EPFO Pension Increase 2025: Latest Updates And Eligibility Rules

The Employees' Provident Fund Organisation (EPFO) manages the Employee Pension Scheme (EPS), providing retirement security to millions of salaried employees across India. In 2025, several changes and discussions around the EPFO pension increase have gained significant attention. These changes are critical for pensioners as they directly impact the monthly pension amount, eligibility, and long-term financial security of retired employees.

Understanding the employee pension scheme

The EPFO pension increase 2025 (EPS), introduced in 1995 under the EPFO, ensures that members receive a regular pension after retirement, subject to certain eligibility criteria. A portion of the employer’s EPF contribution is diverted towards the pension scheme to build a corpus for the employee’s post-retirement life.

Under EPS, an employer contributes 8.33% of the employee’s basic salary (subject to a salary cap) towards the pension fund, while the government contributes an additional 1.16%.

Latest updates on EPFO pension increase 2025

The year 2025 has brought several key developments regarding pension increases under EPS:

Supreme Court judgement (November 2022 implementation): The Supreme Court upheld the legality of higher pension contributions linked to actual salaries, rather than the existing ceiling of Rs. 15,000 per month. This allowed eligible employees to opt for higher pensions based on their full salary.

Revised contribution limits: Employees earning more than Rs. 15,000 monthly basic salary may now contribute based on their actual salary, subject to certain terms, thereby increasing their pensionable amount.

EPFO guidelines on higher pension application: EPFO issued guidelines for employees and pensioners to apply for higher pensions. The online application process was launched to streamline submissions.

These developments are now being operationalised in 2025, allowing many members to benefit from substantially increased pension amounts.

How the pension increase works: calculation example

Let us consider a scenario to understand the impact of the pension increase:

Employee's basic salary: Rs. 40,000 per month

Pensionable service: 30 years

Formula for monthly pension:

(Pensionable salary × Pensionable service) / 70

If calculated under the earlier ceiling (Rs. 15,000), the pension would be:

(Rs. 15,000 × 30) / 70 = Rs. 6,428.57 (rounded to Rs. 6,429 approx.)

Under the new option using actual salary:

(Rs. 40,000 × 30) / 70 = Rs. 17,142.86 (rounded to Rs. 17,143 approx.)

Thus, the pension amount increases by approximately Rs. 10,714 per month in this example, showcasing the significant financial benefit for eligible employees who opt for higher pension contributions.

Eligibility rules for higher EPFO pension in 2025

EPFO has outlined clear eligibility rules for members wishing to opt for the higher pension benefit:

Who can apply?

Employees who were part of the EPS prior to 1 September 2014.

Employees who had contributed based on their full salary but did not exercise the option for higher pension earlier.

Employees who now wish to exercise the option under the Supreme Court’s directions.

Key conditions

The employee must have contributed to EPF prior to the 2014 amendment.

Joint declaration by both employee and employer is mandatory.

Proof of actual salary-based contributions may be required.

Applications must be submitted through the EPFO’s online portal within the prescribed timeline.

Cut-off date

EPFO has fixed deadlines for applications. Missing these timelines may disqualify employees from availing the higher pension option.

EPFO pension fund sustainability and financial implications

The implementation of higher pension options is expected to place additional financial burden on EPFO’s pension fund. As employees contribute on higher salary amounts, EPFO will have to manage larger outflows when these employees retire. To maintain sustainability, EPFO may introduce actuarial assessments and recalibrate contribution rates periodically.

Impact on existing and future pensioners

Existing pensioners

Many retired employees have submitted joint applications to receive revised pension payouts. Upon verification, EPFO will disburse the revised amounts along with arrears for applicable periods. These arrears can run into substantial sums depending on service length and salary history.

Future pensioners

Employees still in service have an opportunity to secure a larger pension corpus by opting for higher contributions now. For instance, an employee earning Rs. 50,000 monthly basic salary with 35 years of service may receive:

(Rs. 50,000 × 35) / 70 = Rs. 25,000 monthly pension upon retirement

Compared to the earlier ceiling, this results in more than three times the pension amount.

Concerns and ongoing debates

Despite the advantages, some stakeholders have raised concerns regarding:

The financial sustainability of EPFO in the long term.

The higher contribution burden on employees and employers.

