Comprehensive Guide to Salary Slip Format for Employees and Employers

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

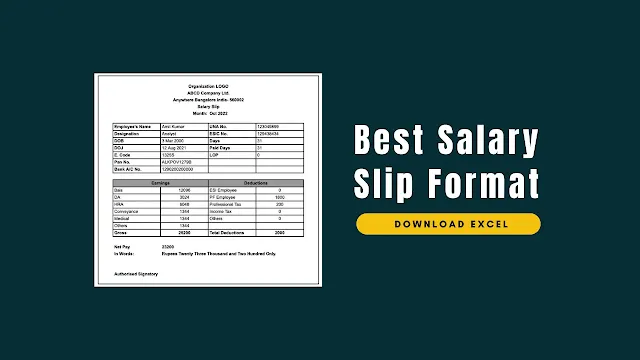

A salary slip might seem like just another monthly formality — but it’s much more than that. Every month, employees receive a salary, and with it, a crucial document: the salary slip or payslip. While many ignore it, this slip plays a big role in your financial life — from tax filing to loan approvals.

In this guide, you’ll learn everything you need to know about the salary slip format: what it contains, why it matters, and how to read or design one effectively.

What Is a Salary Slip?

A salary slip is a monthly document provided by an employer that details an employee’s earnings, deductions, and net pay. It is a legal proof of income and is often required for financial transactions, including applying for loans or filing taxes.

In many organizations, salary slips are now generated digitally through HRMS (Human Resource Management Systems), making them easy to download and store.

Why Is a Salary Slip Important?

1. Proof of Income

Salary slips are essential when applying for home loans, personal loans, credit cards, and even rental agreements. It proves you have a steady income.

2. Tax Filing

Your payslip includes information on tax deductions like TDS and helps with accurate income tax filings. It also helps you track HRA, exemptions, and other benefits.

3. Transparency and Trust

A clear salary slip assures employees that the company is transparent about pay structures. It helps avoid disputes over salary or deductions.

4. Visa and Immigration

Many embassies request recent salary slips as part of visa applications to confirm employment and financial stability.

Components of a Salary Slip

Salary slips are divided into specific sections that make it easier to understand how your pay is structured.

A. Earnings Section (Gross Pay)

This includes all payments made before deductions:

- Basic Salary: The fixed part of your salary and the base for calculating other benefits.

- House Rent Allowance (HRA): Helps cover rent; typically 40–50% of basic.

- Dearness Allowance (DA): Aimed at offsetting inflation, mainly in government jobs.

- Conveyance Allowance: Travel-related reimbursement.

- Medical Allowance: For medical expenses.

- Special Allowance: Bonuses or performance incentives.

B. Deductions Section

This includes mandatory and voluntary deductions:

- Provident Fund (PF): A retirement fund; usually 12% of basic salary.

- Professional Tax (PT): Deducted based on state laws.

- TDS (Tax Deducted at Source): Based on your estimated annual income.

- ESIC: Insurance contribution if your salary falls within eligibility limits.

- Loan/Advance Repayment: Any company loans deducted from your salary.

C. Employer Contributions

These are shown for informational purposes:

- Employer’s PF Contribution

- Gratuity Accrual

- ESIC (Employer Share)

These don’t affect your take-home pay but count toward long-term benefits.

Sample Salary Slip Format

Here’s a simple example:

Company Name: XYZ Pvt Ltd

Employee Name: Raj Mehta

Employee ID: 10245

Designation: Software Developer

Month: March 2025

Earnings

Basic Salary: ₹30,000

HRA: ₹12,000

Conveyance: ₹1,600

Medical Allowance: ₹1,250

Special Allowance: ₹2,000

Total Earnings: ₹46,850

Deductions

PF: ₹3,600

TDS: ₹1,200

Professional Tax: ₹200

Total Deductions: ₹5,000

Net Salary (Take-Home): ₹41,850

Digital vs. Paper Salary Slips

- Many companies now provide digital salary slips through portals or emails. They are:

- Easy to download and store

- Secure and tamper-proof

- Environmentally friendly

Still, some official processes might require printed copies, so having both options available is ideal.

Legal Requirements and Compliance

In India, salary slips are implied under labor and tax laws, even if not mandated directly. Relevant regulations include:

- Minimum Wages Act, 1948

- Payment of Wages Act, 1936

- State-specific Shops and Establishments Acts

Organizations under EPF or ESIC must maintain accurate salary records for deductions and contributions.

Employees should keep at least 6 to 12 months of salary slips for income proof and tax compliance.

Best Practices for Creating a Salary Slip

- Clearly show employee and employer details

- Categorize earnings and deductions properly

- Include net pay and gross salary

- Avoid confusing terms or ambiguous entries

- Use official digital signatures or stamps

- Ensure it complies with the latest tax and labor laws

Common Mistakes to Avoid

- Incorrect tax or PF deduction calculations

- Missing or outdated information

- Ambiguous item names (e.g., “Other Allowance”)

- No total or net pay shown

- Errors in employee details

Mistakes like these can create compliance risks and employee dissatisfaction.

Conclusion

A salary slip is more than just a formality — it’s a vital financial and legal document. It helps in income verification, tax planning, and employee-employer transparency. Whether you’re in HR designing payslips or an employee reviewing yours, understanding the salary slip format will help you manage your financial affairs more confidently.

FAQs

1. What is a salary slip?

A salary slip is a monthly document given by your employer that lists your earnings, deductions, and the final amount you take home. It serves as official proof of income.

2. Why do I need a salary slip?

You need it to apply for loans, credit cards, visas, or rentals, and to file your income taxes accurately.

3. What are the main parts of a salary slip?

It includes your earnings (like basic pay and allowances), deductions (like taxes and PF), and net salary (your take-home pay).

4. Do companies have to provide salary slips?

Yes, most companies are required to provide salary slips, especially under labor laws and for tax compliance.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.