How Much Will Silver Cost in 2025? Should You Buy Now or Wait?

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Silver has always played a unique role in the world of finance and industry. It is both a precious metal and an essential component in manufacturing, technology, and green energy. As we move through 2025, silver prices have seen notable fluctuations, trading between $28 and $36 per ounce in the middle of the year. These price shifts are influenced by a range of factors, from inflation and industrial demand to geopolitical events and supply constraints. The question for many investors is clear: is now the right time to buy silver, or should you wait?

Current State of the Silver Market in 2025

The silver market in 2025 is characterized by volatility but also strong underlying demand. Global economic uncertainty, rising inflation, and an accelerated push toward renewable energy have placed silver in a highly favorable position. As both a store of value and a key industrial input, silver is attracting attention from a broad spectrum of buyers—from institutional investors to everyday collectors.

One of the core reasons for silver’s strong performance is its growing role in the green economy. As industries shift toward electrification and sustainability, silver’s use in technologies like solar panels, electric vehicle batteries, and semiconductors is expanding rapidly.

Key Drivers of Silver Prices in 2025

1. Expanding Industrial Demand

Silver is essential in a wide range of industrial applications. It is used in electronics, medical devices, 5G infrastructure, and renewable energy systems. In particular, the growth of solar energy is creating massive new demand for silver, as photovoltaic cells require significant amounts of it. Electric vehicles, which rely on silver for battery connections and power distribution, are also contributing to rising demand.

This industrial appetite is expected to continue growing, putting consistent upward pressure on silver prices, especially as more countries commit to decarbonization and cleaner technologies.

2. Constrained Supply Chains

While demand is increasing, supply is under pressure. Investment in silver mining has not kept pace with demand, and many of the world’s largest silver producers—including Mexico and Peru—have faced operational disruptions due to regulatory, labor, and environmental issues. Ore grades are also declining, meaning more effort and expense are required to extract silver.

These supply limitations make it difficult for the market to respond quickly to demand spikes, which supports higher spot prices and increased premiums on physical silver products.

3. Inflation and Economic Uncertainty

In an era of persistent inflation, many investors are looking to tangible assets that can serve as a hedge against the declining value of fiat currencies. While gold traditionally plays this role, silver offers a more affordable alternative with similar inflation-resistant properties. With central banks adjusting interest rates and global markets facing uncertainty, silver’s reputation as a hard asset is strengthening.

4. Strong Retail Investment Activity

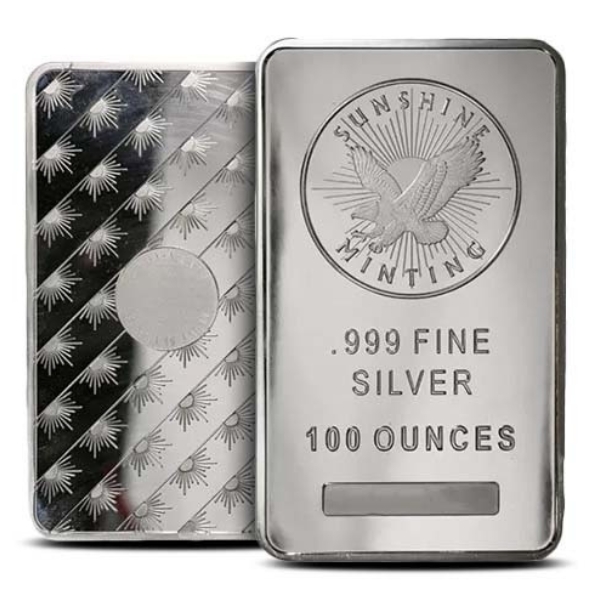

Beyond institutional interest, retail investors have played a major role in silver’s 2025 performance. Products like 1 oz silver coins, 5 oz rounds, and 10 oz silver bars are in high demand. Many buyers are acquiring physical silver not just for investment returns, but also for financial security in times of market instability.

This retail enthusiasm has kept premiums above spot levels, especially for government-minted coins and popular private mint bars. Physical silver is increasingly viewed as a reliable, portable, and liquid form of wealth preservation.

How Are Other Precious Metals Performing?

Silver’s gains are impressive, but other metals are also playing important roles in the investment landscape:

Gold remains the dominant safe-haven asset. Its value continues to rise in response to inflation and global market instability, making it a cornerstone of many diversified portfolios.

Palladium has seen greater price volatility due to shifting trends in electric vehicle production and changing demand in automotive manufacturing.

Platinum is gaining traction thanks to its use in hydrogen fuel cells and clean energy applications. Its price is on a slow but steady upward trend.

Should You Buy Silver Now or Wait?

The silver market’s current fundamentals—rising demand, limited supply, high inflation, and strong investor interest—suggest that now may be a favorable time to enter or expand a position in silver. While prices may experience short-term fluctuations, the long-term trajectory appears positive, especially as industrial and investment demand continue to climb.

Waiting for significantly lower prices could mean missing out on potential gains or being forced to pay even higher premiums later. For investors seeking a blend of affordability, long-term value, and physical asset security, silver remains an attractive opportunity in 2025.

Conclusion

Silver’s value in 2025 is being shaped by a powerful mix of economic, industrial, and investment forces. As prices remain elevated within the $28–$36 range and the market continues to experience strong demand, silver is clearly positioned as both a strategic investment and a vital industrial metal. Whether you’re hedging against inflation or investing in the future of clean energy, silver offers a compelling case for buying now rather than waiting.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.