Hybrid Work & Payroll in the UAE: Managing Complexity

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

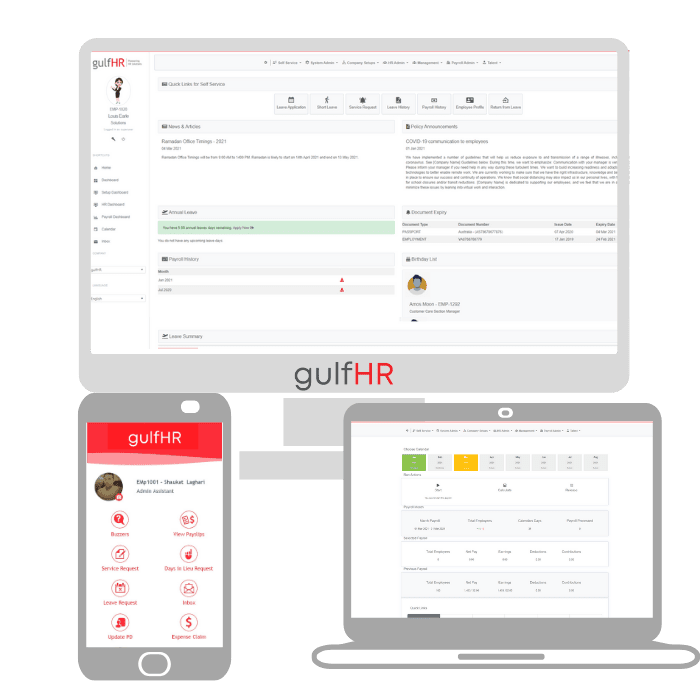

Balancing on-site and remote working environments offers flexibility, but it also introduces a range of complexities—particularly in payroll management. For HR professionals and business leaders, adopting a reliable hr payroll software uae solution is becoming essential to navigate these challenges.

The Rise of Hybrid Work in the UAE

The UAE has rapidly adapted to hybrid work models, driven by digital transformation and evolving employee expectations. A growing number of companies across sectors—finance, tech, healthcare, and beyond—are allowing employees to split their time between home and the office.

This flexibility has unlocked many benefits:

- Improved work-life balance

- Increased productivity

- Access to a wider talent pool

- Cost savings on office infrastructure

However, it also places new demands on HR and payroll teams that must ensure accuracy, compliance, and efficiency in a distributed work environment.

Key Payroll Challenges in a Hybrid Setup

Hybrid work, while offering advantages, disrupts traditional payroll processes. Here’s how:

1. Tracking Work Hours Across Locations

In a hybrid setup, employees clock in from multiple locations. Manual timesheets or outdated systems may fail to capture actual work hours, overtime, or shift variations, leading to discrepancies in payroll.

2. Leave & Attendance Irregularities

Remote work can blur lines between personal and professional time. Managing leave balances, sick days, or holiday entitlements becomes more complex, especially when integrated with different time zones and calendars.

3. Inconsistent Pay Structures

Hybrid models may introduce role-based changes, part-time structures, or contract-based work. Payroll must adapt to these variables without error, ensuring each employee receives accurate compensation.

4. Regulatory Compliance

The UAE’s labor laws, including WPS (Wage Protection System), gratuity calculations, and end-of-service benefits, must be upheld regardless of where employees work. Mistakes or delays can lead to penalties and damage to employer reputation.

5. Expense & Reimbursement Management

Employees working remotely often incur additional costs—home internet, electricity, transport for occasional office visits. Efficient payroll must account for and reimburse such expenses accurately and promptly.

How Technology Simplifies Hybrid Payroll Management

To overcome these complexities, businesses are turning to digital tools and automation. Here's how modern payroll systems are redefining HR operations in the UAE:

✅ Cloud-Based Accessibility

Modern payroll platforms operate in the cloud, giving HR teams real-time access to employee records, attendance logs, and salary data—anytime, anywhere. This is essential when teams themselves are working in a hybrid format.

✅ Automated Time Tracking

Smart integrations with biometric systems, mobile apps, or geofencing allow automatic clock-in/out tracking, even from remote locations. This minimizes errors and ensures payroll is based on actual working hours.

✅ Real-Time Leave Management

With self-service portals, employees can apply for leave, view balances, and get approvals without visiting HR in person. These tools sync seamlessly with payroll, reducing manual intervention.

✅ Custom Pay Rules

Hybrid teams often have diverse employment contracts. Payroll software enables you to set pay rules for different employee categories—full-time, part-time, consultants—ensuring compliance and accuracy.

✅ WPS and Labour Law Compliance

Leading solutions are built to meet UAE-specific regulations. They automate WPS file generation, gratuity calculations, and ensure real-time compliance updates, so companies remain aligned with government mandates.

✅ Transparent Payslips and Taxation

In hybrid settings, transparency becomes critical. Automated systems provide error-free payslips, clear deductions, and prompt salary disbursements, reinforcing employee trust and satisfaction.

Best Practices for Payroll Success in Hybrid Environments

To ensure smooth payroll operations, organizations must implement both strategy and technology effectively. Here are some best practices tailored to UAE businesses:

1. Adopt a Centralized Payroll Platform

A unified system reduces reliance on fragmented spreadsheets or emails. Choose a platform that integrates time tracking, leave, compliance, and employee self-service in one dashboard.

2. Standardize Policies Across Work Models

Define clear guidelines for working hours, expense reimbursements, overtime, and flexible schedules. Make sure they’re documented and communicated to all employees.

3. Train HR Teams on Hybrid Needs

Your HR staff must understand both the technology and the legal implications of hybrid work. Invest in training so they can handle exceptions, troubleshoot errors, and interpret data confidently.

4. Regularly Audit Payroll Processes

Review payroll logs, track error rates, and solicit employee feedback to identify issues early. A proactive audit process can prevent compliance risks and build operational resilience.

5. Ensure Data Security & Access Control

With remote access comes the risk of data breaches. Secure your payroll software with encryption, two-factor authentication, and user-level access control to protect sensitive employee data.

Looking Ahead: The Future of Payroll in a Hybrid World

As hybrid work solidifies its place in the UAE’s employment ecosystem, payroll systems will evolve with more intelligent, AI-powered tools that predict trends, automate decision-making, and personalize employee experiences.

- In the coming years, expect to see:

- AI-powered anomaly detection in payroll

- Chatbot-driven employee queries

- Predictive analytics for payroll forecasting

- Fully mobile payroll apps for on-the-go HR management

Final Thoughts

Managing payroll in a hybrid work environment isn’t just about salary calculations—it’s about empowering employees, maintaining compliance, and driving strategic HR goals in an ever-changing world.

Businesses in the UAE must stay ahead by adopting scalable, flexible, and compliant payroll solutions that cater to the demands of hybrid work. By doing so, they don’t just solve payroll headaches—they build a foundation for a future-ready workforce.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.