Detailed Overview of Margin Trading and How It Works in India

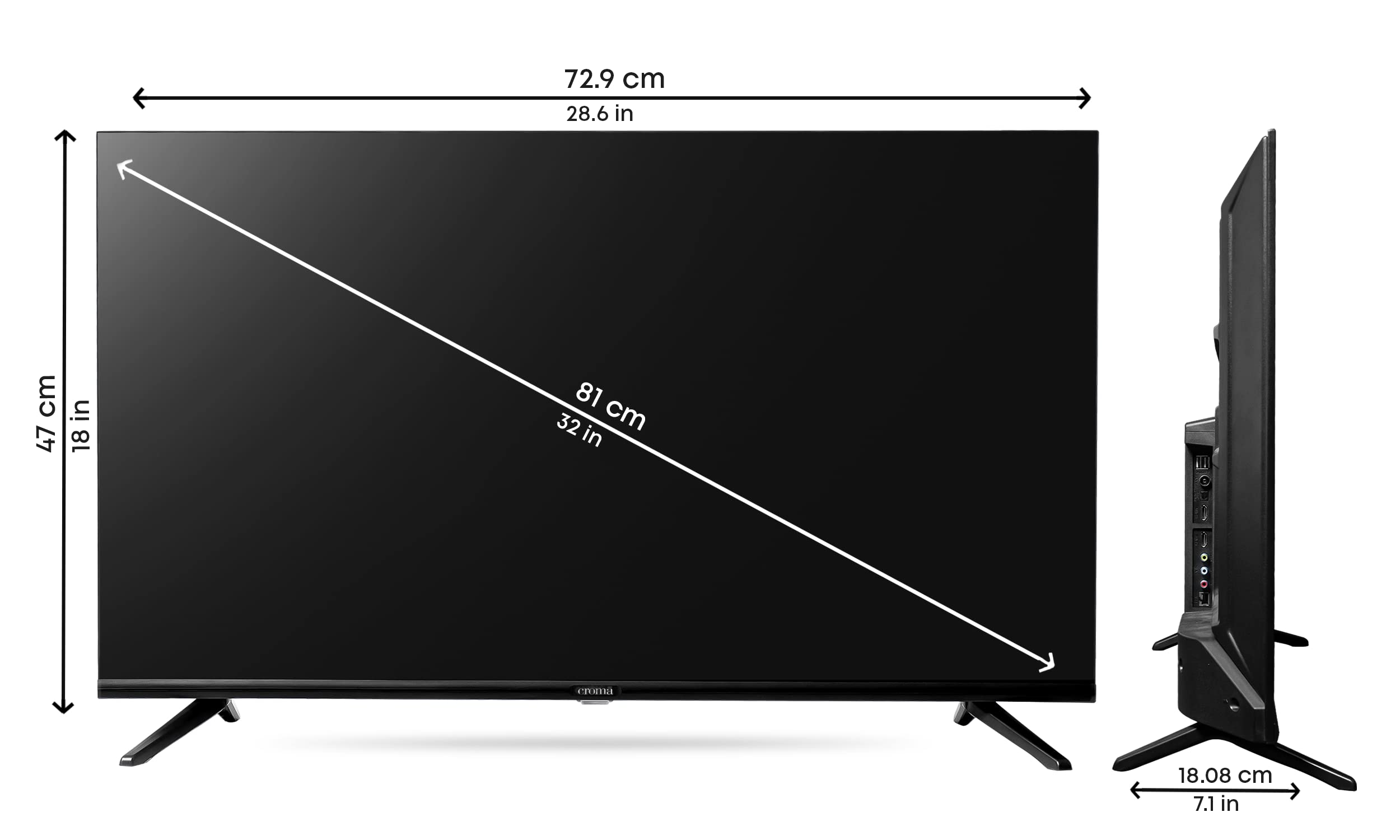

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Margin trading has gained popularity as a powerful strategy in the Indian stock market, enabling traders to amplify their potential returns. This financial practice involves borrowing funds from a broker to buy securities, facilitating larger investments than available capital would allow. This article provides an insightful overview of how margin trading functions in India, highlighting its mechanics, benefits, and associated risks. We'll also touch upon arbitrage trading as a related strategy. The computations demonstrated will be in Indian Rupees (INR).

