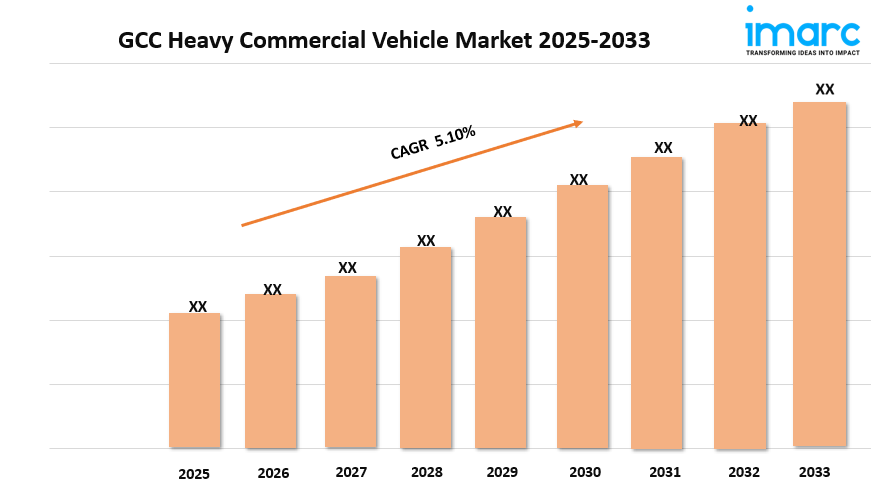

GCC Heavy Commercial Vehicle Market Growth, Size, and Trends Analysis 2025-2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

GCC Heavy Commercial Vehicle Market Overview

Market Size in 2024: USD 17.2 Billion

Market Size in 2033: USD 27 Billion

Market Growth Rate 2025-2033: 5.10%

According to IMARC Group's latest research publication, "GCC Heavy Commercial Vehicle Market Report by Vehicle Type (Heavy Truck, Heavy Buses), Class Type (Class 7, Class 8), Propulsion Type (Diesel, CNG, Alternate Fuel), End User (Individual, Fleet Owner), Application (Transportation, Construction, Mining, Agriculture, and Others), and Region 2025-2033", the GCC heavy commercial vehicle market size reached USD 17.2 billion in 2024. Looking forward, IMARC Group expects the market to reach USD 27 billion by 2033, exhibiting a growth rate (CAGR) of 5.10% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/gcc-heavy-commercial-vehicle-market/requestsample

Growth Factors in the GCC Heavy Commercial Vehicle Market

- Infrastructure Development and Construction Boom

The GCC region's ambitious infrastructure projects are a major driver for the heavy commercial vehicle (HCV) market. Countries like Saudi Arabia and the UAE are investing heavily in mega-projects, such as Saudi Arabia’s Red Sea Project and the UAE’s strategic sewage tunnel in Dubai. These initiatives require robust vehicles like heavy trucks and trailers to transport construction materials and equipment. For instance, the construction of smart cities and rail networks across the GCC demands reliable HCVs to support logistics, ensuring the timely delivery of resources. This surge in construction activity fuels consistent demand for durable, high-capacity vehicles tailored for heavy-duty tasks.

- Economic Diversification and Industrial Growth

GCC countries are actively reducing their reliance on oil by diversifying into sectors like manufacturing, retail, and tourism. This shift has spurred demand for heavy commercial vehicles to support emerging industries. For example, Saudi Arabia’s Vision 2035 initiative emphasizes manufacturing growth, requiring HCVs for transporting goods and materials. The rise of non-oil sectors has led to increased logistics needs, with heavy trucks playing a critical role in moving products across borders and within urban centers. This diversification fosters a dynamic market for HCVs, as businesses seek efficient transport solutions to support their expanding operations.

- Rising Demand for Logistics and E-Commerce

The rapid growth of e-commerce and logistics in the GCC is a significant growth factor for the HCV market. With online retail booming, companies like Amazon and Noon rely on heavy trucks for efficient supply chain management and last-mile delivery. The UAE, a key logistics hub, has seen increased demand for HCVs to transport goods across its ports and airports. For instance, the expansion of warehousing facilities in Dubai supports the need for high-capacity vehicles to handle large cargo volumes. This trend underscores the critical role of HCVs in meeting the region’s growing logistics demands.

Key Trends in the GCC Heavy Commercial Vehicle Market

- Adoption of Electric and Hybrid Vehicles

The GCC is witnessing a shift toward electric and hybrid heavy commercial vehicles, driven by environmental goals and government incentives. For example, in June 2023, FAMCO launched Volvo’s first heavy-duty electric truck range in the Middle East, with Unilever adopting the Volvo FH electric truck in the UAE for sustainable operations. These vehicles align with the region’s push for reduced carbon emissions, supported by initiatives like the UAE’s sustainability goals. Incentives, such as tax breaks, make electric HCVs more attractive, encouraging logistics and construction companies to modernize their fleets with eco-friendly options.

- Integration of Telematics and Smart Technologies

Telematics is transforming the GCC’s HCV market by enhancing fleet management and operational efficiency. This technology allows fleet operators to monitor vehicle performance, fuel consumption, and driver behavior in real time. For instance, transport companies in the GCC use telematics to track long-haul trucks, optimizing routes and reducing fuel costs. Despite initial skepticism due to high costs, adoption has grown, with 50-60% of heavy-duty fleets now leveraging telematics. This trend reflects the market’s move toward data-driven solutions, enabling businesses to improve asset tracking and meet the demands of complex logistics networks.

- Regulatory Push for Safety and Efficiency

Stringent regulations in the GCC are shaping the HCV market by prioritizing safety and environmental compliance. For example, the UAE’s federal law, effective October 2023, imposes a 65-tonne weight limit on heavy vehicles to protect road infrastructure and enhance safety. Such regulations drive demand for newer, fuel-efficient, and compliant vehicles. Companies are investing in advanced HCVs that meet these standards, such as those with improved braking systems and emission controls. This regulatory focus ensures that manufacturers and fleet operators prioritize innovation to align with the region’s safety and sustainability objectives.

We explore the factors propelling the GCC heavy commercial vehicle market growth, including technological advancements, consumer behaviors, and regulatory changes.

GCC Heavy Commercial Vehicle Industry Segmentation:

The report has segmented the market into the following categories:

Vehicle Type Insights:

- Heavy Truck

- Heavy Buses

Class Type Insights:

- Class 7

- Class 8

Propulsion Type Insights:

- Diesel

- CNG

- Alternate Fuel

End User Insights:

- Individual

- Fleet Owner

Application Insights:

- Transportation

- Construction

- Mining

- Agriculture

- Others

Country Insights:

- Saudi Arabia

- United Arab Emirates

- Qatar

- Kuwait

- Oman

- Bahrain

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Future Outlook

The GCC heavy commercial vehicle market is poised for sustained growth, driven by ongoing infrastructure development, economic diversification, and technological advancements. As countries like Saudi Arabia and the UAE continue to invest in mega-projects and non-oil sectors, the demand for heavy trucks and buses will remain robust. The shift toward electric and hybrid vehicles, supported by government incentives, will accelerate, with companies like Volt Mobility leading the way through large-scale electric vehicle contracts. Additionally, the integration of telematics and autonomous technologies will enhance operational efficiency, positioning the GCC as a hub for innovative transport solutions. Despite global economic challenges, the region’s strategic focus on logistics and sustainability will ensure a dynamic market trajectory.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.