Freight Trucking Market Size, Growth, Share, Growth and Forecast 2025-2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Summary:

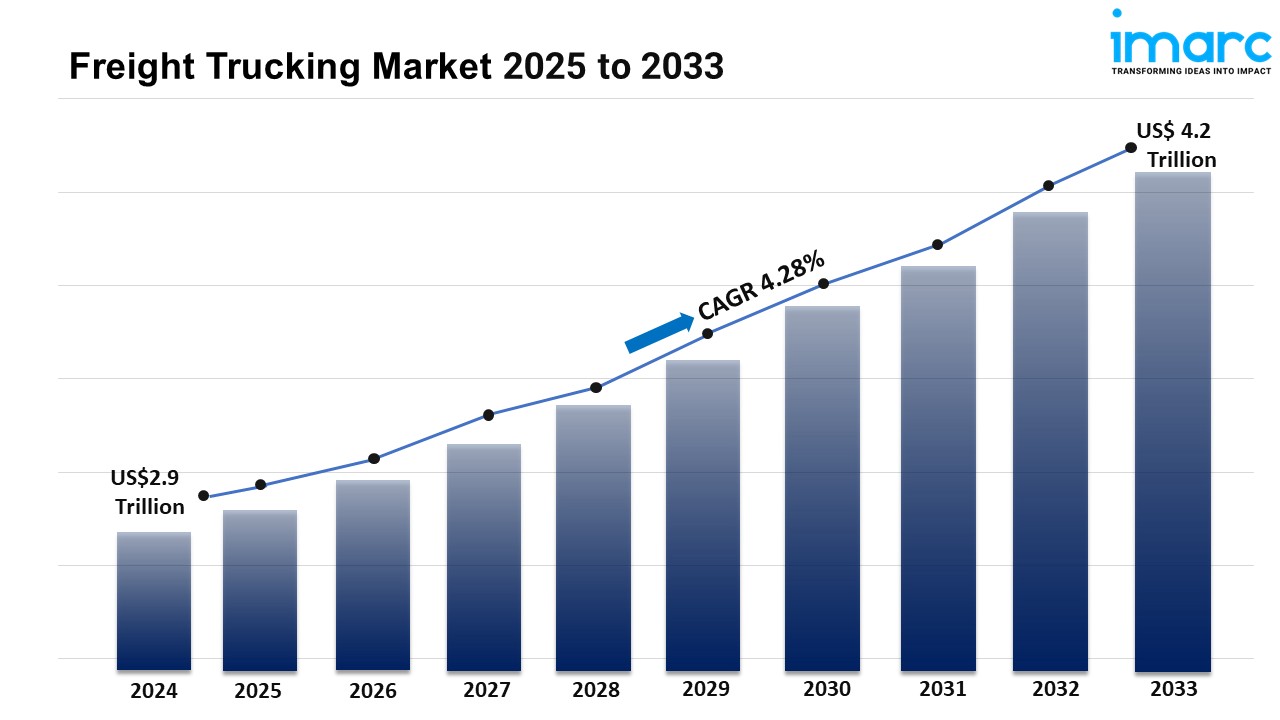

The global freight trucking market size reached USD 2.9 Trillion in 2024.

The market is expected to reach USD 4.2 Trillion by 2033, exhibiting a growth rate (CAGR) of 4.28% during 2025-2033.

Asia Pacific leads the market, accounting for the largest freight trucking market share.

Dry van and box trucks account for the majority of the market share in the truck type segment due to their versatility in transporting a wide range of goods across various industries.

Dry bulk goods hold the largest share in the freight trucking industry.

Based on the distance, the market has been categorized into 50 miles or less, 51 to 100 miles, 101-200 miles, 201-500 miles, and above 500 miles.

Oil and gas remains a dominant segment in the market owing to the continuous need for transporting heavy equipment, fuels, and raw materials for energy production.

The expanding e-commerce sector and growing infrastructure investments are primary drivers of the freight trucking market.

Technological advancements are significantly enhancing operational efficiency and reliability, which is reshaping the freight trucking market.

