How to read and interpret silver price graphs for better investment decisions

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

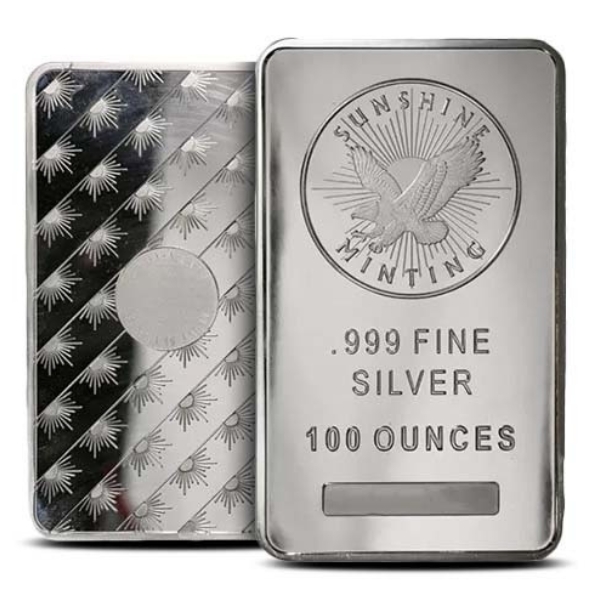

Investing in precious metals like silver can be a strategic move for diversifying your portfolio and safeguarding against economic instability. However, making informed investment decisions requires a thorough understanding of silver price trends. Whether you're a seasoned investor or new to the world of precious metals, understanding how to read and interpret silver price graphs is crucial. This knowledge empowers you to make decisions that can lead to profitable returns and more strategic investments.

Understanding the Silver Spot Price

The silver spot price is the current market price of silver for immediate delivery. It reflects the value of one ounce of silver at any given moment, based on live trading on global exchanges. Unlike futures prices, which are concerned with contracts for future delivery, the spot price represents the current value, providing a snapshot of the market's supply and demand dynamics.

Why the Silver Spot Price Matters

The silver spot price is a critical benchmark for setting the prices of silver products, including coins, bars, and rounds. It is also used to price financial instruments like ETFs and contracts tied to silver. For investors, keeping an eye on the spot price is essential, as it directly impacts the cost of buying or selling silver. A good grasp of spot price trends allows investors to identify entry and exit points, maximizing potential profits and minimizing losses.

Key Factors Influencing the Silver Spot Price

Several factors influence the silver spot price, making it a dynamic and sometimes volatile market.

1. Supply and Demand:

The most fundamental factor affecting the silver spot price is the balance between supply and demand. When demand for silver rises—whether due to industrial use, jewelry demand, or investment interest—the price typically increases. Conversely, an oversupply of silver can lead to a decrease in the spot price.

2. Industrial Demand:

Silver is not just a precious metal; it's also a vital industrial component used in electronics, solar panels, and medical devices. Changes in industrial demand, driven by technological advancements or economic shifts, can significantly impact silver prices. For example, an increase in demand for solar panels could drive up the price of silver due to its use in photovoltaic cells.

3. Market Sentiment:

Investor sentiment, shaped by factors like economic data, geopolitical events, and market trends, plays a crucial role in determining silver prices. Positive economic indicators may lead to a stronger currency, potentially lowering silver prices as the metal becomes more expensive in other currencies. Conversely, during periods of economic uncertainty or geopolitical tension, investors often flock to silver as a safe-haven asset, driving up its price.

4. Inflation and Currency Strength:

Silver, like other precious metals, is often viewed as a hedge against inflation. When inflation rises, the purchasing power of paper currencies declines, leading investors to seek refuge in tangible assets like silver. Additionally, the strength of the US dollar, which is inversely related to silver prices, plays a significant role. When the dollar weakens, silver becomes more attractive to investors using other currencies, pushing up its price.

How to Read Silver Price Graphs

Silver price graphs are visual representations of how the spot price of silver changes over time. To interpret these graphs effectively, it’s important to understand some key components:

1. Timeframe:

Price graphs can represent different timeframes—daily, weekly, monthly, or even yearly trends. Short-term graphs can help identify recent price movements, while long-term graphs provide a broader perspective on silver’s performance over time.

2. Price Scale:

The price scale on the graph’s vertical axis indicates the range of silver prices, while the horizontal axis typically represents time. By examining the price scale, you can assess the magnitude of price changes and volatility in the silver market.

3. Trend Lines and Patterns:

Trend lines connect a series of high or low points on the graph, indicating the general direction of the market. Upward trends suggest increasing prices, while downward trends indicate falling prices. Additionally, look for patterns like "head and shoulders," "double tops," or "double bottoms," which can signal potential market reversals.

4. Moving Averages:

Moving averages smooth out price data by creating a constantly updated average price over a specific period. The 50-day and 200-day moving averages are common indicators used to identify long-term trends. When the short-term average crosses above the long-term average, it could signal a buying opportunity, and vice versa.

Making Informed Investment Decisions

By understanding and interpreting silver price graphs, you can make more informed investment decisions. Keep an eye on key indicators like trend lines, moving averages, and market sentiment to anticipate potential price movements. Additionally, stay informed about broader economic factors that could impact the silver market, such as inflation rates, currency strength, and industrial demand.

In conclusion, reading and interpreting silver price graphs is a valuable skill for any investor interested in precious metals. By mastering this skill, you can navigate the silver market more effectively, making strategic decisions that align with your investment goals. Whether you’re looking to capitalize on short-term price movements or invest for the long term, understanding the nuances of silver pricing will give you a significant advantage in the marketplace.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.