Legal ambiguities for employees who retired between 2014 and 2022.

EPFO is expected to release clarifications and amendments as the new rules get fully implemented throughout 2025.

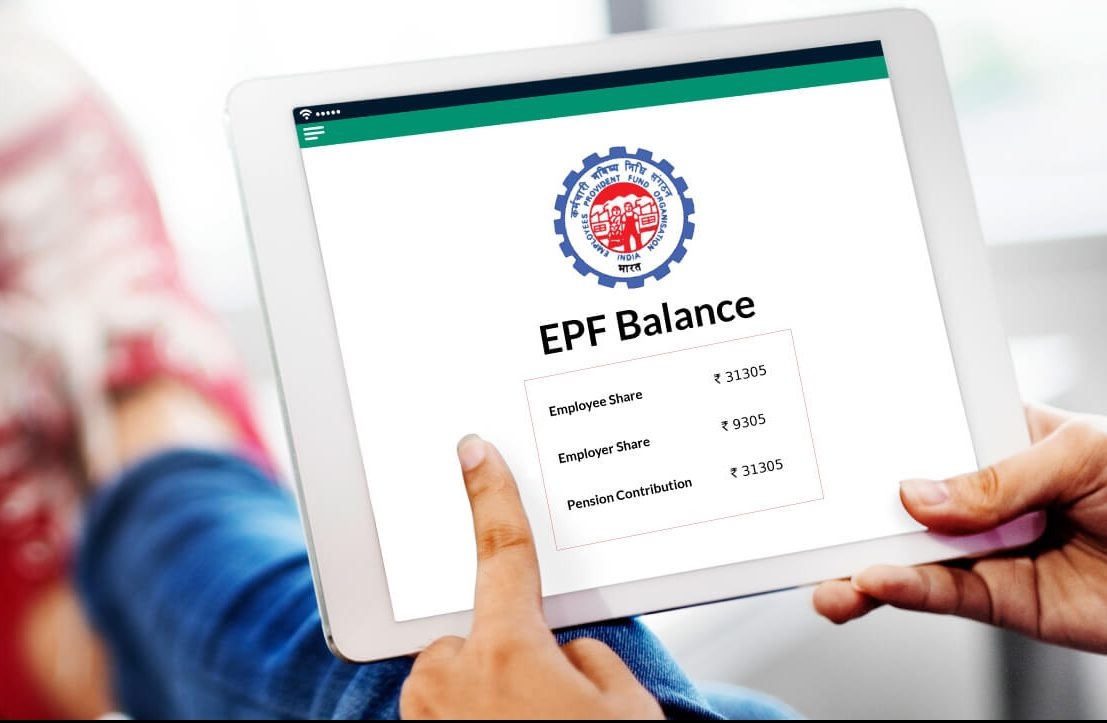

Technological enhancements for EPS processing

EPFO has digitised much of the application and processing systems for higher pension applications:

Online submission of joint declarations.

Aadhaar-based verification for identity and eligibility.

E-verification by employers through the unified EPFO portal.

Automated pension recalculations and transparent arrear tracking.

Digital transformation ensures faster processing, greater transparency and accountability for pension disbursements.

Role of government monitoring

The government is actively monitoring the implementation of higher pension benefits to ensure:

Equitable access to all eligible employees.

Prevention of procedural delays.

Sustainable long-term management of the pension fund.

EPFO has also established grievance redressal mechanisms to resolve disputes and application errors promptly.

Summary

The EPFO pension increase 2025 is a landmark change for India’s retirement ecosystem, offering eligible employees a chance to secure substantially higher pensions under the revised salary-based formula. Through digitisation, EPFO has streamlined the application and verification process, enabling faster processing and accurate disbursals. For example, an employee with a Rs. 40,000 basic salary over 30 years may now receive Rs. 17,143 monthly pension compared to Rs. 6,429 earlier, nearly tripling retirement income. Nevertheless, concerns persist around financial sustainability and clarity for retirees affected by earlier amendments. The government’s ongoing monitoring, coupled with EPFO’s digital reforms, is expected to help address these challenges while ensuring transparency and fairness in pension administration.

Disclaimer: This article is intended for informational purposes only. Individuals must carefully assess all advantages, disadvantages and risks before participating or investing in the Indian financial market.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.