Key Factors Driving Digital Transformation in Banking

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

The banking industry is undergoing significant changes as digital transformation continues to reshape the landscape. With increasing customer expectations, evolving regulatory requirements, and advances in technology, banks are turning to digital solutions to stay competitive. The integration of digital strategies is driving unprecedented innovation and efficiency within the sector. This article explores the key factors driving digital transformation in banking, with a focus on how banking software development services are enabling this change.

1. Changing Customer Expectations

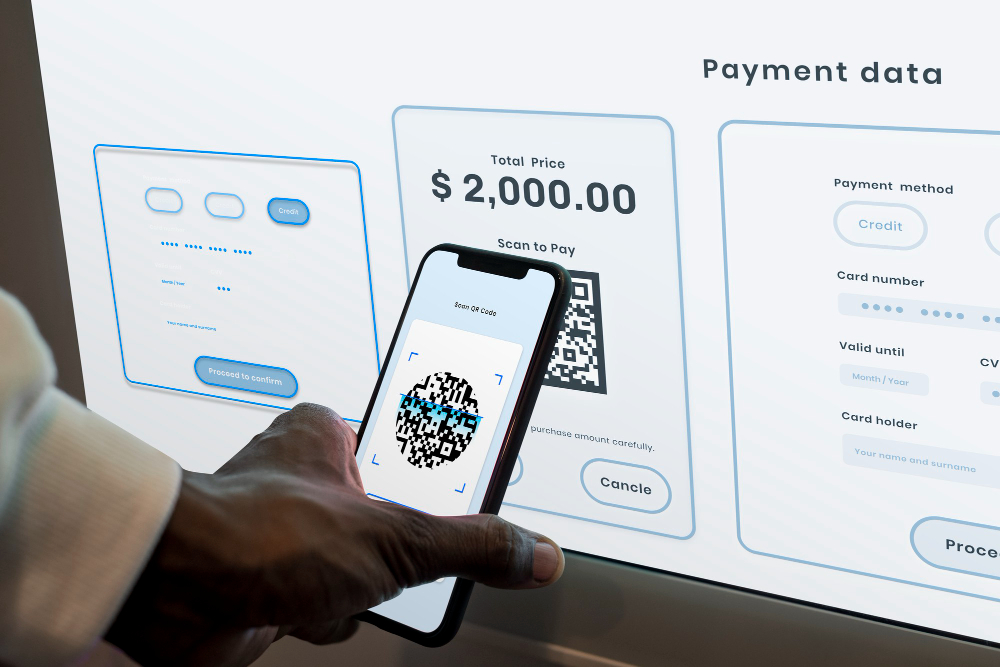

In today's digital age, customers demand seamless and personalized banking experiences. Gone are the days when customers were willing to wait in line at a physical bank branch for basic transactions. Modern customers expect instant access to banking services through user-friendly apps and online platforms. The desire for speed, convenience, and personalization has led banks to prioritize digital transformation initiatives to meet customer expectations.

With banking software development services, financial institutions can create tailored digital experiences that cater to individual needs. Features such as mobile banking, chatbots, personalized financial advice, and instant payment solutions are becoming standard offerings. By implementing robust software solutions, banks can ensure they meet the growing demand for enhanced customer experiences while maintaining security and compliance.

2. Technological Advancements

The rapid evolution of technology has made digital transformation in banking not only possible but necessary. Key technologies such as Artificial Intelligence (AI), Machine Learning (ML), blockchain, cloud computing, and the Internet of Things (IoT) are reshaping how banks operate. These technologies enable banks to automate processes, improve data analysis, and enhance cybersecurity.

Artificial Intelligence and Machine Learning: AI and ML are empowering banks to deliver smarter services, such as fraud detection, automated loan approval, and risk management. By integrating AI-driven banking software development services, banks can predict customer behaviors, optimize operational workflows, and streamline decision-making processes.

Blockchain Technology: The use of blockchain is transforming the way banks handle transactions, making them more transparent and secure. Blockchain-based banking software development services are helping banks reduce costs and minimize the risk of fraud, making digital transformation in banking a more viable option.

Cloud Computing: Cloud technology enables banks to store and process large amounts of data more efficiently. By adopting cloud-based solutions, banks can scale their operations quickly and deliver services with higher reliability.

