Best Portfolio Management Services: Unlocking Maximum Returns on Your Investments

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Choosing the best Portfolio Management Services (PMS) is a critical decision for investors aiming to maximize returns, minimize risk, and achieve their financial goals. PMS offers a personalized approach to managing investments, tailoring strategies to suit the individual needs of clients. These services are especially popular among high-net-worth individuals (HNIs), who require customized investment strategies, professional fund management, and direct ownership of stocks. Given the significance of these services in wealth management, it is essential for investors to carefully evaluate various PMS providers to ensure they make the right choice.

One of the key benefits of PMS is its highly personalized investment approach. Unlike mutual funds, where investors pool their money into a common fund, PMS allows investors to directly own stocks, ensuring more control and transparency. Professional fund managers handle the investments, creating a tailored portfolio based on the client’s financial goals, risk appetite, and investment horizon. This personalized strategy enables PMS clients to have a more hands-on approach to their wealth, with the ability to make quick decisions as market conditions change.

Leading PMS providers in India, such as Motilal Oswal, ICICI Prudential, and Kotak PMS, have earned a reputation for offering sophisticated investment solutions. These firms specialize in creating customized asset allocation strategies that address the specific needs of each investor. They employ a range of asset classes, including equities, fixed income, and alternative investments, to ensure diversification and risk management. Moreover, these providers leverage a robust research framework to identify investment opportunities that have the potential to deliver strong returns while minimizing potential losses.

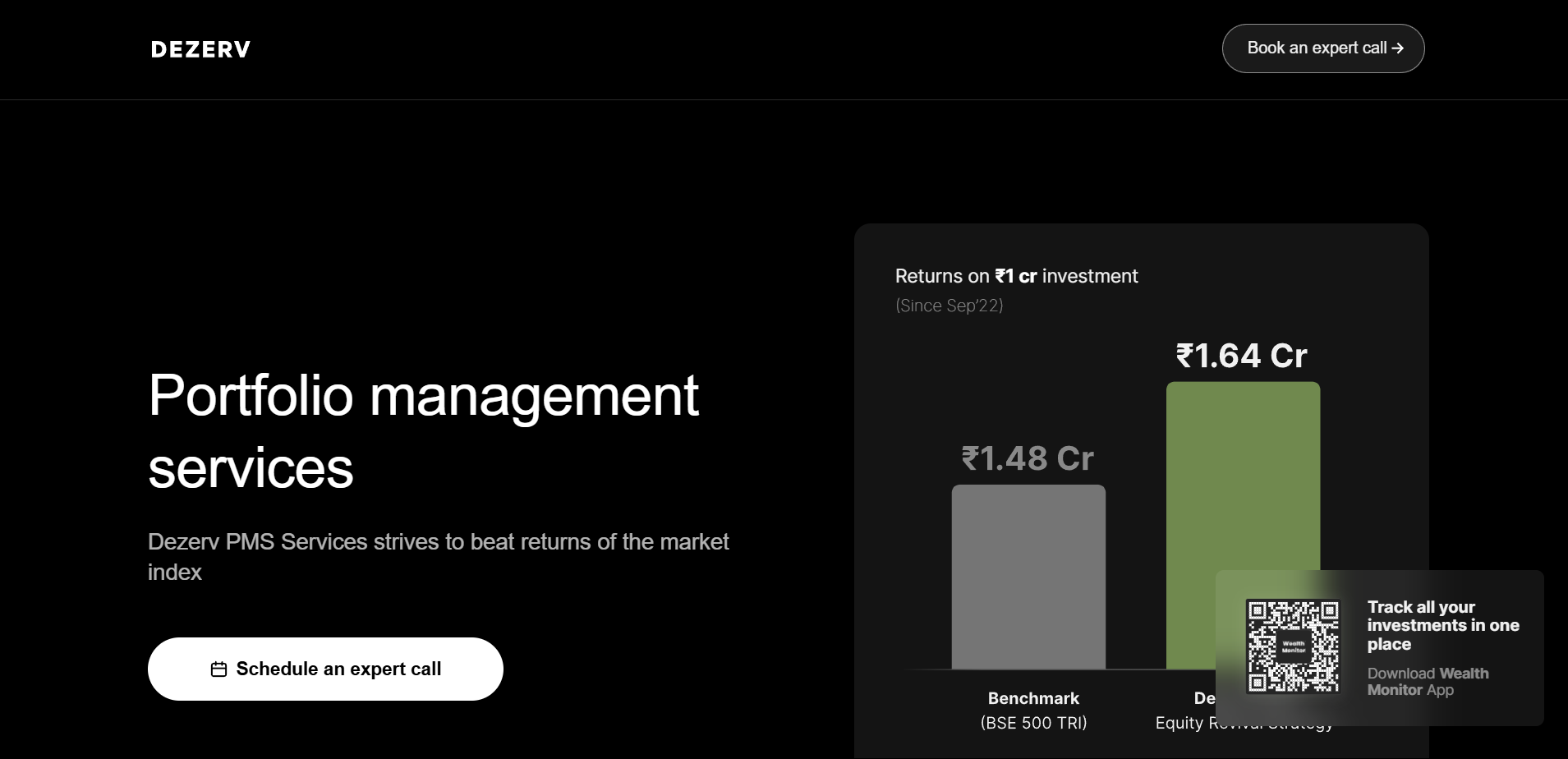

When choosing a PMS provider, investors should take several factors into consideration to ensure they are making the right decision. Past performance is one of the most important indicators. While past returns do not guarantee future performance, they provide insight into the provider's ability to navigate different market cycles. Investors should examine the long-term performance track record and compare it with industry benchmarks. This will help gauge the effectiveness of the investment strategies employed by the PMS provider.

Another important factor to consider is the fee structure. PMS providers typically charge fees based on a combination of management fees and performance-based fees. Management fees are fixed and are charged annually, while performance fees are based on the returns generated by the portfolio. These fees vary among providers and can significantly affect the net returns. Therefore, investors should ensure that the fee structure aligns with their expectations and provides value for the services rendered.

The investment philosophy and approach to risk management should also be evaluated. Different PMS providers have varying investment philosophies, such as value investing, growth investing, or a combination of both. It’s crucial to align with a provider whose investment philosophy resonates with the investor's goals. Additionally, risk management is a vital component of wealth management. Investors should inquire about the strategies used by the provider to manage risk, including diversification, hedging, and rebalancing of the portfolio.

Lastly, investors should consider the transparency and communication levels provided by the PMS provider. Clear and regular updates about portfolio performance, as well as access to reports and insights, are essential for keeping investors informed about their investments.

In conclusion, PMS offers a range of advantages for investors, particularly those with high-net-worth and specific investment needs. By considering factors such as past performance, fee structure, investment philosophy, and transparency, investors can make an informed choice when selecting a PMS provider. The right PMS provider can help investors achieve long-term wealth growth and meet their financial objectives, while minimizing risks and ensuring a well-balanced portfolio.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.