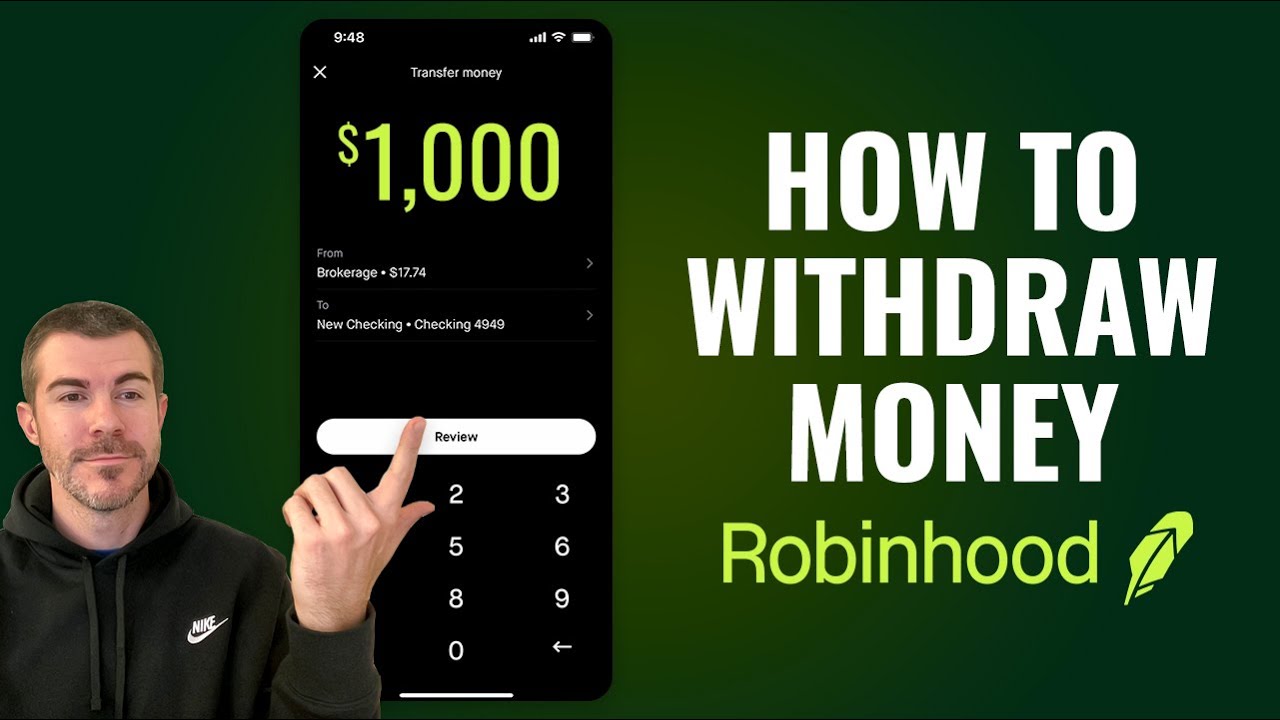

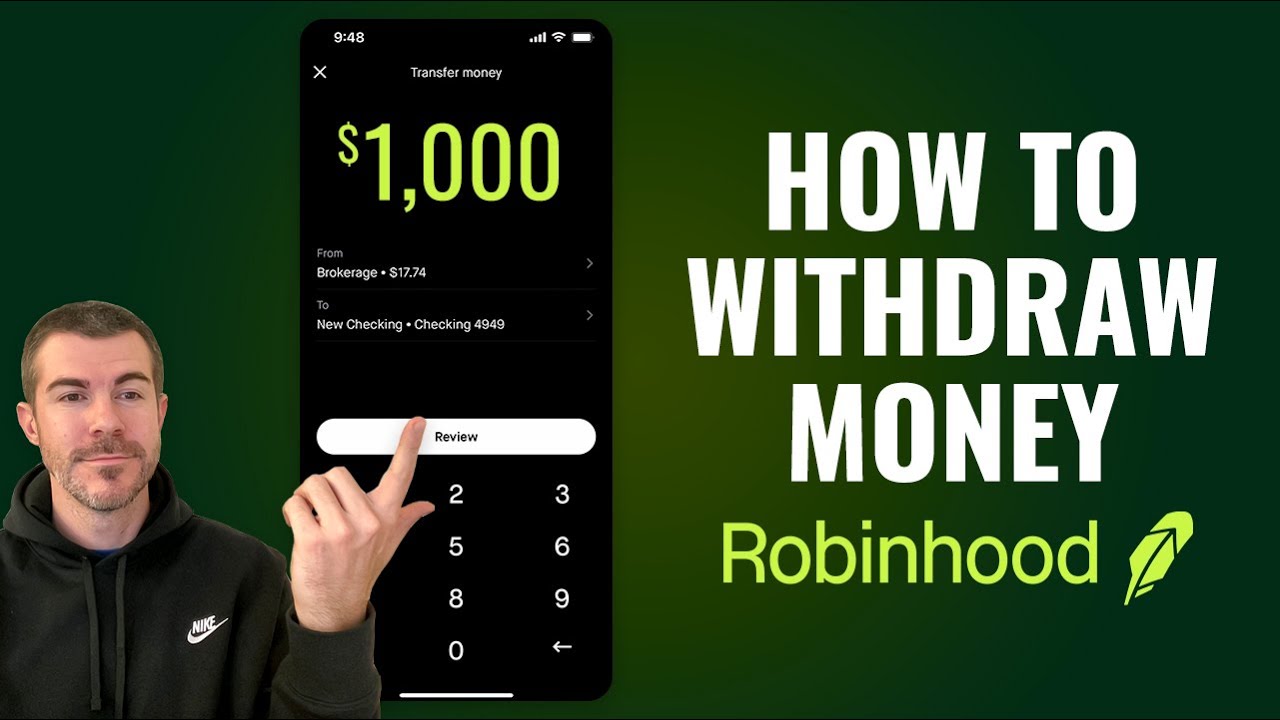

How to Withdraw Money from Robinhood – A Step-by-Step Guide

Robinhood has become one of the most popular platforms for buying and selling stocks, options, and cryptocurrencies. However, for new investors, understanding how to withdraw funds from Robinhood to a bank account can be a bit confusing. This guide will explain the process of withdrawing funds, the timing involved, and address common issues that users may face.

How to Withdraw Money from Robinhood to Your Bank Account

Withdraw money from Robinhood to a bank account is straightforward once you understand the steps involved. Here’s a step-by-step guide:

1. Open the Robinhood App: Launch the app on your device and log in to your account.

2. Access the Account Menu: Tap on the Account icon (usually at the bottom right).

3. Select “Transfers”: In the menu, select Transfers to view the transfer options.

4. Choose “Transfer to Your Bank”: Tap on Transfer to Your Bank to initiate the withdrawal process.

5. Enter the Withdrawal Amount: Specify the amount you wish to transfer to your bank account. Ensure this amount does not exceed your available withdrawable cash.

6. Confirm the Transfer: Double-check the information and confirm the transfer. Robinhood will show you an estimated processing time.

How to Withdraw Money from Robinhood Immediately

While Robinhood provides free instant deposits, withdrawals can take a bit longer. Here’s how you can expedite the process:

1. Verify Your Bank Account: Ensure that your bank account is verified and linked to Robinhood. Unverified accounts may delay withdrawal processing.

2. Check for Withdrawable Cash: Funds become withdrawable cash once they clear any settlement period. Only withdrawable cash can be transferred immediately.

3. Use Cash Management Feature (If Available): Robinhood’s Cash Management feature offers users a debit card to spend directly from their account, eliminating the need to transfer money.

4. Wait for Settlement: Stock trades require up to two business days (T+2) to settle. Only after settlement can the proceeds become withdrawable.

5. Select “Instant Transfers”: Robinhood does not offer instant withdrawals, but choosing a direct deposit bank with quick processing times can speed up access to funds.

Why Can’t I Withdraw Money from Robinhood After Selling?

There are several reasons why you may not be able to withdraw funds immediately after selling assets on Robinhood:

• Settlement Period: Following a sale, funds need two business days to settle (T+2) before becoming available for withdrawal.

