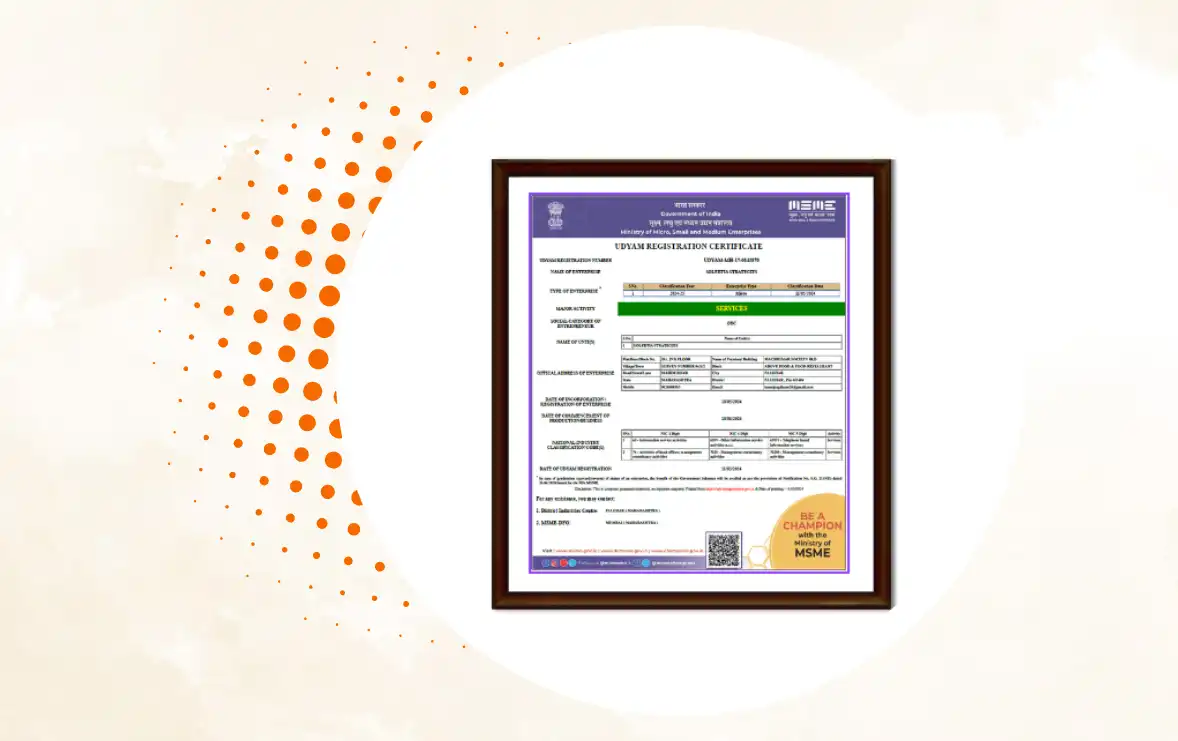

Udyam Registration is a pivotal initiative introduced by the Indian government to support and nurture Micro, Small, and Medium Enterprises (MSMEs). It is a simplified process designed to register businesses under the MSME category, providing them with access to a host of benefits, including financial aid, tax exemptions, and priority in government initiatives. The Udyam Registration process is entirely online, making it convenient and accessible for entrepreneurs across the country.

Key Benefits of Udyam Registration for Businesses

1. Access to Government Schemes and Financial Support

Udyam-registered businesses are eligible for several government schemes that provide financial assistance and incentives. These include subsidies, tax relief, and grants aimed at reducing financial burdens and fostering growth. Such schemes ensure that businesses, especially small and medium enterprises, can expand their operations and improve their competitiveness in both domestic and international markets.

For instance, schemes like the Prime Minister’s Employment Generation Programme (PMEGP) and Zero Defect Zero Effect (ZED) certification programs are specifically tailored for MSMEs. These initiatives not only offer financial benefits but also encourage innovation and quality improvements.

2. Simplified Loan Process

One of the standout benefits of Udyam Registration is the ease of obtaining loans from banks and financial institutions. Businesses with an Udyam certificate qualify for government-backed schemes like the Credit Guarantee Fund Scheme for Micro and Small Enterprises (CGTMSE), which offers collateral-free loans.

Additionally, these businesses can secure loans at lower interest rates, reducing their financial strain. This simplified loan process enables MSMEs to access working capital and invest in infrastructure, technology, and human resources.

3. Tax and Duty Exemptions

Tax benefits are a significant advantage of Udyam Registration. Businesses registered under this scheme can avail of numerous exemptions and rebates, which lower their overall operational costs. These benefits include:

Direct Tax Exemptions: Certain types of income are exempt from taxes for MSMEs, subject to conditions specified by the government.

Reduced GST Rates: In some cases, MSMEs may benefit from reduced rates under the Goods and Services Tax (GST).

Export Duty Benefits: Export-oriented MSMEs can take advantage of reduced or waived customs duties, making their products more competitive in international markets.

4. Protection Against Delayed Payments

The Micro, Small, and Medium Enterprises Development (MSMED) Act, 2006, provides protection to Udyam-registered businesses against delayed payments. Buyers are legally required to make payments within a specified time frame, failing which they are liable to pay interest. This ensures that small businesses maintain steady cash flow, a critical factor for their survival and growth.

5. Priority in Government Tenders

Government procurement policies prioritize Udyam-registered businesses, giving them a competitive edge in securing government contracts. MSMEs can participate in tenders without the burden of prior experience or significant financial turnover requirements. This opens up a wide range of opportunities for these businesses to expand their operations and establish a robust market presence.

6. Enhanced Credibility and Trust

An Udyam certificate enhances the credibility of a business. It signals to customers, investors, and partners that the business complies with government regulations and has met the criteria for MSME classification. This added trust can result in stronger business relationships and increased customer confidence.

How to Register for Udyam Online

The Udyam Registration process is straightforward and entirely online, eliminating the need for extensive paperwork. Here’s a step-by-step guide:

Visit the Official Udyam Registration Portal: Ensure you use the official government website to avoid fraudulent intermediaries.

Provide Basic Information: Enter details such as the Aadhaar number of the business owner, PAN card details, and business information.

Self-Declaration: Declare the category of your business (micro, small, or medium) based on investment and turnover.

Verification and Submission: Submit the form for verification. Upon approval, you will receive the Udyam certificate with a unique identification number.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.