Industry Trends and Drivers:

E-commerce Expansion

The explosive growth of e-commerce has transformed consumer expectations regarding delivery speed and convenience, significantly escalating the demand for freight transportation. As more shoppers turn to online platforms for their purchases, they increasingly expect rapid and reliable delivery options. This trend has led to a surge in the need for efficient trucking services, which are essential for transporting goods from distribution centers to local destinations. Additionally, companies that can offer quick delivery times often gain a competitive edge, prompting logistics providers to optimize their operations and expand their fleets. Moreover, the rise of same-day and next-day delivery options has increased the importance of last-mile logistics, making it crucial for trucking companies to develop strategies that enhance speed and reduce costs. As e-commerce continues to flourish, the trucking industry must adapt to these evolving demands by improving service levels and leveraging technology to streamline operations, ensuring that they can meet consumer expectations effectively and maintain high levels of customer satisfaction.

Growing Infrastructure Investments

Governments are making significant investments in transportation infrastructure, particularly in roads and highways due to the increasing demands of freight transportation. Additionally, upgrading these systems is essential for enhancing the efficiency and capacity of freight trucking, allowing for smoother and more reliable transport of goods across regions. Moreover, improved infrastructure reduces congestion, minimizes delays, and enhances safety, enabling trucking companies to optimize their routes and delivery schedules. Furthermore, investments in infrastructure can stimulate economic growth by facilitating trade and supporting local businesses. Besides this, the development of dedicated freight corridors and intermodal facilities is also crucial, as they provide seamless connections between different modes of transport, such as trucks, trains, and ships. As governments recognize the critical role of freight transportation in the economy, these infrastructure improvements support the trucking industry and contribute to a more resilient supply chain, ultimately benefiting consumers through more efficient service and potentially lower costs.

Technological Advancements

The trucking industry is undergoing a technological transformation that significantly enhances operational efficiency and reliability. Additionally, various innovations such as global positioning system (GPS) tracking and route optimization software enable trucking companies to monitor their vehicles in real-time, allowing for precise delivery estimates and improved route planning. This technology minimizes delays and reduces fuel consumption by identifying the most efficient paths for transportation. Besides this, telematics systems provide valuable data on vehicle performance, driver behavior, and maintenance needs, helping companies to proactively address issues and improve safety. Furthermore, with the integration of these technologies, businesses can make informed decisions that optimize their logistics operations, ultimately lowering costs and increasing customer satisfaction across the globe.

Request Sample For PDF Report: https://www.imarcgroup.com/freight-trucking-market/requestsample

The report has segmented the market into the following categories:

Truck Type Insights:

Dry Van and Box Truck

Refrigerated Truck

Tanker Truck

Flatbed Truck

Others

Dry van and box trucks represent the largest segment due to their versatility in transporting a wide range of goods across various industries.

Cargo Type Insights:

Dry Bulk Goods

Oil and Diesel

Postal

Others

Dry bulk goods hold the largest market share owing to the rising demand for transporting commodities like grain, coal, and minerals.

Distance Insights:

50 Miles or Less

51 to 100 Miles

101-200 Miles

201-500 Miles

Above 500 Miles

Based on the distance, the market has been categorized into 50 miles or less, 51 to 100 miles, 101-200 miles, 201-500 miles, and above 500 miles.

End User Insights:

Food and Beverages

Industrial and Manufacturing

Energy and Mining

Oil and Gas

Pharmaceutical and Healthcare

Others

Oil and gas dominates market growth due to the continuous need for transporting heavy equipment, fuels, and raw materials for energy production.

Market Breakup by Region:

North America (United States, Canada)

Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

Latin America (Brazil, Mexico, Others)

Middle East and Africa

Asia Pacific holds the leading position owing to a large market for freight trucking driven by rapid industrialization, infrastructure development, and expanding trade networks in countries like China and India.

Top Freight Trucking Market Leaders:

A.P. Møller – Mærsk A/S

J & J Logistics LLC

J.B. Hunt Transport Services Inc.

Landstar System Inc.

Old Dominion Freight Line Inc.

R+L Carriers Inc.

Schneider National Inc.

Swift Transportation Company (Knight-Swift Transportation Holdings Inc.)

XPO Logistics Inc.

Yellow Corporation

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.