Essential Bookkeeping Services in Dallas & Income Tax Preparation in Austin

Strong8k brings an ultra-HD IPTV experience to your living room and your pocket.

Managing finances is a critical aspect of running a business, and having professional support can make a significant difference. Whether you’re a small business owner in Dallas looking for reliable bookkeeping services or an individual in Austin needing expert income tax preparation, this guide will help you understand the importance of these services and how they can benefit you.

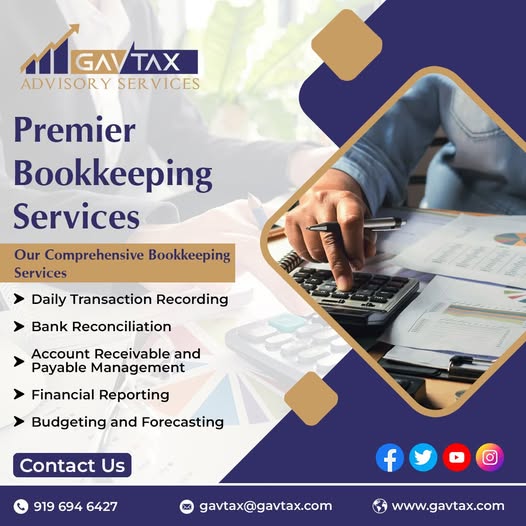

Bookkeeping Services in Dallas

1. Accurate Financial Records: Bookkeeping services in Dallas ensure that all your financial transactions are recorded accurately. This includes tracking income, expenses, assets, and liabilities. Accurate records are essential for making informed business decisions and maintaining financial health.

2. Financial Compliance: Dallas businesses must comply with local, state, and federal financial regulations. Professional bookkeeping services help ensure compliance by keeping thorough records and preparing necessary financial statements. This reduces the risk of penalties and legal issues.

3. Efficient Cash Flow Management: Effective cash flow management is crucial for the survival and growth of any business. Bookkeeping services in Dallas help monitor and manage cash flow by keeping track of receivables and payables, ensuring that your business remains financially stable.

4. Financial Reporting and Analysis: Regular financial reports generated through bookkeeping provide insights into the financial performance of your business. These reports help identify trends, assess profitability, and plan for future growth. Dallas-based bookkeepers can tailor these reports to meet your specific business needs.

5. Time and Cost Savings: Outsourcing bookkeeping services in Dallas allows business owners to focus on core activities. It saves time and reduces the cost associated with hiring and training in-house staff. Professional bookkeepers bring expertise and efficiency, ensuring your financial records are always up-to-date.

Income Tax Preparation in Austin

1. Expertise and Knowledge: Income tax preparation in Austin requires a deep understanding of tax laws and regulations. Professional tax preparers have the expertise to navigate complex tax codes and ensure that your tax returns are accurate and compliant with the latest laws.

2. Maximizing Tax Deductions: A key benefit of professional income tax preparation in Austin is the ability to maximize tax deductions. Tax experts can identify all eligible deductions and credits, reducing your tax liability and increasing your refund.

3. Avoiding Errors and Penalties: Filing taxes can be complicated, and errors can lead to penalties and audits. Professional tax preparers in Austin ensure that your tax returns are error-free, minimizing the risk of audits and associated penalties.

4. Time Efficiency: Preparing your own taxes can be time-consuming and stressful. By outsourcing income tax preparation in Austin, you can save time and avoid the hassle of dealing with paperwork and complex calculations. This allows you to focus on other important aspects of your life or business.

5. Year-Round Support: Many tax preparation services in Austin offer year-round support, not just during tax season. This means you have access to expert advice and assistance whenever you need it, helping you make informed financial decisions throughout the year.

Conclusion

Whether you’re a business owner in Dallas seeking reliable bookkeeping services or an individual in Austin needing expert income tax preparation, professional financial services can make a significant difference. Bookkeeping services in Dallas provide accurate financial records, ensure compliance, and help manage cash flow, while income tax preparation in Austin offers expertise, maximizes deductions, and avoids costly errors. Investing in these services not only saves time and money but also provides peace of mind, allowing you to focus on what you do best.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.