Microbiome Sequencing Services Market Size, Share, Growth, Demand And Report 2024-2032

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Summary:

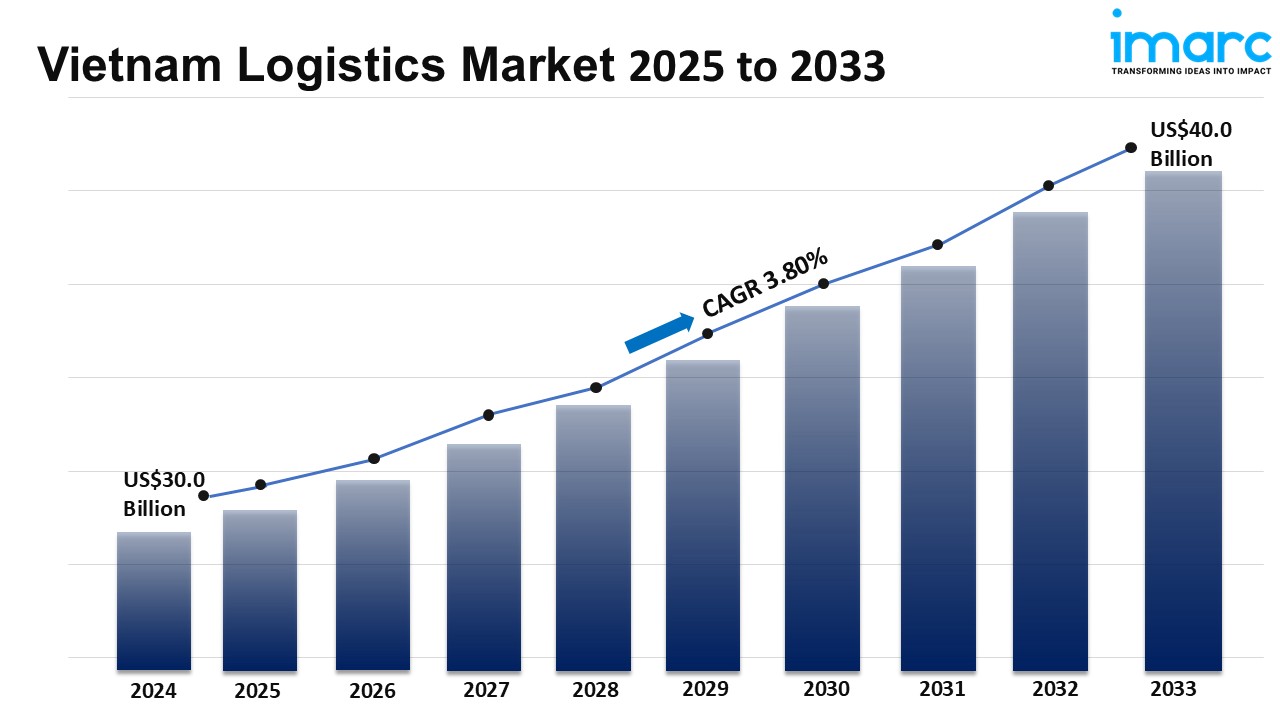

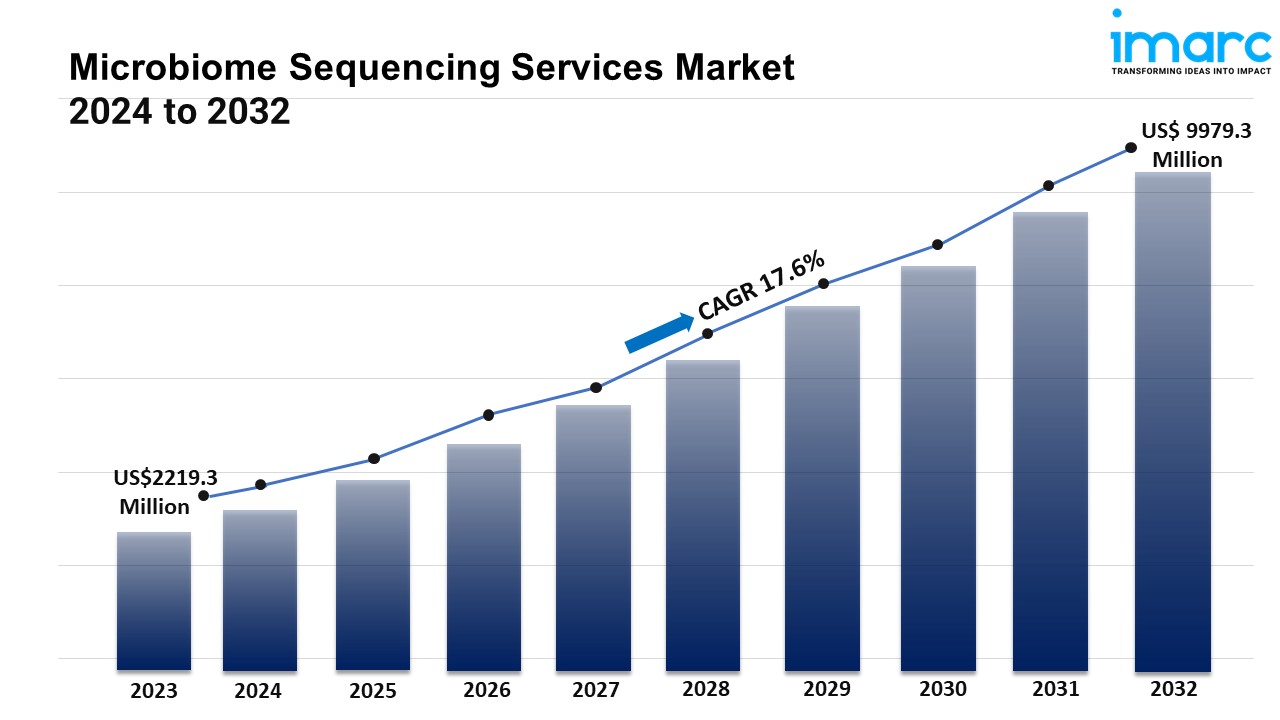

• The global microbiome sequencing services market size reached USD 2,219.3 Million in 2023.