3. Increased Competition

The rise of fintech companies and digital-only banks has intensified competition in the banking sector. These new players often have the advantage of being more agile, cost-effective, and tech-savvy compared to traditional banks. As a result, established banks are being forced to accelerate their digital transformation efforts to remain competitive.

To keep up with new market entrants, banks are increasingly investing in innovative banking software development services. These services help them create digital platforms that offer faster transactions, seamless integrations, and enhanced user experiences. The adoption of such services is not just a trend but a necessity to retain market share and attract new customers.

4. Regulatory Compliance and Risk Management

The banking industry is highly regulated, and compliance requirements continue to evolve, making it essential for financial institutions to adopt modern digital tools. Digital transformation in banking helps streamline compliance processes and improves risk management through better data tracking and reporting.

Banking software development services enable banks to implement compliance solutions that monitor transactions, identify suspicious activities, and generate reports to meet regulatory standards. Additionally, these services help banks manage risks more effectively by utilizing data analytics and predictive modeling to anticipate potential issues before they become major problems.

5. The Need for Cost Efficiency

Cost management is a critical factor driving digital transformation in banking. Traditional banking operations are often costly and labor-intensive, requiring significant investment in physical branches, paperwork, and manual processes. Digital solutions, on the other hand, offer a way to reduce costs while improving service quality.

By leveraging banking software development services, banks can automate routine tasks, reduce operational expenses, and optimize resource allocation. The use of chatbots, automated customer service solutions, and AI-powered analytics helps minimize the need for human intervention, lowering costs associated with staffing and training.

6. Enhanced Cybersecurity Requirements

As banking services become increasingly digital, cybersecurity has emerged as a top priority for financial institutions. The risk of cyberattacks, data breaches, and financial fraud has never been higher, making it essential for banks to adopt cutting-edge security measures.

Digital transformation in banking emphasizes the importance of integrating advanced cybersecurity solutions into digital platforms. Banking software development services often include security features such as multi-factor authentication, encryption, and secure data storage, helping banks protect sensitive customer information and comply with regulatory requirements. Additionally, AI-powered threat detection systems can identify potential risks in real-time, allowing for quicker response to cyber threats.

7. Data-Driven Decision Making

Data is at the core of digital transformation in banking. Banks are now able to collect, analyze, and utilize vast amounts of data to make informed business decisions. By leveraging data analytics, banks can gain insights into customer behavior, identify new revenue opportunities, and optimize their services.

Banking software development services facilitate the integration of data analytics tools into banking platforms. These tools help banks track customer interactions, evaluate financial trends, and predict future market conditions. The ability to make data-driven decisions enables banks to stay ahead of competitors and deliver better, more personalized services to customers.

8. Remote Work and Digital Collaboration

The COVID-19 pandemic accelerated the shift towards remote work and digital collaboration, which has had a significant impact on banking operations. The need for flexible and remote-friendly systems has become more evident, leading to increased adoption of cloud-based banking solutions and collaboration tools.

Banking software development services support the development of digital platforms that facilitate remote work for employees and digital collaboration with customers. This includes secure online communication channels, digital document management systems, and virtual customer service tools. By adopting these solutions, banks can continue to operate efficiently, even in a remote or hybrid work environment.

9. Sustainability and Green Banking Initiatives

Environmental sustainability is becoming a priority for many banks as they seek to reduce their carbon footprint and support green initiatives. Digital transformation in banking plays a key role in achieving sustainability goals by reducing the need for physical paperwork, cutting down on energy consumption, and promoting online services over in-branch visits.

Banking software development services enable banks to offer eco-friendly digital products, such as paperless statements, digital signatures, and energy-efficient data centers. These initiatives not only contribute to environmental protection but also appeal to a growing segment of customers who prioritize sustainability.

Conclusion

Digital transformation in banking is no longer optional but a strategic imperative for financial institutions looking to stay competitive in a rapidly changing environment. By adopting modern banking software development services, banks can meet evolving customer expectations, enhance operational efficiency, and stay ahead of regulatory requirements. The integration of advanced technologies, coupled with a data-driven approach and a focus on cybersecurity, positions banks to navigate the challenges of digital transformation successfully.

As the landscape continues to evolve, banks that embrace digital transformation will be better equipped to innovate, grow, and provide value to their customers. The driving factors highlighted above underscore the importance of a well-planned digital transformation strategy, one that leverages technology to build a resilient, customer-centric, and sustainable banking future.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.