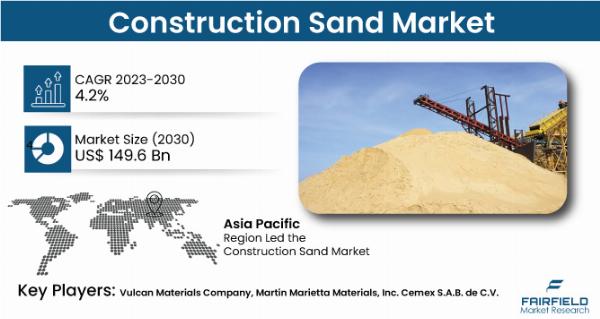

Construction Sand Market to Expand at a CAGR of 4.2% from 2023 to 2030

The global construction sand market, valued at approximately $112.2 billion in 2023, is projected to expand at a compound annual growth rate (CAGR) of 4.2%, reaching $149.6 billion by 2030. This growth is driven by the crucial role of construction sand in concrete and mortar production, essential for a wide array of construction projects ranging from residential buildings to large-scale infrastructure developments.

Quick Report Digest

Market Dynamics: The construction sand market encompasses the extraction, processing, and supply of sand for construction purposes. It serves as a fundamental component in concrete and mortar, supporting diverse construction applications worldwide.

Key Drivers: Global urbanization, infrastructure development, and a booming construction sector are major drivers of market growth. Increasing demand for housing, commercial spaces, and public infrastructure fuels the need for construction sand.

Market Segmentation: The market is segmented into natural sand, sourced from riverbeds and quarries, and manufactured sand, produced through crushing rocks. Natural sand remains dominant, while manufactured sand gains traction due to its consistent quality.

Major Applications: Construction sand finds extensive use in industrial projects, commercial constructions, residential developments, and infrastructure projects, underscoring its versatility across various sectors.

Regional Insights: Asia Pacific leads the market, driven by rapid urbanization and extensive construction activities. North America and Europe also contribute significantly, particularly in residential and commercial sectors. Latin America, the Middle East, and Africa show potential for growth with increasing infrastructure projects shaping their markets.

Key Growth Determinants

1. Demand for Eco-friendly Sand Alternatives: Heightened environmental awareness and stringent regulations drive the adoption of eco-friendly alternatives in the construction sand market. Innovations in recycled and synthetic sand alternatives support sustainable construction practices.

2. Growing Urbanization Pace: Global urban expansion fuels demand for construction sand in infrastructure, residential, and commercial projects. The construction sector responds to accommodate the growing urban population, sustaining demand for sand.

3. Construction Industry’s Growth: Booming infrastructure projects and residential developments worldwide bolster the construction sand market. Economic growth and modernization initiatives drive the need for this essential construction material.

Major Growth Barriers

1. R&D Challenges in Eco-friendly Adhesives: Limited R&D efforts hinder the development of construction adhesives from bio-based materials, impacting the adoption of sustainable bonding solutions in the industry.

2. Regulatory Restrictions on Sand Mining: Stringent environmental regulations limit sand mining activities, affecting supply chains and potentially increasing construction costs. Compliance with evolving regulations becomes crucial for industry players.

Key Trends and Opportunities

Recycling Initiatives: Growing initiatives to recycle construction waste reduce reliance on traditional sand sources, aligning with sustainability goals.

Alternative Materials Adoption: Adoption of manufactured sand and industrial by-products gains popularity, especially in regions with strict environmental regulations.

Digitalization and Supply Chain Optimization: Deployment of digital technologies improves operational efficiency in sand extraction, transportation, and distribution, enhancing market competitiveness.

Regional Outlook

1. Asia Pacific: Dominates the market with rapid urbanization and infrastructure developments in countries like China and India.

2. North America and Europe: Mature markets with consistent demand for construction sand in residential and commercial sectors.

3. Middle East and Africa: Fastest-growing region due to major infrastructure projects driving sand demand.

Fairfield’s Competitive Landscape Analysis

The competitive landscape includes industry leaders like Vulcan Materials Company, Martin Marietta Materials, Inc., CEMEX S.A.B. de C.V., and CRH plc. These companies focus on sustainability, innovation, and strategic expansions to maintain market leadership.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.