Can I Deduct a Reverse Osmosis System for My Business? A Comprehensive Tax Guide

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Is a Reverse Osmosis System a Deductible Business Expense?

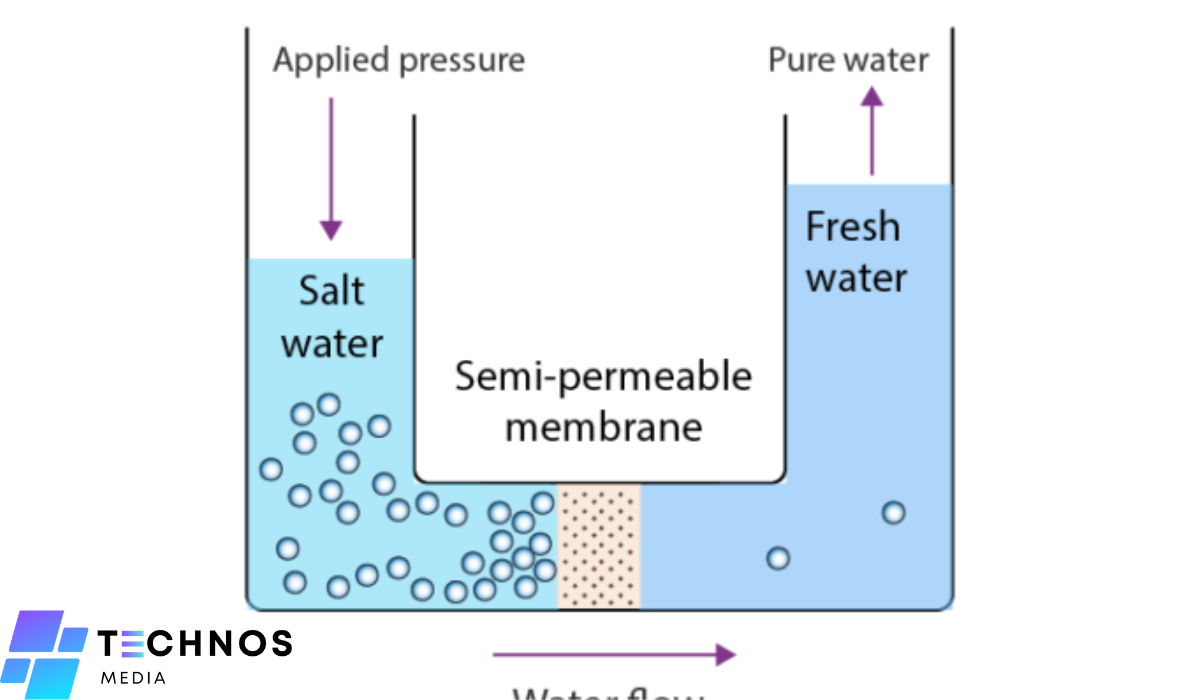

Business owners often wonder whether purchasing a reverse osmosis (RO) system qualifies as a deductible expense. The answer depends on how the system is used, its relevance to business operations, and IRS guidelines on business deductions.

According to the IRS, business expenses must be ordinary and necessary to qualify for deductions. If an RO system is essential for your business operations, you may be able to claim it as a business expense.

What Types of Businesses Can Deduct a Reverse Osmosis System?

Not all businesses may qualify for a tax deduction on an RO system. However, businesses that rely on purified water for operations have a strong case for deduction.

Examples of Businesses That May Qualify:

- Restaurants and Cafés: Clean water is essential for cooking, beverage preparation, and food safety.

- Medical and Dental Offices: Sterile water is crucial for patient care and equipment maintenance.

- Manufacturing Plants: Many industries require purified water for production processes.

- Gyms and Spas: Clean drinking water is essential for customer service.

- Offices with Water Filtration Needs: Providing clean drinking water to employees can qualify under certain circumstances.

If your business falls into any of these categories, an RO system may be considered a necessary expense.

How Can a Reverse Osmosis System Be Classified for Tax Purposes?

An RO system can be classified under different tax categories, depending on its use:

1. Office Supplies and Equipment Deduction

If the RO system is used primarily for drinking water in an office or retail space, it can be classified as an office supply or equipment purchase.

2. Business Utility Expenses

For businesses that require purified water as part of their operations (e.g., restaurants or healthcare facilities), the RO system could be classified as part of utility expenses.

3. Capital Expenditure and Depreciation

If the system is a significant investment and has a lifespan of more than one year, it may be considered a capital expenditure. In this case, you may need to depreciate the cost over time rather than deducting it all in one year.

Can You Deduct the Full Cost in the Year of Purchase?

Under Section 179 of the IRS tax code, businesses can deduct the full cost of qualifying equipment in the year it is purchased rather than depreciating it over several years. However, the system must be actively used in business operations.

To determine if your RO system qualifies for a full deduction, consider:

- The total cost of the system.

- Whether it is considered a necessary business expense.

- If it meets Section 179 requirements.

What Documentation Is Required to Claim the Deduction?

To deduct the cost of a reverse osmosis system, you need proper documentation to support the expense claim.

Required Documents:

- Receipts and Invoices: Proof of purchase detailing the cost, date, and seller.

- Business Purpose Explanation: A brief statement on how the system is used for business operations.

- Depreciation Schedule (if applicable): If deducting over multiple years, maintain depreciation records.

- Utility Bills (if applicable): If claiming as a utility expense, retain relevant bills.

- Maintaining accurate records ensures compliance with tax regulations and minimizes audit risks.

Are There Any Limitations or Restrictions?

While many businesses can deduct an RO system, some restrictions may apply:

- Personal Use: If the system is used in a home office or shared with personal space, the deduction may be limited.

- Luxury vs. Necessity: If the IRS determines the system is a luxury rather than a necessity, it may not be deductible.

- Business Structure Considerations: Different business entities (LLC, S-Corp, sole proprietorship) may have varying rules on deductions.

- Consulting with a tax professional can help clarify these limitations.

Can Home-Based Businesses Deduct a Reverse Osmosis System?

Home-based business owners may still be eligible for a deduction, but the IRS is strict about personal vs. business use. To qualify:

- The system must be primarily used for business purposes.

- Only the percentage of business use can be deducted.

- A clear business need must be established (e.g., a home bakery requiring purified water).

What Are Alternative Ways to Claim the Deduction?

If you’re unable to deduct the full cost, consider other tax-saving strategies:

- Business Improvement Deduction: If the system is part of a larger renovation, it may qualify under business improvements.

- Maintenance and Repair Deductions: If you upgrade an existing RO system, repair costs may be deductible.

- Energy-Efficiency Credits: Some states offer tax incentives for eco-friendly water systems.

Conclusion: Is a Reverse Osmosis System a Tax-Deductible Business Expense?

Yes, a reverse osmosis system can be a tax-deductible expense if it meets IRS criteria for business necessity. Restaurants, healthcare facilities, manufacturing businesses, and offices with water filtration needs have the strongest cases for deduction. However, proper documentation is required, and deductions may vary based on business structure, usage, and IRS regulations.

To maximize tax benefits, consult a tax professional to determine the best way to claim your reverse osmosis system deduction.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.