Make the Most of SSS by Ensuring Timely Contributions

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

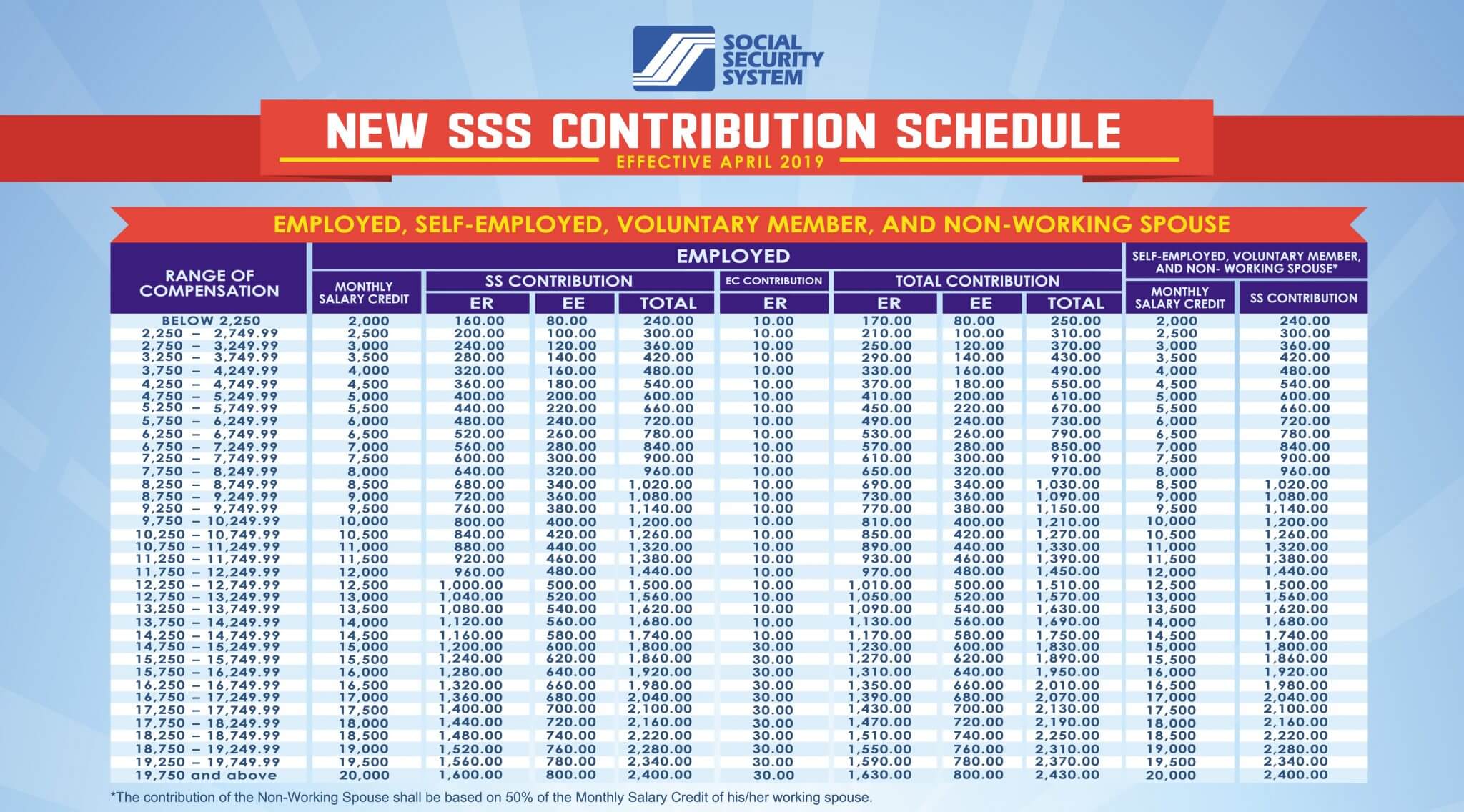

The Social Security System (SSS) plays a critical role in ensuring the financial security and well-being of Filipino workers. Established to provide social protection to employees in the Philippines, the SSS serves as a safeguard for individuals and their families in times of illness, disability, old age, or death. Through the contributions made by employees and employers, SSS is able to extend various benefits such as retirement pensions, sickness benefits, disability benefits, and death benefits. In this regard, ensuring timely contributions to the SSS is essential for workers to maximize their benefits and for the sustainability of the social security system. For a better understanding of the contribution rates and schedules, individuals can refer to the SSS Philippines table which outlines the required contribution amounts based on monthly salary brackets.

Importance of SSS Contributions

The SSS system operates on the premise that both workers and employers contribute to a fund, which will later be used to provide financial aid during moments of need. The contributions made by employees and employers are deducted from salaries and wages, and these funds are saved and accumulated for future benefits. It is through this process that an individual’s eligibility for various benefits is determined, including pension benefits after retirement, sickness benefits during incapacitation, and maternity benefits during pregnancy.

