Newsletter Copywriting – Emails That Convert, Not Bore!

Newsletter Copywriting – Emails That Convert, Not Bore!

How to Claim OPD Expenses Under Your Health Insurance Plan?

Written by Aakash » Updated on: April 29th, 2025

When you hear the words health insurance, what do you typically think of? Hospitalisations, surgeries, or maybe emergencies. But what about visits to your doctor on a normal day, diagnostic procedures, or even prescribed drugs? Those are important too! That's where health insurance with OPD cover enters the scene.

Having OPD benefits isn't just about being covered in case of serious sicknesses but also for the regular check-ups and minor sicknesses that creep up on you. It's like having a health umbrella, which not only protects you from storms but also from those surprise drizzles.

Whether you're coping with a chronic illness, receiving yearly check-ups, or just seeing a specialist for reassurance, OPD coverage allows you to maintain your wellness without incurring escalating costs.

What Are OPD Expenses?

OPD expenses are medical expenses incurred without being hospitalised, and it becomes important to consider them when choosing a healthcare plan. These expenses include:

General practitioner or specialist visits

Diagnostic procedures (X-rays, blood work, etc.)

Small procedures such as stitches or dressing

Medicines prescribed

Dental and optical treatment (in certain policies)

In simpler words, OPD costs are similar to your car's maintenance expenses: recurring, unavoidable, and easy to forget until they accumulate.

What Are OPD Health Insurance Plans?

OPD health insurance policies are ones that insure not only hospitalisation but also outpatient treatment. Such policies are a boon for people and families requiring regular check-ups, continued treatment, or those who just wish to have broader coverage.

Picking among the best health insurance policy offerings involves more than simply considering emergency treatment, it's about selecting coverage that meets your day-to-day needs as well.

Why is OPD Cover Important?

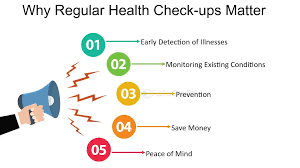

Many may assume that it is not a necessity, but here's why OPD coverage is more important than you might know:

Saves you money on preventive check-ups

Covers repeated treatments for ongoing diseases

Helps cut out-of-pocket hospital bills

Urges preventative healthcare

Incidentally, the best health insurance policy today already include OPD coverage as an added benefit, making them complete and customer-oriented.

How to Claim OPD Expenses Under Your Health Insurance Plan?

It is easier to claim OPD expenses from your health insurance than you think. Follow these easy steps to guide you through it.

Step 1: Read Your Policy Details

Read the terms and conditions of your health insurance policy or look up your insurer's website (such as nivabupa.com). Look for:

Eligibility for OPD claims

OPD limit per year

List of empanelled clinics and pharmacies

Required documents

Step 2: Save All Bills and Prescriptions

Each test, consultation, or medicine you wish to claim should be supported by:

Original doctor's prescription

Consultation invoice

Diagnostic reports

Pharmacy bills showing GST details

It's like keeping expense receipts for a work trip, it's a chore, but it makes reimbursement go smoothly.

Step 3: Claim Online or Offline

The majority of insurers, including Niva Bupa, provide offline and online channels and offer a cashless OPD facility at the network clinics, so you might not have to pay out of pocket at all. Here's how to do it:

Method

How to Do It?

Time Taken

Online

Log in to the customer portal or app, upload scanned documents

24–72 hours

Offline

Visit a branch office with physical documents

3–5 working days

Step 4: Track Your Claim Status

Stay updated via SMS, email, or the insurer’s portal. If anything is missing or needs clarification, the team will reach out to you.

Step 5: Receive Reimbursement or Enjoy Cashless Service

Once your claim is approved, the amount will either be credited to your account or settled directly with the clinic/pharmacy in the case of cashless service.

Tips for a Hassle-Free OPD Claim

With a little planning and alertness, you can sidestep common mistakes and make sure that your claim gets settled speedily and without any hassle. Here are some useful tips to help you get the most out of your OPD cover with minimal stress.

Know your limits: Understand your OPD claim limit for the year

Use network clinics: It can reduce paperwork and enhance speeds

Maintain clear documentation: No scribbled bills or unsigned prescriptions

Claim promptly: Don't wait until the policy year ends

Wrapping Up!

Health is a small-step journey consisting of regular, persistent steps, such as an early doctor visit, a screening test, or a follow-up on a persistent symptom. OPD medical insurance plans are not merely there to cater to those catastrophic moments but rather to every moment of life so that healthcare becomes holistic in nature. Claiming OPD costs effortlessly gives you power over your finances as well as your healthcare. Peace of mind isn't all about having the cover, though that certainly doesn't hurt, but knowing how to leverage it during its moments of utmost necessity.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

Copyright © 2019-2025 IndiBlogHub.com. All rights reserved. Hosted on DigitalOcean for fast, reliable performance.