How to Withdraw Money from Robinhood

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Withdrawing money from Robinhood is a straightforward process, but it involves several steps and considerations to ensure a smooth transaction. In this comprehensive guide, we will walk you through everything you need to know about withdrawing money from Robinhood, including understanding what withdrawable cash is, the factors that affect it, and how to increase your withdrawable cash.

What is the Robinhood Withdrawable Cash?

Withdrawable cash on Robinhood refers to the funds that are available for you to withdraw from your account. This includes the cash from selling stocks or other assets, dividends received, and any cash deposits you've made. However, not all funds in your account may be immediately withdrawable due to various factors such as unsettled trades and regulatory requirements.

How to Withdraw Money from Robinhood?

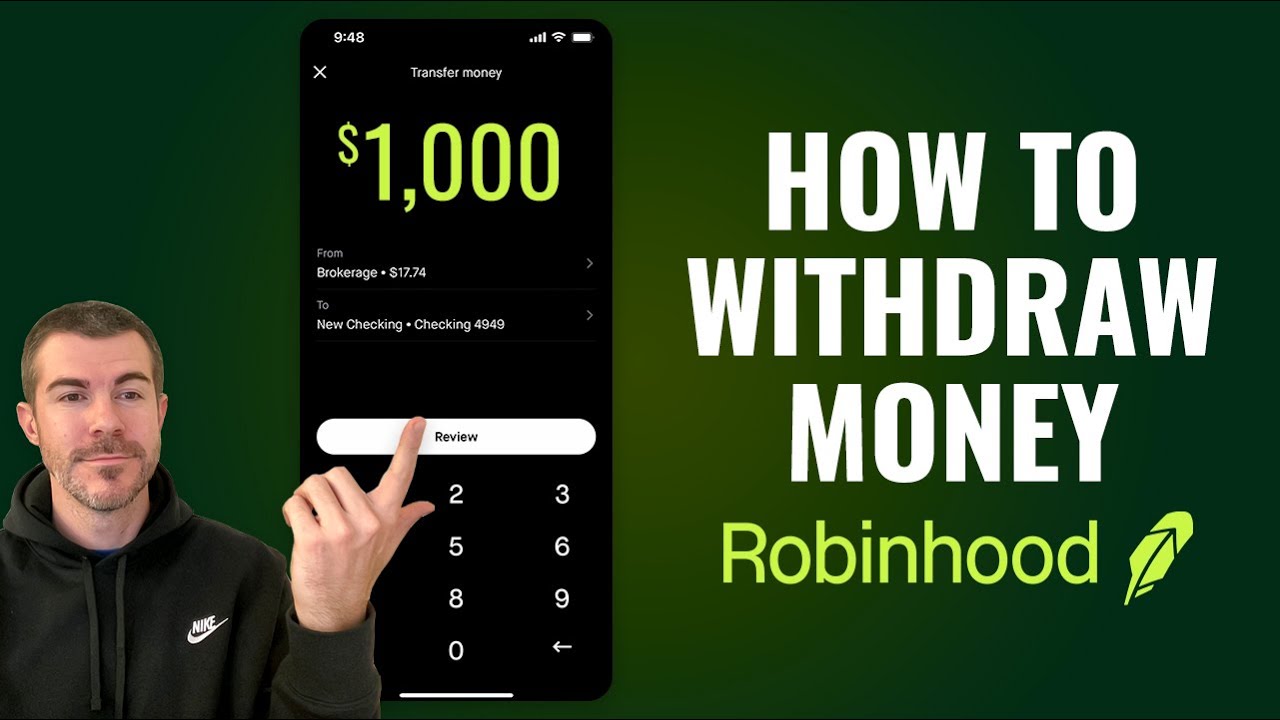

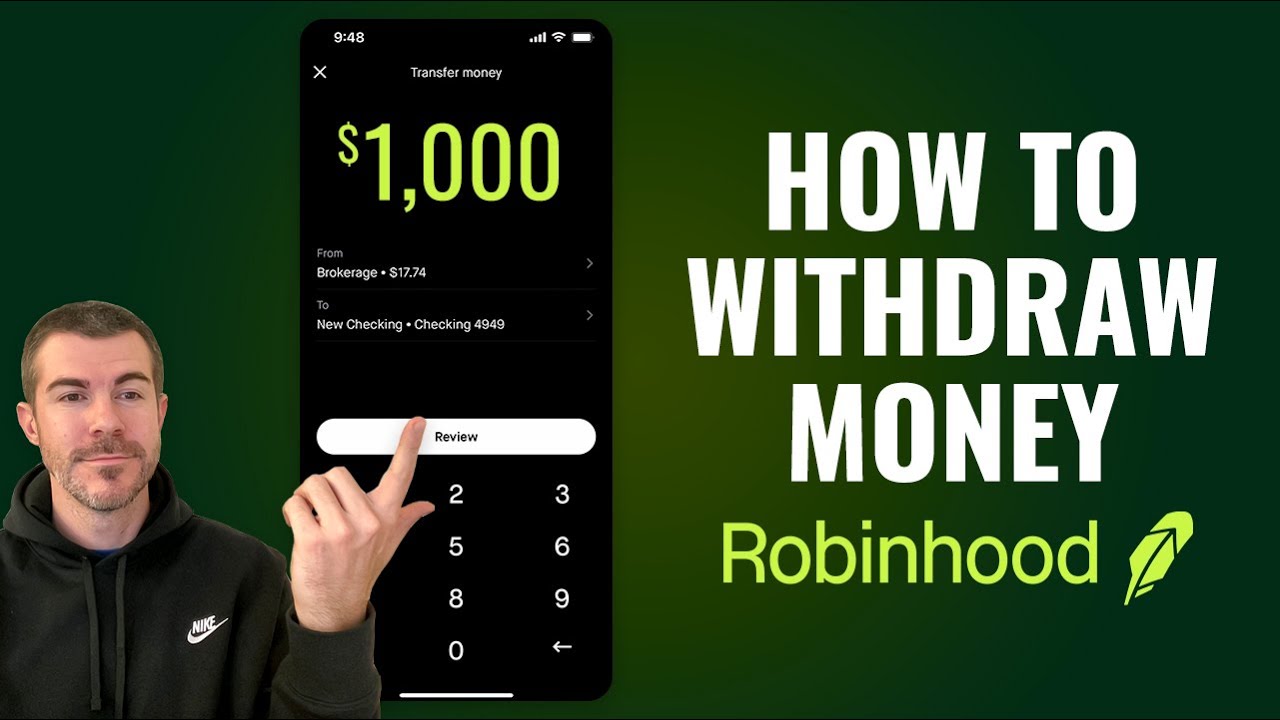

To withdraw money from Robinhood, follow these steps:

1. Open the Robinhood App: Launch the Robinhood app on your mobile device and log in to your account.

2. Navigate to Account: Tap on the account icon located at the bottom right corner of the screen.

3. Go to Transfers: Select the "Transfers" option from the menu.

4. Initiate Withdrawal: Tap on "Transfer to Your Bank" and enter the amount you wish to withdraw.

5. Select Bank Account: Choose the bank account to which you want to transfer the funds. If you haven't linked a bank account yet, you will need to do so by following the prompts.

6. Confirm the Transfer: Review the details and confirm the transfer. The funds will be transferred to your bank account, typically within 5 business days.

What are the Factors that Affect your Robinhood Withdrawable Cash?

Several factors can affect the amount of withdrawable cash in your Robinhood account:

1. Unsettled Funds: When you sell a stock, the funds take 2 business days to settle. These unsettled funds cannot be withdrawn until the settlement period is complete.

2. Deposits in Progress: Cash deposits made to your Robinhood account also have a holding period before they become withdrawable.

3. Pending Transactions: Any pending transactions, such as buying stocks or transferring funds, can impact the available withdrawable cash.

4. Regulatory Requirements: Certain regulatory requirements may impose restrictions on the withdrawable cash to ensure compliance with financial laws.

Why Is My Withdrawable Cash $0 on Robinhood?

There could be several reasons why your withdrawable cash is showing as $0:

1. Unsettled Transactions: If you have recently sold securities, the funds may still be in the settlement period.