The SSS is vital for workers as it offers a safety net in the face of various life challenges. The program helps reduce the burden of unexpected expenses related to medical treatment, rehabilitation, or burial costs. However, for individuals to truly benefit from this system, they must ensure that their contributions are made in a timely and consistent manner.

Timely Contributions: Why They Matter

Making SSS contributions on time is crucial for workers to gain the full value of the system. Below are several reasons why timely contributions should be prioritized:

Eligibility for Benefits Timely contributions ensure that individuals remain eligible for SSS benefits. If contributions are not made on time, workers may lose their eligibility to claim benefits or experience delays when applying for claims. For instance, the SSS requires a certain number of contribution months to qualify for a retirement pension, and delayed payments could cause an individual to miss out on these benefits altogether.

Avoidance of Penalties and Interest One of the significant drawbacks of late payments is the imposition of penalties and interest. The SSS imposes a 1% penalty per month on overdue contributions. This means that individuals who miss the payment deadlines will face increased amounts to pay, which may lead to financial strain. By ensuring timely contributions, workers can avoid accumulating interest charges that can significantly increase the amount owed to SSS.

Maximized Benefit Payouts SSS benefits are calculated based on the total contributions made by a worker over the years. Timely and consistent contributions ensure that individuals contribute the maximum amount, which in turn results in higher benefit payouts. For example, retirees who have consistently paid their contributions will receive higher pensions compared to those who have gaps in their payment history. Therefore, ensuring that contributions are made on time can directly affect the amount of money workers receive in retirement.

Accurate Records Timely contributions also help ensure that workers' SSS records are accurate. The SSS maintains detailed records of every worker’s contribution history, and any discrepancies caused by late payments could lead to confusion or delays in the processing of claims. Ensuring that payments are made on time guarantees that all contributions are properly recorded, making it easier to claim benefits when necessary.

Challenges in Making Timely Contributions

While ensuring timely SSS contributions is crucial, there are several challenges that workers may face:

Financial Constraints Many employees, particularly in low-income sectors, may struggle with making SSS contributions on time due to financial difficulties. When workers are not earning enough to cover basic needs, setting aside money for SSS payments can feel burdensome. This can often result in delayed contributions or missed payments altogether. It is vital, therefore, to budget effectively and prioritize the SSS payments to maintain eligibility for benefits.

Employer Non-Compliance Some employers fail to remit SSS contributions on behalf of their employees. While this is a violation of the law, it still happens in certain industries or companies. In these cases, employees may find themselves unable to claim benefits because their contributions were not paid on time. To address this, employees should ensure that their employers are properly remitting the contributions and should follow up regularly with the HR department.

Lack of Awareness A lack of awareness about the importance of timely contributions is another challenge. Some workers may not understand how SSS works or the long-term benefits of paying on time. Without adequate knowledge, workers may become complacent and miss payment deadlines. Providing educational resources and spreading awareness about the advantages of consistent SSS contributions can help resolve this issue.

Changes in Employment Status Workers who shift from one employer to another or those who transition from regular to freelance or self-employed status may find it more challenging to make timely contributions. Self-employed individuals or freelancers are responsible for paying their own SSS contributions, which can lead to confusion or missed payments if they do not have a regular paycheck from an employer.

How to Ensure Timely Contributions

Set a Payment Schedule Establishing a payment schedule and sticking to it is one of the best ways to ensure that SSS contributions are made on time. Workers can either set aside money every month for SSS or automate the payment process through payroll deductions or online payment systems. This will help reduce the chances of missing a payment.

Regular Monitoring of SSS Account Workers should regularly monitor their SSS account to track their contributions and ensure that they are up to date. The SSS provides an online portal where members can view their contribution history. This enables workers to verify that their employer has remitted the correct amount and that there are no discrepancies. Freelancers or self-employed individuals can also make use of this online portal to pay their contributions directly.

Timely Filing and Payment For self-employed individuals, freelancers, and voluntary members, ensuring timely payment involves filing and paying their contributions on time. This can be done through various payment channels, including online payments via the SSS website or through accredited banks and payment centers. Making sure that the SSS payment is completed by the designated deadline is critical to avoid penalties and ensure continued eligibility for benefits.

Collaborating with Employers For employees working under an employer, it is essential to establish clear communication with the HR department or payroll office to ensure that SSS contributions are remitted on time. If there are delays or issues, it is important to follow up promptly to prevent any long-term repercussions. Workers should keep track of pay slips and verify that the correct amount is being deducted for SSS.

Be Informed About SSS Policies Workers should stay informed about any changes in SSS policies, contribution rates, or payment deadlines. By staying updated on the latest rules and regulations, workers can better plan their finances and ensure that their contributions remain timely.

Timely SSS contributions are a key aspect of maximizing the benefits provided by the Social Security System. By ensuring that contributions are made consistently and on time, workers not only secure financial protection in the event of sickness, disability, or old age, but also avoid penalties, interest charges, and other complications. Through proper planning, regular monitoring of accounts, and cooperation with employers, Filipino workers can make the most out of their SSS membership and enjoy peace of mind knowing that they have a reliable safety net for themselves and their families.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.