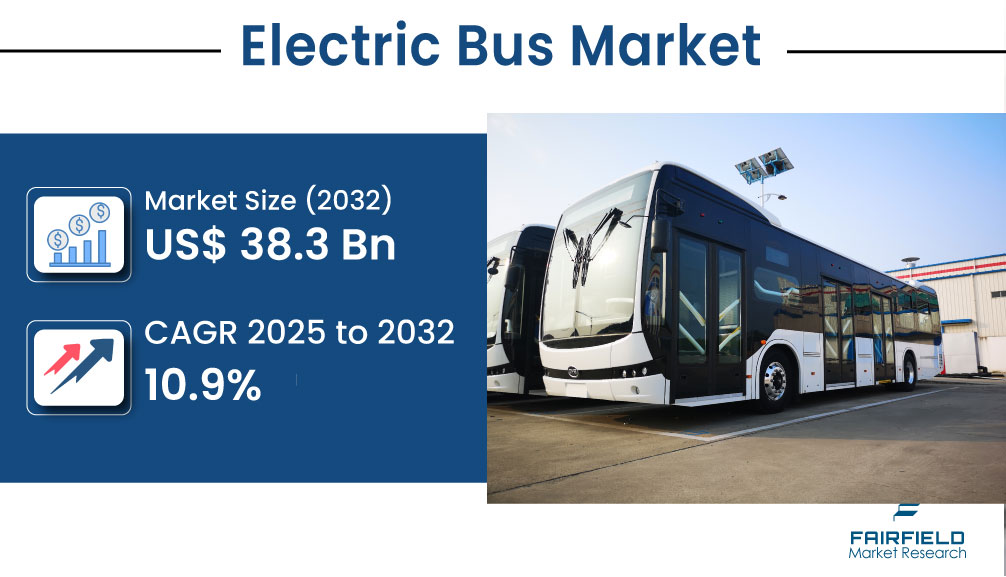

Electrifying the Future: Global Electric Bus Market to Hit US$ 38.3 Billion by 2032

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

The global electric bus market is on the brink of transformational growth, with its value projected to rise from US$ 18.6 billion in 2025 to US$ 38.3 billion by 2032. This impressive CAGR of 10.9% signals a decisive shift toward zero-emission mass transit solutions as cities worldwide tackle rising pollution, climate change, and the urgent need for cleaner urban mobility. Fairfield Market Research reports that electric buses are no longer a future concept—they are now central to global public transport strategies.

𝐂𝐥𝐢𝐜𝐤 𝐇𝐞𝐫𝐞 𝐅𝐨𝐫 𝐌𝐨𝐫𝐞: https://www.fairfieldmarketresearch.com/report/electric-bus-market

Sustainability Mandates Powering the Transition

Strong policy action is the main engine behind the electric bus market’s expansion. Governments across Asia, Europe, and North America are accelerating their commitments to net-zero emissions, making the electrification of public transport a top priority. Financial incentives, regulatory mandates, and funding programs—like China’s Green Mobility initiative, the EU’s Green Deal, and the U.S. Infrastructure Investment and Jobs Act—are actively supporting the shift from diesel fleets to electric ones.

Electric buses offer not only reduced greenhouse gas emissions but also quieter operations and lower long-term operating costs. Cities are rapidly incorporating them into their smart mobility plans to improve air quality, reduce noise pollution, and support digitized transit systems.

Infrastructure and Battery Technology: The Two Biggest Challenges

Despite robust growth projections, electric bus adoption still faces some persistent obstacles. One of the most pressing issues is the lack of widespread, reliable charging infrastructure. This is particularly problematic for high-frequency routes and long-haul services where range limitations and charging delays can disrupt operations.

Battery technology has improved considerably, but challenges related to energy density, lifespan, and cost remain. While next-generation solid-state batteries hold promise for faster charging and higher range, commercial deployment is still a few years away. Until then, range anxiety and high initial costs may limit market penetration in certain regions.