Understanding Margin Trading

What is Margin Trading?

Margin trading allows an investor to purchase more stocks than would otherwise be possible with their own available funds. By borrowing capital from a brokerage, traders can take larger positions in the market, potentially enhancing their returns and losses. The difference between the total value of an investment and the loan amount from the broker is called the margin.

Mechanics of Margin Trading in India

1. Margin Account Setup: To engage in margin trading, investors must open a margin account with their brokerage firm. This account allows them to borrow money for investing in securities.

2. Collateral Requirements: The investor must maintain a minimum balance or collateral in the margin account, known as the Margin Requirement or Minimum Margin. It is usually expressed as a percentage of the total purchase price of the securities.

3. Leverage and Margin: Leverage in margin trading refers to the ratio of borrowed funds to the investor's own funds. For instance, a 4:1 leverage means the investor can buy stocks worth four times their own investment.

4. Interest on Borrowed Funds: The borrowed amount incurs interest charged by the broker. The rate varies across brokerage firms and can significantly impact profits.

Example Calculation

Consider an investor with an INR 50,000 capital who wishes to invest in a stock priced at INR 1,000 per share. Without margin trading, they can buy 50 shares. However, with a 4:1 leverage, the investor can purchase up to 200 shares.

- Own Funds: INR 50,000

- Stock Price: INR 1,000

- Leverage: 4:1

The investor borrows an additional INR 1,50,000 (total investment = INR 2,00,000) and buys 200 shares.

- Interest Rate on Loan: Assume 10% annually

If the stock price rises to INR 1,200:

- New Value of Investment: 200 shares * INR 1,200 = INR 2,40,000

- Profit Calculation: (INR 2,40,000 - INR 1,50,000 loan - INR 50,000 own funds) - Interest

- Interest Calculation: (INR 1,50,000 * 10% annual) = INR 15,000 (assuming a holding period of one year for simplicity)

- Net Profit: INR 45,000 (excluding transaction fees and taxes)

Without margin, the profit would have been:

- For 50 Shares: 50 * (INR 1,200 - INR 1,000) = INR 10,000

Margin trading thus demonstrates potential for substantial returns, albeit with increased risk due to borrowed capital and interest obligations.

Risks and Considerations in Margin Trading

While margin trading can amplify profits, it poses significant risks:

1. Market Volatility: Sudden market movements can result in margin calls, where the broker demands additional funds to cover potential losses.

2. Interest Costs: The cost of borrowing can erode profits, especially in markets with modest returns.

3. Regulatory Restrictions: The Securities and Exchange Board of India (SEBI) regulates margin trading, mandating margin requirements, and imposing penalties for defaults.

Arbitrage Trading: A Related Strategy

Understanding Arbitrage Trading

Arbitrage trading exploits price differences of a security in different markets to earn profits. In the Indian context, this might involve buying a stock on one exchange where it's priced lower and simultaneously selling it on another exchange where the price is higher.

Example

Consider a stock priced at INR 500 on NSE and INR 505 on BSE. An arbitrage trader could buy on NSE and sell on BSE.

- Buy on NSE: 100 shares * INR 500 = INR 50,000

- Sell on BSE: 100 shares * INR 505 = INR 50,500

- Profi: INR 500 (excluding transaction fees and taxes)

Arbitrage trading requires quick execution and accurate information to capitalize on discrepancies before they disappear. It generally involves lower risk compared to margin trading but demands a keen understanding of markets and rapid decision-making.

Conclusion

A brokerage calculator, with its promise of leveraging limited funds for greater market exposure, emerges as a popular vehicle in the dynamic arena of the Indian stock market. However, it is not devoid of pitfalls, and a prudent approach is essential, requiring acute awareness of both market conditions and borrowing costs. Similarly, arbitrage trading offers opportunities based on market inefficiencies, albeit with its intricacies brokerage calculator.

Investors must meticulously weigh the advantages against the risks and costs associated with these trading forms before embarking on them.

Disclaimer

This article is for informational purposes and does not constitute financial advice. Investment in margin trading and arbitrage trading carries risks, including the potential loss of principal. Investors are advised to thoroughly evaluate the pros and cons, their risk tolerance, and seek professional financial advice tailored to their individual circumstances.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.