2. Recent Deposits: Deposits you've made might still be in the holding period and not yet available for withdrawal.

3. Pending Orders: Pending orders for buying or selling stocks can impact the available withdrawable cash.

4. Account Restrictions: Certain account restrictions or holds could also result in a $0 withdrawable cash balance. Contact Robinhood support for assistance if you suspect this is the case.

Can You Withdraw Money from Robinhood?

Yes, you can withdraw money from Robinhood, provided you have sufficient withdrawable cash in your account. Ensure that all your funds are settled and there are no pending transactions that could impact your available balance.

How to Withdraw Cash from Robinhood?

To withdraw cash from Robinhood, follow the steps outlined in the "How to Withdraw Money from Robinhood?" section. The process involves transferring the withdrawable cash to your linked bank account.

How Do You Withdraw Money from Robinhood?

Withdrawing money from Robinhood is a simple process that involves selecting the amount you wish to withdraw and transferring it to your linked bank account. Ensure all your funds are settled and no pending transactions affect your available balance.

Does Robinhood Charge a Fee for Withdrawing Money?

Robinhood does not charge a fee for withdrawing money to your bank account. However, your bank might charge a fee for incoming transfers, so it's essential to check with your bank regarding any potential fees.

How to Increase Withdrawable Cash on Robinhood?

To increase your withdrawable cash on Robinhood, consider the following tips:

1. Wait for Settlement Periods: Ensure that any sold securities have completed the 2-day settlement period before attempting to withdraw.

2. Complete Deposit Hold Periods: Wait for any cash deposits to clear the holding period before trying to withdraw.

3. Avoid Pending Transactions: Make sure there are no pending buy or sell orders that could impact your withdrawable cash.

4. Maintain Sufficient Balance: Keep a sufficient balance in your account to cover any pending orders or account requirements.

5. Contact Support: If you have any issues or concerns about your withdrawable cash, contact Robinhood support for assistance.

In conclusion, withdrawing money from Robinhood is a straightforward process once you understand the factors that affect your withdrawable cash. By following the steps outlined in this guide and ensuring that your funds are settled and available, you can easily transfer your money to your bank account without any hassle.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

![How to Withdraw Money from Robinhood [Complete Guide]](https://indibloghub.com/public/images/courses/6700f6af122be6203_1728116399.jpg)