Topic Cluster Planning – Boost Topical Authority Like a Pro!

Topic Cluster Planning – Boost Topical Authority Like a Pro!

How Fintech Solutions are Revolutionizing Personal Finance Management

Written by olivia » Updated on: June 17th, 2025

In recent years, the intersection of financial services and technology, commonly known as fintech, has brought about significant changes in how individuals manage their personal finances. Fintech solutions leverage advanced technologies to offer innovative tools and platforms that streamline financial activities, enhance user experience, and empower individuals to make informed financial decisions. This article explores the transformative impact of fintech solutions on personal finance management, highlighting key technologies and benefits reshaping the industry.

The Evolution of Personal Finance Management

Traditionally, managing personal finances involved manual processes such as budgeting with spreadsheets, visiting bank branches for transactions, and relying on financial advisors for investment advice. However, fintech solutions have disrupted this landscape by introducing digital platforms that provide real-time access to financial information, automate routine tasks, and offer personalized financial guidance.

Advantages of Fintech Solutions

Accessibility and Convenience

Fintech solutions enable users to access their financial information anytime, anywhere, through mobile apps and online platforms. This accessibility eliminates the need for physical visits to banks and allows individuals to manage their finances on-the-go.

Automation of Financial Tasks

Automation is a cornerstone of fintech solutions, automating tasks such as bill payments, savings transfers, and investment portfolio management. This not only saves time but also reduces the likelihood of human error, ensuring accurate financial management.

Personalized Financial Advice

Using algorithms and machine learning, fintech solutions analyze user data to offer personalized financial advice. From budgeting tips to investment strategies, these platforms provide tailored recommendations that align with individual financial goals and risk tolerance.

Enhanced Security

Fintech companies prioritize cybersecurity, employing encryption and secure authentication methods to protect user data and transactions. This enhanced security gives users peace of mind when conducting financial transactions online.

Key Technologies Driving Fintech Solutions

1. Artificial Intelligence (AI) and Machine Learning

AI plays a crucial role in fintech solution development by powering algorithms that analyze vast amounts of data to predict financial trends, assess creditworthiness, and personalize user experiences. Machine learning algorithms continuously learn from data inputs, improving the accuracy of financial advice and risk assessments over time.

2. Blockchain Technology

Blockchain, known for its secure and transparent ledger system, is revolutionizing financial transactions and digital currencies. Fintech solutions leverage blockchain to enable faster, more secure peer-to-peer payments, reduce transaction costs, and enhance transparency in financial transactions.

3. Data Analytics

Data analytics tools in fintech solutions help users gain insights into their spending habits, savings patterns, and investment performance. By visualizing financial data through charts and graphs, these tools empower individuals to make informed decisions and adjust their financial strategies accordingly.

4. Mobile Applications

Mobile apps are integral to fintech solutions, offering users a convenient way to manage their finances on smartphones and tablets. These apps provide functionalities such as account monitoring, bill payments, budget tracking, and investment management, enhancing user engagement and accessibility.

Use Cases of Fintech Solutions in Personal Finance Management

1. Budgeting and Expense Tracking

Fintech apps simplify budgeting by categorizing expenses, tracking spending patterns, and setting financial goals. Users receive alerts for overspending and insights into areas where they can save money, promoting better financial discipline.

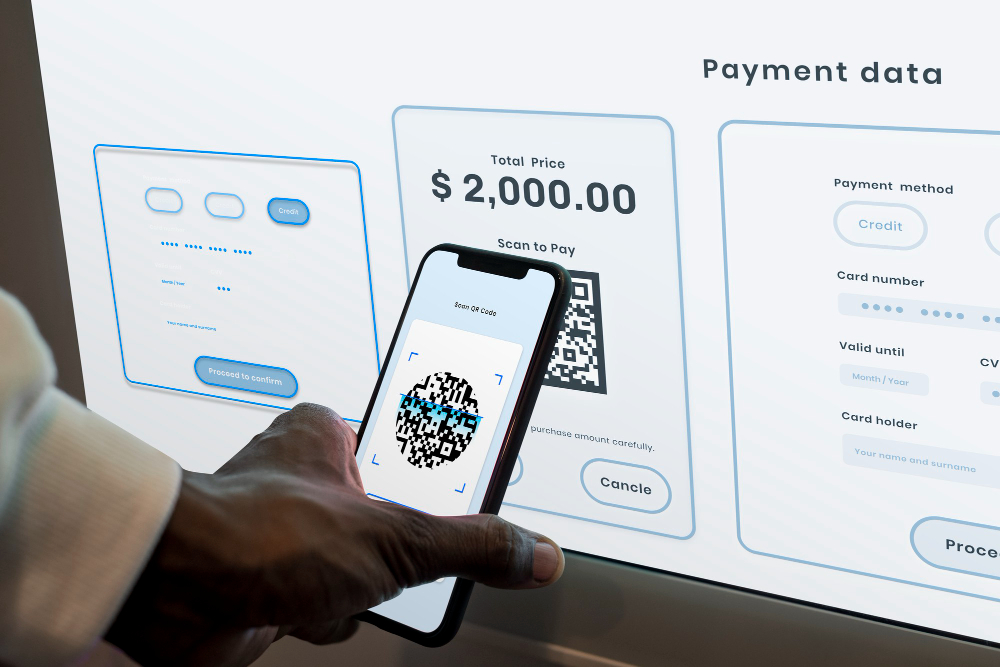

2. Digital Payments

Digital payment platforms facilitate seamless transactions, enabling users to pay bills, transfer money between accounts, and make online purchases securely. Features such as digital wallets and peer-to-peer payment systems streamline financial transactions across borders.

3. Investment and Wealth Management

Fintech solutions democratize investment opportunities by offering robo-advisors and automated investment platforms. These tools create diversified investment portfolios based on user preferences and risk profiles, making investing accessible to a broader audience.

4. Credit Scoring and Loans

Fintech companies utilize AI-driven algorithms to assess creditworthiness and offer personalized loan products with competitive interest rates. Digital lending platforms streamline the loan application process, providing faster approvals and disbursements compared to traditional banks.

Future Trends in Fintech and Personal Finance

The future of fintech and personal finance management promises continued innovation and evolution. Emerging trends such as voice-activated banking, decentralized finance (DeFi), and predictive analytics will further enhance the capabilities of fintech solutions, offering users more personalized and integrated financial experiences.

Voice-Activated Banking

Voice-enabled fintech applications allow users to perform banking tasks using voice commands, enhancing accessibility for visually impaired individuals and simplifying everyday financial transactions.

Decentralized Finance (DeFi)

DeFi platforms leverage blockchain technology to offer financial services such as lending, borrowing, and trading without intermediaries like banks. These platforms promote financial inclusivity and transparency while offering users greater control over their assets.

Predictive Analytics

Advancements in predictive analytics will enable fintech solutions to anticipate user financial needs and behaviors more accurately. By analyzing historical data and market trends, these tools will provide proactive financial advice and personalized recommendations in real-time.

Conclusion

Fintech solutions are transforming personal finance management by leveraging advanced technologies such as AI, blockchain, and mobile applications to offer accessible, automated, and personalized financial services. These solutions empower individuals to take control of their finances, from budgeting and digital payments to investment and wealth management. As fintech continues to innovate, the future holds promising opportunities for enhancing financial literacy, improving financial inclusion, and reshaping the way individuals interact with their money. Embracing fintech solutions can lead to more informed financial decisions, greater financial security, and enhanced overall well-being in an increasingly digital economy.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

Copyright © 2019-2025 IndiBlogHub.com. All rights reserved. Hosted on DigitalOcean for fast, reliable performance.