India Online Insurance Market Size, Share, Growth, Demand And Report 2025-2033

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

India Online Insurance Market Overview

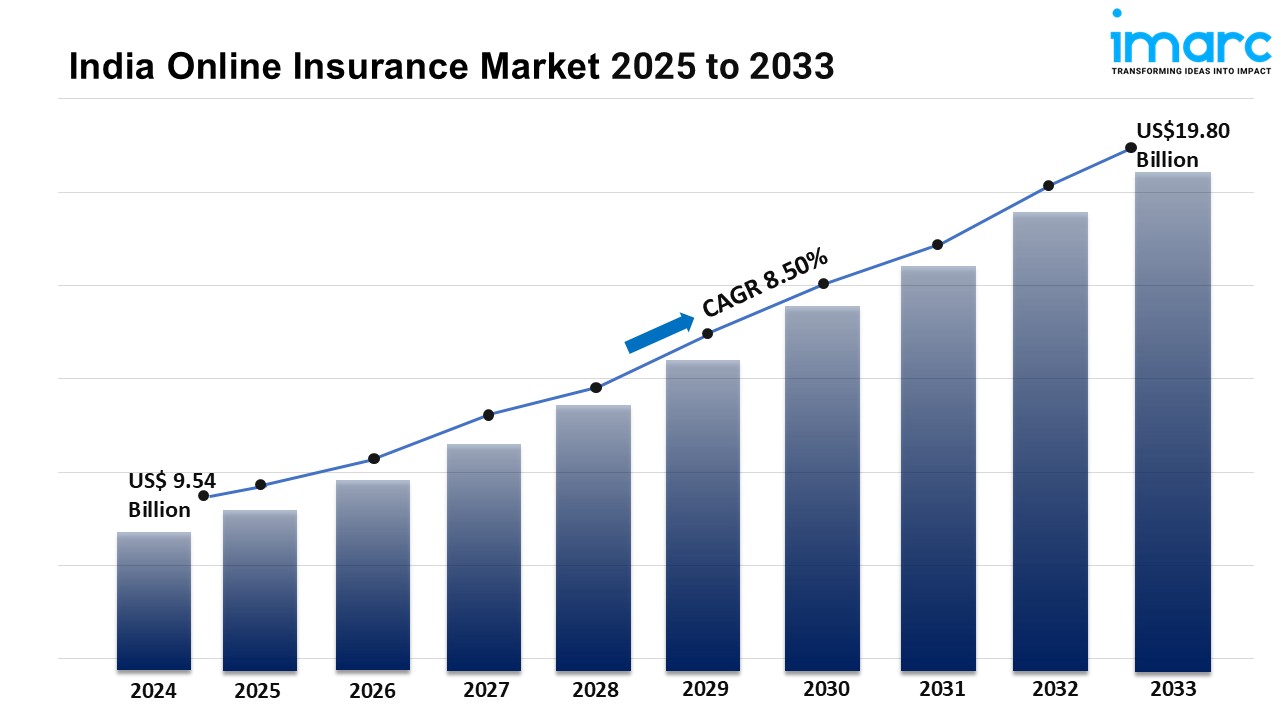

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 9.54 Billion

Market Forecast in 2033: USD 19.80 Billion

Market Growth Rate (2025-2033): 8.50%

The India online insurance market size reached USD 9.54 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 19.80 Billion by 2033, exhibiting a growth rate (CAGR) of 8.50% during 2025-2033. The market is propelled by rising internet penetration, growing smartphone adoption, and a consumer shift toward digital platforms. Additionally, factors such as convenience, policy transparency, regulatory support, and innovative digital solutions further drive the transition to online insurance purchases.

For an in-depth analysis, you can refer sample copy of the report: https://www.imarcgroup.com/india-online-insurance-market/requestsample

India Online Insurance Market Trends and Drivers:

Digital Transformation and Regulatory Support

Widespread internet and smartphone usage, especially in tier-2 and tier-3 cities, is expanding access to online insurance products.

Over 500 million internet users are contributing to a digitally savvy consumer base preferring instant and paperless insurance transactions.

Government initiatives like Digital India and IRDAI reforms are streamlining processes through API-driven platforms and paperless underwriting.

The COVID-19 pandemic accelerated demand for contactless insurance solutions across health, life, and motor segments.

Insurers are adopting AI-powered chatbots, mobile apps, and digital claims processing to enhance user experience and trust.

Technological Innovation and Product Personalization

InsurTech startups are transforming the industry with hyper-personalized offerings and data analytics.

Use of machine learning algorithms enables tailored products, such as sachet insurance for gig workers or usage-based motor insurance.

Partnerships between traditional insurers and tech platforms allow for embedded insurance in e-commerce, travel, and health services.

Blockchain technology is improving transparency in claims processing, while IoT devices (e.g., wearables) support real-time health data for dynamic pricing.

Efforts to reach rural users include vernacular content, video-based education, and solutions for low literacy barriers.

Socio-Economic Shifts and Consumer-Centric Strategies

A rising middle class and growing financial literacy are increasing interest in long-term financial protection.

Millennials and Gen Z are driving demand for flexible, customizable policies and wellness-linked health plans.

Growth of the gig economy is creating markets for micro-insurance products, covering income loss or equipment damage.

Agri-tech collaborations and NBFCs are enabling mobile-based weather-indexed crop insurance in rural areas.

Emerging trends include subscription-based insurance models and gamified loyalty programs to boost engagement and retention.

Firms are emphasizing customer experience (CX) with predictive analytics and proactive service strategies, ensuring adaptability to India’s diverse demographic landscape.

India Online Insurance Market Industry Segmentation:

Insurance Type Insights:

Life Insurance

Non-Life Insurance

Enterprise Size Insights:

Large Enterprises

Small and Medium Enterprises

Regional Insights:

North India

South India

East India

West India

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask Our Expert & Browse Full Report with TOC & List of Figure: https://www.imarcgroup.com/request?type=report&id=30021&flag=C

Key highlights of the Report:

Market Performance (2019-2024)

Market Outlook (2025-2033)

COVID-19 Impact on the Market

Porter’s Five Forces Analysis

Strategic Recommendations

Historical, Current and Future Market Trends

Market Drivers and Success Factors

SWOT Analysis

Structure of the Market

Value Chain Analysis

Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.