Tech Innovation Opens Doors to New Market Avenues

On the positive side, technological innovation continues to reshape the electric bus landscape. Advancements in battery design, such as lithium iron phosphate (LFP) and emerging solid-state solutions, are improving the total cost of ownership and performance reliability. These innovations are making electric buses viable not only for urban short-haul routes but also for intercity and rural transit networks.

Electric buses are increasingly being integrated into intelligent transit ecosystems. Real-time tracking, predictive maintenance, fleet energy management, and data analytics tools are enhancing operational efficiency. As smart city initiatives expand, these connected buses will be crucial for managing traffic, reducing congestion, and optimizing resource usage.

Propulsion Trends: BEVs Hold Majority Share, While FCEVs and PHEVs Carve Niches

Battery Electric Vehicles (BEVs) currently dominate the global electric bus market. Their expanding range capabilities and improving affordability make them ideal for urban transport. Leading manufacturers such as Alexander Dennis and Wrightbus continue to introduce innovative BEV models like the Enviro100EV and GB Kite Electroliner BEV.

Fuel Cell Electric Vehicles (FCEVs) are gaining traction for long-distance routes where hydrogen refueling infrastructure is emerging. Plug-in Hybrid Electric Vehicles (PHEVs), which combine electric drivetrains with combustion engines, are being deployed as transitional solutions in markets with limited charging capacity. Together, these technologies provide a spectrum of solutions tailored to regional needs and infrastructure maturity.

Asia Pacific Leads the Charge, Europe and North America Follow with Strategic Investments

Asia Pacific remains the largest and most advanced region in terms of electric bus adoption. China, with its vast manufacturing ecosystem and proactive government support, accounts for over half of the global electric bus stock. Major OEMs such as BYD, Yutong, and Tata Motors are leading innovations and fulfilling both domestic and international demand.

India is gaining momentum through its FAME scheme, with several cities announcing large-scale tenders for electric buses. This is boosting domestic production and improving affordability for mass deployment.

In Europe, aggressive emission targets and clean air regulations are pushing cities to electrify their fleets. Countries like Germany, the UK, and France are rolling out subsidies, public procurement mandates, and low-emission zones to facilitate adoption. OEMs like Volvo, Solaris, and VDL are tailoring their product lines to suit European roads and urban densities.

North America is also seeing steady gains. The U.S. and Canada are supporting electric bus expansion through programs like the Low or No Emission Vehicle Program and the Zero Emission Transit Fund. OEMs such as Proterra, New Flyer, and Lion Electric are scaling up production and partnering with transit agencies to modernize fleets.

Competitive Landscape: OEMs Bet Big on Innovation and Regional Partnerships

As the electric bus market grows, so does the competition. Leading companies—BYD, Volvo Buses, Proterra, Tata Motors, Solaris, and Yutong—are focusing on vehicle range, battery optimization, and digital features to differentiate their offerings. Partnerships with battery suppliers, infrastructure developers, and local governments are also becoming central to market expansion.

Recent developments that underscore this trend include:

Volvo Buses launched its BZR electric chassis in March 2024, offering up to 540 kWh battery capacity, aimed at both urban and intercity transit systems.

In June 2024, Stagecoach placed a landmark order for 244 electric buses from Alexander Dennis, making it the largest fleet procurement under the UK’s ZEBRA2 program.

Tata Motors introduced a fleet of electric buses at its Pantnagar plant in December 2024 to transport over 5,000 employees, aligning with internal carbon reduction goals.

Expert Commentary

Fairfield Market Research experts believe that the electric bus industry is entering a high-growth, high-stakes phase. As urban centers worldwide seek to become more sustainable, electric buses are rapidly moving from trial programs to mainstream adoption. However, unlocking the market’s full potential will require coordinated efforts to improve battery performance, scale infrastructure, and tailor products to local requirements.

With strong policy backing, growing public acceptance, and continuous technological progress, electric buses are well-positioned to redefine the future of public transportation across developed and emerging economies alike.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.