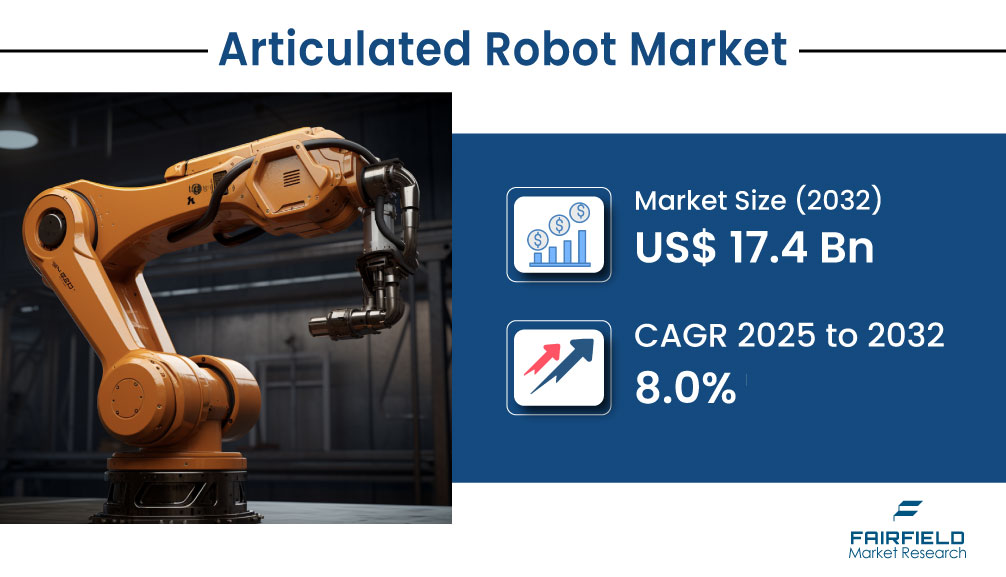

Global Articulated Robot Market Gears Up for US$ 17.4 Billion Milestone by 2032 Amid Manufacturing Tech Shift

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

The global articulated robot market is undergoing a powerful transformation, with Fairfield Market Research projecting a leap in market valuation from US$ 10.1 billion in 2025 to US$ 17.4 billion by 2032. This notable rise, supported by a compound annual growth rate (CAGR) of 8.0%, is being driven by growing demand for automation in manufacturing, the rise of Industry 4.0, and the rapid integration of advanced technologies like artificial intelligence (AI), machine vision, and industrial IoT.

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.fairfieldmarketresearch.com/report/articulated-robot-market

Articulated robots—multi-jointed, highly flexible systems—have become an essential part of modern production processes. Their ability to handle complex and repetitive operations with high speed and precision is making them indispensable across industries such as automotive, electronics, logistics, pharmaceuticals, and food processing.

Market Landscape and Expansion Momentum

As global industries prioritize efficiency, speed, and consistent product quality, articulated robots are seeing widespread deployment. Their capacity to perform functions such as welding, material handling, assembling, and dispensing allows manufacturers to streamline operations and reduce dependence on manual labor.

In 2023, the handling segment retained dominance in functional categories due to its application across diverse sectors. Automotive continues to lead in terms of industry adoption, while food and beverages, precision engineering, and healthcare sectors are rapidly adopting robotic automation for improved safety, accuracy, and output.

Key Highlights from the Report

Articulated robot market forecast to reach US$ 17.4 billion by 2032, expanding at 8.0% CAGR

Handling robots dominate functional use cases, especially in automotive and logistics

Asia Pacific leads global adoption, with China and India advancing smart factory initiatives

Integration of AI, IoT, and machine vision technologies enhances operational agility

Collaborative robots gain traction among SMEs for affordable, safe, and flexible automation

Adoption in healthcare, cosmetics, and food processing sectors opens new growth avenues

Regional Overview

Asia Pacific remains the largest and fastest-growing regional market, led by the rapid industrialization and smart manufacturing policies of China, India, Japan, and Southeast Asian nations. China, in particular, maintains its lead with widespread robot deployment in automotive, consumer electronics, and machinery production.

