How to Determine Your Home’s True Market Value

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

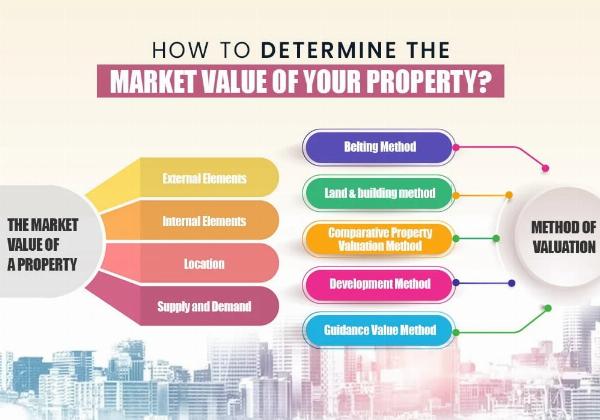

Understanding your home's market value is crucial whether you’re looking to sell, refinance, or simply assess your investment. Market value is essentially what a buyer is willing to pay for your property in the current market. Here’s a concise guide to help you determine your home’s true market value.

1. Comparative Market Analysis (CMA)

One of the most common methods for estimating your home’s value is a Comparative Market Analysis (CMA). This involves comparing your property to similar homes (comps) that have recently sold in your area. To get a CMA, you can:

Consult a Real Estate Agent: Agents have access to MLS (Multiple Listing Service) data and can provide a detailed CMA report. They consider factors like size, condition, location, and recent sales.

Online Tools: Various online platforms offer automated valuation models (AVMs). While convenient, these tools may not always account for unique features or recent market changes.

2. Professional Appraisal

A professional appraisal provides an unbiased, expert opinion of your home’s value. Appraisers use a detailed methodology that includes:

Property Inspection: An appraiser will examine the interior and exterior of your home, noting features and condition.

Market Trends: They analyze recent sales of comparable properties and market conditions.

Replacement Cost: They estimate the cost to replace your home with a similar one, adjusting for depreciation.

An appraisal is a reliable method but typically costs between $300 and $500.

3. Evaluate Recent Sales

To gauge market trends, look at recent sales data for properties similar to yours. Focus on:

Sold Listings: Properties that have recently sold are the best indicators of current market conditions.

Active Listings: Homes currently on the market can give insights into pricing trends and competition.

Expired Listings: Properties that failed to sell can highlight potential pricing issues or market shifts.

4. Consider Market Conditions

Market conditions greatly influence property value. Factors to consider include:

Supply and Demand: In a seller’s market with high demand and low inventory, prices tend to rise. Conversely, a buyer’s market with high inventory and low demand can drive prices down.

Economic Indicators: Interest rates, employment rates, and economic growth can impact buyer affordability and market activity.

5. Assess Home Features

Unique features of your home can significantly affect its value:

Upgrades and Renovations: Recent renovations or higher upgrades (like a new kitchen or bathroom) can increase your home’s value.

Condition and Maintenance: A well-maintained home with no major issues typically commands a higher price.

Location: Factors such as proximity to schools, amenities, and neighborhood desirability can influence value.

6. Utilize Online Valuation Tools

Online valuation tools can provide a quick estimate of your home’s value. While these tools use algorithms and data to generate an estimate, they should be used as a starting point rather than a definitive value.

Conclusion

Determining your home’s true market value involves a combination of methods and considerations. Start with a Comparative Market Analysis or professional appraisal, evaluate recent sales, and consider current market conditions. Additionally, assess the unique features of your home and use online tools for a broader perspective. By combining these approaches, you can arrive at a well-rounded estimate of your home’s market value, helping you make informed decisions whether buying, selling, or refinancing.

Contact us for more information:-

Phone:- +91 7835005003

Email:- [email protected]

Website:- https://property.sale

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.