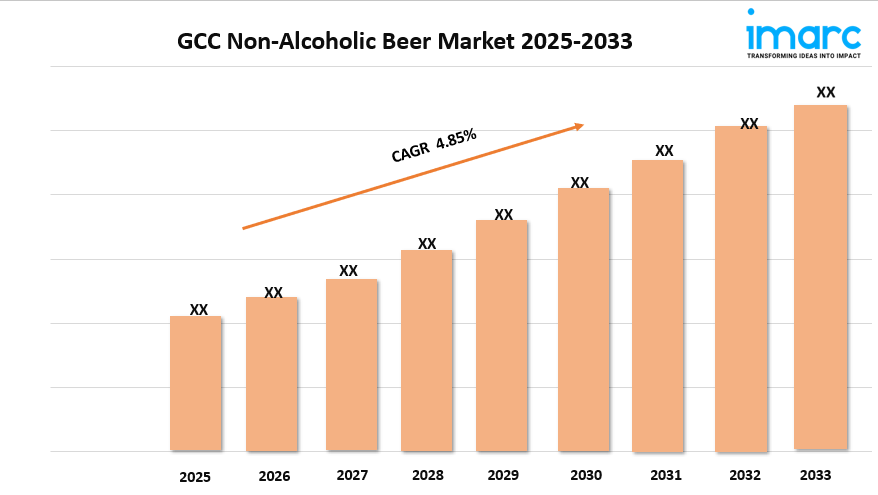

GCC Non-Alcoholic Beer Market Trends, Growth, and Demand Forecast 2025-2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

GCC Non-Alcoholic Beer Market Overview

Market Size in 2024: USD 87.8 Million

Market Size in 2033: USD 137.3 Million

Market Growth Rate 2025-2033: 4.85%

According to IMARC Group's latest research publication, "GCC Non-Alcoholic Beer Market Report by Brewery Type (Macro Brewery, Micro Brewery, and Others), Technology (Restricted Fermentation, Dealcoholization, and Others), Flavour (Flavoured, Unflavoured), Packaging (Glass Bottles, Metal Cans, and Others), Distributional Channel (Direct Sales, Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, and Others), End User (Institutions, Direct Consumers), and Country 2025-2033", the GCC Non-Alcoholic beer market size reached USD 87.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 137.3 Million by 2033, exhibiting a growth rate (CAGR) of 4.85% during 2025-2033.

Download a sample PDF of this report: https://www.imarcgroup.com/gcc-non-alcoholic-beer-market/requestsample

Growth Factors in the GCC Non-Alcoholic Beer Market

- Rising Health Consciousness

A surge in health awareness among GCC consumers is a major driver for the non-alcoholic beer market. With increasing concerns about cardiovascular diseases and alcohol-related health risks, many are seeking healthier beverage options. Non-alcoholic beer, containing beneficial polyphenols like xanthohumol, supports heart health and reduces inflammation, appealing to health-conscious individuals. For instance, brands like Heineken have capitalized on this trend by promoting their zero-alcohol variants as guilt-free alternatives. This shift is particularly strong among millennials and expatriates in the UAE and Saudi Arabia, where wellness trends are gaining traction, boosting demand for these beverages.

- Cultural and Religious Alignment

The GCC’s predominantly Muslim population, for whom alcohol consumption is prohibited under Islamic law, creates a natural market for non-alcoholic beer. These beverages offer a socially acceptable alternative that aligns with cultural and religious norms while mimicking the taste of traditional beer. Brands like Barbican and Moussy have thrived by catering to this demographic, offering flavors that resonate with local preferences, such as fruity and spicy variants. This alignment ensures widespread acceptance, especially in Saudi Arabia and Qatar, where strict regulations on alcohol consumption further encourage the adoption of non-alcoholic alternatives.