Europe remains a key contributor to global market expansion, with Germany, France, and the UK showing strong uptake in automotive and electronics sectors. Automation in precision engineering and sustainability-driven manufacturing has added to the demand for advanced robots.

North America is also witnessing robust growth, particularly in the United States, where large-scale investments in digital manufacturing, reshoring, and robotics innovation are driving adoption. Canada and Mexico are contributing as well through automation investments in automotive and electronic assembly sectors.

Market Growth Drivers

The primary growth engine for the articulated robot market is the intensifying push for industrial automation. As labor costs increase and skilled workers become scarce, companies are leveraging automation to maintain competitiveness, reduce operational risks, and improve throughput.

The integration of intelligent technologies is also fueling market growth. AI and IoT capabilities now allow articulated robots to support real-time data analytics, predictive maintenance, and adaptive production workflows—key elements in modern smart factories.

Challenges to Market Expansion

Despite a strong outlook, certain factors may hinder rapid adoption. One of the most pressing challenges is the shortage of skilled personnel capable of managing, programming, and maintaining advanced robotic systems, particularly in emerging economies.

Additionally, integrating articulated robots into existing legacy systems requires substantial upfront investment, planning, and customization. This complexity can deter small manufacturers from transitioning to automation, especially where budgets and technical support are limited.

Emerging Trends and Market Opportunities

New use cases for articulated robots are emerging beyond the traditional industrial landscape. The healthcare industry is leveraging robotic precision in surgery support, diagnostics, and pharmaceutical packaging. Similarly, the food and beverage industry is using robots for hygienic, high-speed packaging and sorting. In the cosmetics industry, demand is growing for robots capable of handling fragile and high-precision items.

Collaborative robots, or cobots, are creating a transformative shift in accessibility. Designed to operate safely alongside humans, cobots offer intuitive programming, compact size, and lower cost—making them ideal for SMEs looking to automate with minimal infrastructure upgrades.

Market Segmentation Insights

By function, handling robots remain the most widely used, followed by welding systems used heavily in automotive assembly. Dispensing and assembling robots are increasingly relevant in electronics and consumer goods industries where precision is paramount.

Industry-wise, automotive remains the strongest segment, with high-volume, standardized processes well-suited to robotic automation. Electronics, pharmaceuticals, and food & beverage sectors are also accelerating deployment to meet increasing demands for hygiene, consistency, and scalability.

Competitive Landscape

The articulated robot market remains competitive, with leading global players driving innovation, regional expansion, and technological enhancements. Key companies include:

ABB Ltd.

FANUC Corporation

KUKA AG

Yaskawa Electric Corporation

Universal Robots

Mitsubishi Electric

Comau

Kawasaki Heavy Industries

OMRON Corporation

Notable strategic developments include:

ABB's acquisition of Path Robotics (February 2024), enhancing its AI-based automation capabilities

Fanuc's release of a new series of flexible robots tailored for automotive use (January 2024)

Yaskawa Electric’s expansion into Southeast Asia with a new production facility in Thailand (December 2023)

Expert Commentary

According to analysts at Fairfield, articulated robots are not just supporting the automation wave—they're shaping its future. Their unmatched precision and adaptability make them a foundation for next-gen manufacturing. As automation spreads across new sectors and becomes more SME-friendly, the demand for articulated robots will expand even further.

Why This Market Merits Attention

Strong alignment with Industry 4.0 and global digital transformation goals

Expanding demand across healthcare, cosmetics, food, and electronics industries

Technological advancements driving smarter, more cost-effective robot deployment

High-growth potential in emerging economies and SME segments

Strong strategic focus by market leaders through innovation and regional expansion

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.