Schema + Rich Snippets – Dominate Search with Visual Results!

Schema + Rich Snippets – Dominate Search with Visual Results!

Maximizing Home Office Tax Deductions in Canada

Written by Sohail Sial » Updated on: June 17th, 2025

Key Highlights

· Canadian residents working from home can claim a portion of their home expenses as a tax deduction.

· To be eligible, your home office must be your primary place of business or used regularly to meet clients.

· You can claim expenses using either the detailed method or the temporary flat rate method.

· Deductible expenses include a portion of your rent or mortgage interest, utilities, home insurance, and internet.

· Keep detailed records of your expenses and the size of your workspace to support your claims.

Introduction

With more people working from home, many Canadians are using this chance to set up home offices. Did you know the Canada Revenue Agency (CRA) lets you deduct some of your home expenses on your tax return if you meet certain conditions? Knowing how to make the most of these home office tax deductions can help you save a lot and improve your finances.

Understanding Home Office Tax Deductions in Canada

Working from home has many benefits. However, it can also mean more costs. Luckily, the CRA knows this and allows deductions for certain home office expenses. These deductions can help lower the costs of using part of your home for business. This can lead to less taxable income.

But, there are rules when claiming home office expenses. It is important to know if you are eligible. You should also learn about the different ways to claim these expenses. This will help you make the most of your deductions and avoid problems during tax time.

The fundamentals of home office deductions for 2024

As the new tax year approaches, it is important to stay updated on what the CRA says about home office deductions. In 2024, the rules for these deductions are mostly the same. You will mainly use the detailed method to claim them.

With this method, eligible employees can deduct part of their home expenses based on how much space they use for work. These expenses include rent or mortgage interest, utilities, home insurance, and internet fees.

Be sure to keep good records and clearly understand the eligibility criteria. This way, it will be easier to file your taxes.

Criteria for eligibility: Who can claim?

Not all Canadians who work from home can claim home office expenses. The CRA has specific rules about who is eligible.

First, your home office needs to be your main place of work. This means you do most of your work there. You can also claim expenses if you regularly meet clients or customers at your home office, and you use it only for business.

Also, eligible employees have to show that using their home office is directly linked to their employment income. You need to keep detailed records of work tasks, client meetings, and any other proof that supports your claim.

Detailed Guide to Eligible Home Office Expenses

Knowing which home office expenses you can deduct is very important for saving on taxes. The CRA classifies expenses as either direct or indirect. Each type has its own rules to follow. It’s essential to correctly categorize these expenses and understand the specific guidelines for each one. This will help you make a successful claim.

Direct versus indirect expenses: What's the difference?

Direct expenses are costs that you have only for your home office. These usually include:

· Rent or Mortgage Interest: You can deduct part of this based on the percentage of your home used as an office.

· Home Internet Access Fees: A fair part of your monthly internet bill can be deducted.

Indirect expenses relate to your whole home and can only be partly deducted based on how big your workspace is. Some examples are:

· Property Taxes: You can deduct a percentage based on your home office's square footage.

· Utilities (Heat, Electricity, Water): Like property taxes, these expenses can be deducted based on the size of your workspace.

· Home Insurance: You can claim a reasonable amount based on the size of your home office.

Specific examples of deductible home office costs

When claiming home office deductions, certain expenses are permissible while others are not. Here is a breakdown:

Expense

Can be claimed?

Mortgage interest

A portion, yes

Property taxes

A portion, yes

Rent

A portion, yes

Utilities

A portion, yes

Home internet

A portion, yes

Office supplies

Yes, if for business use

Furniture

Via CCA

New roof

No

Understanding these distinctions is crucial for accurate reporting and preventing potential issues with the CRA.