• Withdrawal Hold: New deposits are subject to a five-business-day hold. If you funded your account recently, the hold period must pass before withdrawals.

• Account Restrictions: Occasionally, accounts face restrictions if suspicious activity is detected or if the user has triggered risk management rules.

• Insufficient Withdrawable Cash: Only cash from fully settled transactions is withdrawable. Pending trades or unsettled amounts cannot be withdrawn.

If you are unable to withdraw, check if your funds have settled, and ensure that no withdrawal restrictions apply.

How Long Does It Take to Withdraw Money from Robinhood After Selling?

How Long Does It Take to Withdraw Money from Robinhood After Selling?

Withdrawing money from Robinhood after selling investments depends on two main factors: settlement time and bank processing time.

1. Settlement Time (T+2): After selling stocks, funds take two business days to settle. This standard settlement period applies to stock and ETF sales.

2. Withdrawal Processing Time: After funds settle, withdrawals can take 1-3 business days to reflect in your bank account. Processing time varies by bank, with some banks processing transactions faster than others.

In total, it can take 3-5 business days from the sale date to have money available in your bank account.

Robinhood Withdrawable Cash: What It Means

In Robinhood, withdrawable cash refers to the amount of money in your account that is eligible for withdrawal. Withdrawable cash includes:

• Settled Funds: Funds from completed sales that have undergone the two-day settlement period.

• Deposits Beyond Hold Period: Deposited funds become withdrawable after the five-business-day hold.

Funds not marked as withdrawable cash cannot be transferred out of Robinhood until they clear the required periods.

Robinhood Withdrawal Limit

Robinhood limits the amount of money that can be withdrawn based on account status and activity. Here are the key points regarding withdrawal limits:

1. Daily Withdrawal Limit: Typically, Robinhood enforces a daily withdrawal limit of $50,000 per business day.

2. New Deposit Hold: Recently deposited funds have a five-business-day hold period before they can be withdrawn.

3. Cash Management Limit: Users with Cash Management can use the debit card up to their balance limit without facing withdrawal restrictions.

If your withdrawal request exceeds the daily limit, you may need to split the transaction over multiple days.

I Sold Stock on Robinhood – Where Is My Money?

After selling stock on Robinhood, users often wonder where their money is or why it isn’t available for withdrawal. Here’s what to expect after selling assets:

1. Settlement Period: When you sell a stock, the funds generated take two business days to settle. During this period, the funds are visible in your account balance but are not yet withdrawable.

2. Withdrawable Cash Notification: Once the funds have settled, they will appear as withdrawable cash. You can then initiate a transfer to your bank.

3. Notifications for Processing: Robinhood typically sends a notification when your money is available for withdrawal, letting you know that the funds have cleared.

4. Bank Processing: Once you’ve initiated a withdrawal, the money will be transferred to your bank, taking an additional 1-3 business days to appear.

Frequently Asked Questions

Can I Withdraw Money from Robinhood on Weekends?

Robinhood processes withdrawals only during standard banking hours (Monday to Friday). Requests initiated over the weekend will begin processing on the next business day.

Why Is My Withdrawal Delayed?

Withdrawal delays can occur due to new deposit holds, settlement requirements, or bank processing times. Check if your funds have settled, and make sure no holds or restrictions apply.

Can I Withdraw Less Than $1?

Yes, Robinhood allows users to withdraw amounts as small as $1, provided it is within the withdrawable cash balance.

How Often Can I Withdraw Money from Robinhood?

There is no restriction on the frequency of withdrawals, as long as they do not exceed the daily limit of $50,000 and are within the available withdrawable cash.

How Do I Check Withdrawable Cash on Robinhood?

To check your withdrawable cash balance, open the app, access the account menu, and view the cash balance. Withdrawable funds will be specified separately from the total balance.

By following these steps and understanding the limitations, Robinhood users can manage their funds effectively and avoid unexpected delays when transferring money out of the platform.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

![How to Withdraw Money from Robinhood [Complete Guide]](https://indibloghub.com/public/images/courses/6700f6af122be6203_1728116399.jpg)