- Growing Expatriate and Tourist Population

The GCC region, particularly the UAE and Saudi Arabia, hosts a large expatriate and tourist population, significantly driving non-alcoholic beer demand. Expatriates, accustomed to beer consumption in their home countries, seek alternatives due to alcohol restrictions. For example, during the 2022 Qatar World Cup, Budweiser’s Bud Zero was exclusively sold at stadiums, catering to international visitors. Tourists, attracted by events like Dubai’s Expo or Saudi Arabia’s cultural festivals, also contribute to market growth. This diverse consumer base encourages manufacturers to innovate with flavors and packaging to meet varied preferences.

Key Trends in the GCC Non-Alcoholic Beer Market

- Popularity of Flavored Non-Alcoholic Beers

Flavored non-alcoholic beers are gaining significant traction in the GCC, driven by consumer demand for diverse taste profiles. Flavors like strawberry, pomegranate, and ginger cater to local palates and health-conscious preferences, as these drinks are often low in sugar and calories. Companies like Lamstel and Aujan Group Holding have introduced exotic flavors, enhancing their appeal among younger consumers and women. This trend reflects a broader shift toward personalized beverage experiences, with flavored variants dominating supermarket shelves in the UAE, where consumers prioritize variety and novelty in their drinking choices.

- Expansion of Craft and Artisanal Offerings

The rise of craft and artisanal non-alcoholic beers is reshaping the GCC market, appealing to urban consumers seeking premium experiences. Microbreweries in Dubai and Riyadh are experimenting with high-quality ingredients and innovative brewing techniques to create unique, alcohol-free options. For instance, Moussy’s craft variants have gained popularity for their rich, authentic taste. This trend aligns with global craft beer movements and caters to a discerning audience that values quality over quantity. Urbanization in metro cities like Abu Dhabi further fuels this demand, as consumers embrace sophisticated, locally-inspired beverages.

- Increased Availability Through Diverse Distribution Channels

The GCC non-alcoholic beer market is benefiting from expanded distribution channels, including supermarkets, e-commerce, and on-premise venues. Supermarkets in Saudi Arabia and the UAE have increased shelf space for brands like Bavaria and Holsten Zero, making these products more accessible. Online retail platforms have also surged, with companies like Anheuser-Busch InBev partnering with e-commerce giants to reach a broader audience. Social media campaigns further amplify visibility, targeting millennials and expatriates. This multi-channel approach enhances consumer convenience and supports market growth by meeting evolving purchasing preferences.

Our comprehensive GCC Non-Alcoholic beer market outlook reflects both short-term tactical and long-term strategic planning. This analysis is essential for stakeholders aiming to navigate the complexities of the market and capitalize on emerging opportunities.

GCC Non-Alcoholic Beer Industry Segmentation:

The report has segmented the market into the following categories:

Breakup by Brewery Type:

- Macro Brewery

- Micro Brewery

- Others

Breakup by Technology:

- Restricted Fermentation

- Dealcoholization

- Others

Breakup by Flavour:

- Flavoured

- Unflavoured

Breakup by Packaging:

- Glass Bottles

- Metal Cans

- Others

Breakup by Distributional Channel:

- Direct Sales

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Breakup by End User:

- Institutions

- Direct Consumers

Breakup by Country:

- UAE

- Saudi Arabia

- Oman

- Kuwait

- Bahrain

- Qatar

Competitive Landscape:

The competitive landscape of the industry has also been examined, along with the profiles of the key players.

Future Outlook

The GCC non-alcoholic beer market is poised for robust growth, driven by evolving consumer preferences and strategic industry advancements. As health consciousness continues to rise, manufacturers will likely invest in innovative flavors and functional ingredients, such as vitamins or probiotics, to differentiate their offerings. The region’s hosting of global events, like Saudi Arabia’s upcoming sports and cultural festivals, will attract more tourists, further boosting demand. Collaborations between regional and international brewers, such as Heineken’s partnerships with local distributors, will enhance product availability and quality. With expanding online and offline distribution channels, the market is set to thrive, catering to a diverse and dynamic consumer base.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.