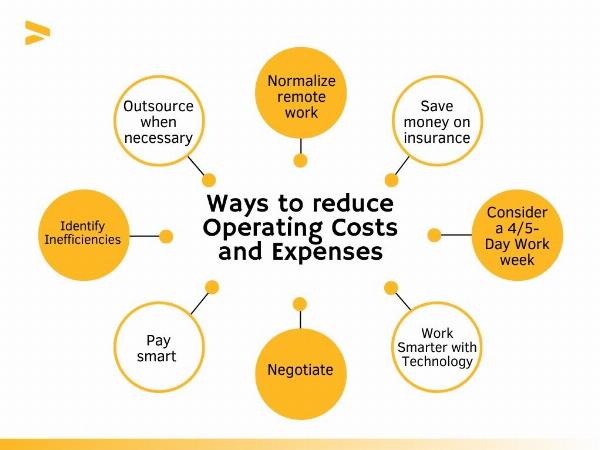

Techniques to Maximize Your Deductions

Optimizing your home office tax deductions takes careful planning. First, you need to know what expenses you can claim. Then, use some simple strategies to find big tax savings. This may mean looking again at how you split your expenses. You might also want to get help from a professional. They can make sure you claim every dollar you deserve.

Strategic allocation of expenses for higher returns

One way to possibly increase your deductions is by managing your expenses wisely. For instance, if you have both business and personal costs, like for the internet or phone, it can help to assign a larger part of those costs to business use. You should do this while staying within fair limits. This can be good for your taxable income.

It's very important to make sure that your expense allocation follows CRA guidelines and represents your true business use. Keeping clear and detailed records of your costs and how you assign them is very important to back up your claims. Always remember, being open and correct is key when dealing with taxes.

Utilizing professional appraisals for accurate claims

Figuring out how much of your home is for business use can be a bit tricky. That’s why getting professional advice can be very helpful. Trusted companies like Ernst & Young offer this kind of service.

Working with a qualified expert for a review can help you understand and support your claims for home office deductions. This is especially useful if your workspace is complicated or if you need help with certain parts of the deduction process.

Keep in mind, your main goal is to increase your deductions while staying correct and following the rules. Getting expert help can make tax season less stressful and give you more confidence.

Avoiding Common Pitfalls in Claiming Home Office Deductions

Claiming home office deductions can be helpful, but there are things to watch out for. The CRA pays close attention to this area. It's important to have good records and know the rules well. Making mistakes or leaving things out can lead to audits and cause problems you don’t want.

Documentation and record-keeping best practices

Keeping careful records of your home office expenses is very important to prevent issues later. Create a method to track all expenses, like receipts, invoices, and bank statements. Make sure to sort each expense as a direct or indirect home office cost. Also, note the date and amount for each one.

Additionally, write down how you figured out the percentage of your home used for business. Keep any measurements or floor plans you used. Being organized like this will help a lot if the CRA asks for proof of your claims. It shows you are open and following their rules.

Navigating complex deductions without triggering audits

Claiming complex deductions, like big expenses or special workspace setups, can get the CRA's attention. This could lead to a higher chance of an audit. Still, it does not mean you should be afraid to claim what you deserve.

A good way to handle this is by getting help from tax experts. Experienced people, especially those who know about home office deductions, can guide you through the details. They can give you advice that fits your situation, make sure your claims are correct and well-documented, and help lower your risk of an audit.

Keep in mind that planning ahead and asking for expert help when you need it can greatly lessen your chances of problems with the CRA.

Conclusion

In conclusion, getting the most out of home office tax deductions in Canada means you need to understand the eligibility criteria and eligible expenses. You can improve your returns by carefully planning your expenses and using professional appraisals. Make sure to keep good records to prevent any audits. Also, stay updated on the new changes for 2024 and check the percentage of expenses you can claim correctly. By following these tips, you can use home office tax deductions in Canada better. If you have more questions or need help, look at our FAQ section or reach out to our experts for personal support.

Frequently Asked Questions

What are the new changes to home office deductions for 2024?

For the 2024 tax year, the flat rate method is gone. Canadians now have to use the detailed method to claim home office deductions. This means you need to fill out Form T2200 from your employer.

How do I calculate the percentage of home office expenses I can claim?

Find the size of your dedicated workspace in square feet. Then, divide that number by the total size of your home in square feet. This percentage can help you account for eligible home office expenses when you make your claim.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

Copyright © 2019-2025 IndiBlogHub.com. All rights reserved. Hosted on DigitalOcean for fast, reliable performance.