Would It Be Too Late to Purchase Gold in the Year 2025? The Indications from the Data

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Getting to Know the Value of Gold

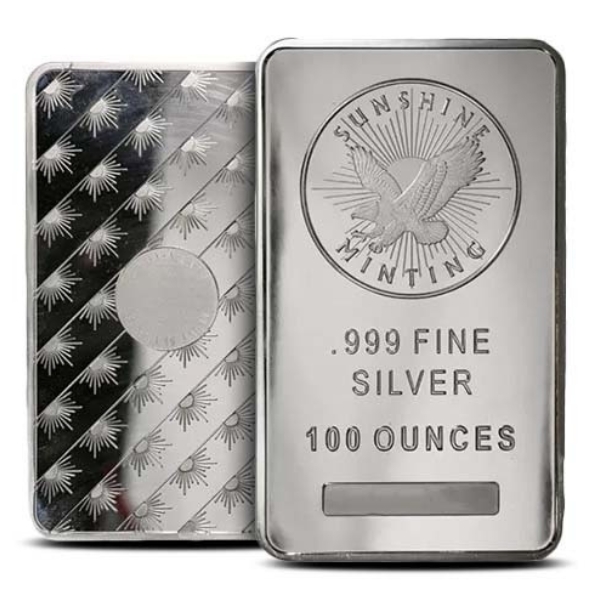

When it comes to the protection of assets during times of economic uncertainty, gold investment has proven to be a safe technique. In the year 2025, determining the value of a kilogram of gold involves knowledge of its reliable history as well as the current market dynamics. Gold has retained its worth as a safe-haven despite the fluctuation of most other assets. The current price of gold bars is dependent upon the price in the USA per ounce. Gold is a commodity that investors frequently seek during times of global tension or inflation.

Unlike fiat currencies, which can be devalued by excessive printing or political instability, gold maintains intrinsic value. This characteristic has made it a cornerstone of wealth preservation for centuries. In today’s digital and fast-moving economy, physical gold—such as bars and coins—still offers reassurance through its tangible presence and universal acceptance.

Acquiring Knowledge of Gold's Previous Prices

The spot price of gold has always reflected the stability of the economy, geopolitical conditions, and investor confidence. Because gold is a safe-haven asset, its price is subject to fluctuations whenever there is global uncertainty. Gold's market price has been impacted by several events over the last few decades, including the financial crisis of 2008, Brexit, and the COVID-19 outbreak. In response to each event, investors rushed to purchase gold bars, American gold coins, and even a kilo of gold, which caused prices to rise.

These historic milestones are clear evidence of gold's resilience and the trust investors place in it. By examining gold’s past performance, investors often identify trends that guide their present-day strategies. The surge in gold prices during times of crisis demonstrates that gold is not only reactive but also predictive—it often signals deeper economic disruptions before they become apparent.

Implications for the Year 2025

Historically significant price shifts can assist investors in gold in 2025 in making well-informed judgments. Historically, the value of gold may react to the economic and political unpredictability that exists. As governments and central banks recover from the effects of pandemics and geopolitical worries, gold may once again prove to be a strong commodity. History can teach us something, but it can't tell us what will happen in the future.

However, certain indicators suggest that gold could continue to rise in value. Persistent inflation, shifting interest rates, and global debt concerns may all contribute to increased demand. Investors also need to consider how gold performs in relation to other assets, such as equities or cryptocurrencies, to determine its role in a balanced portfolio.

Therefore, even if gold bars and American gold coins appear to be appealing, investors should continue their education and keep an eye on the dynamics of the global market before making any decisions.

To What Extent Is It Too Late to Buy Gold in 2025?

There is a common misconception that it is "too late," but gold behaves differently than volatile stocks or speculative assets. This misconception is driven by the fear of buying at the top. Because gold has value on its own and can be used in many economic processes, gold bars and other types of physical gold are likely to remain popular in 2025.

It’s not so much about timing the market perfectly as it is about understanding your financial goals and risk tolerance. Long-term investors often see gold not as a get-rich-quick asset, but as a means of ensuring financial stability. So, in 2025, rather than asking if it’s too late, the better question might be whether your portfolio could benefit from the timeless security that gold provides.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.