• The market is expected to reach USD 9,979.3 Million by 2032, exhibiting a growth rate (CAGR) of 17.6% during 2024-2032.

• North America leads the market, accounting for the largest microbiome sequencing services market share.

• Sequencing by synthesis (SBS) accounts for the majority of the market share in the technology segment for its precision, scalability, and effectiveness in analyzing complex microbial communities.

• Outsourced research holds the largest share in the microbiome sequencing services industry.

• Wet labs remain a dominant segment in the market for their critical role in processing, culturing, and preparing microbiome samples for sequencing.

• Shotgun sequencing represents the leading application segment.

• Pharmaceutical and biotechnology companies lead the market, driven by the growing use of microbiome data in drug development and personalized medicine.

• The growing demand for personalized medicine applications is a primary driver of the microbiome sequencing services market.

• The microbiome sequencing services market growth and forecast highlight a significant rise due to growing use of microbiome sequencing in agriculture and environmental studies.

Industry Trends and Drivers:

• Rising Demand for Personalized Medicine Applications:

The industry is witnessing several microbiome sequencing services market trends such as the increased demand in the field of personalized medicine, as researchers and healthcare providers leverage microbiome data to tailor treatments to individual patients. Microbiome profiling helps in understanding how unique microbial compositions influence health, immune response, and disease susceptibility, allowing for more accurate treatment approaches. In areas like gastrointestinal health, metabolic disorders, and even mental health, microbiome insights are being used to customize dietary recommendations, probiotics, and therapeutic regimens for better patient outcomes. Pharmaceutical companies are also exploring microbiome-based treatments to enhance drug efficacy, particularly for conditions where the gut microbiome impacts drug metabolism. The awareness about the microbiome, personalized medicine applications are set to drive the market, with more patients and clinicians seeking sequencing services to inform targeted treatment plans. This trend is fueling partnerships between sequencing service providers and healthcare institutions, enhancing the microbiome sequencing services demand.

• Expansion of Microbiome Sequencing in Agricultural and Environmental Studies:

Microbiome sequencing services are increasingly applied in agriculture and environmental sciences, where understanding microbial communities is key to improving soil health, crop yields, and ecosystem sustainability. In agriculture, microbiome data helps optimize crop management by identifying beneficial microbes that can promote growth or protect against pests, reducing the reliance on chemical fertilizers and pesticides. Environmental studies utilize microbiome sequencing to monitor biodiversity and understand ecological changes, especially in areas impacted by pollution or climate change. For instance, studying microbial populations in oceans, rivers, or soil can reveal shifts in ecosystem health and resilience. This growing application in non-medical fields is expanding the microbiome sequencing market, with agricultural companies, environmental researchers, and government agencies increasingly investing in microbiome studies to drive sustainable practices. As a result, service providers are developing specialized sequencing solutions tailored for agricultural and environmental research, that is responsible for the microbiome sequencing services market share expansion.

• Integration of Artificial Intelligence in Microbiome Data Analysis:

The integration of artificial intelligence (AI) and machine learning in microbiome data analysis is transforming the microbiome sequencing services market by enhancing the speed, accuracy, and depth of microbial insights. AI-driven algorithms can analyze large datasets generated from sequencing with increased efficiency, identifying complex microbial patterns that might be difficult to detect through traditional methods. This is especially beneficial for large-scale studies and clinical applications, where detailed microbial insights are essential. In personalized medicine, AI tools help correlate microbiome data with patient health outcomes, identifying potential biomarkers for diseases and enabling faster diagnostics. Additionally, in agriculture and environmental science, AI algorithms are used to assess soil health, crop microbiomes, and environmental resilience with precision, helping predict outcomes and guide interventions. With AI, microbiome sequencing providers can offer more sophisticated and actionable data interpretation, appealing to both researchers and practitioners seeking deeper insights. As AI technology advances, the market is likely to see increased reliance on intelligent data analysis, which will expand the microbiome sequencing services market size.

Request Sample For PDF Report: https://www.imarcgroup.com/microbiome-sequencing-services-market/requestsample

Report Segmentation:

The report has segmented the market into the following categories:

Breakup by Technology:

• Sequencing by Synthesis (SBS)

• Sequencing by Ligation (SBL)

• Pyrosequencing

• Sanger Sequencing

• Others

Sequencing by synthesis (SBS) accounts for the majority of shares due to its high accuracy, scalability, and suitability for analyzing complex microbial communities.

Breakup by Research Type:

• Outsourced Research

• Internal Research

Outsourced research dominates the market as many organizations prefer leveraging external expertise and resources for microbiome analysis.

Breakup by Laboratory Type:

• Dry Labs

• Wet Labs

Wet labs represent the majority of shares due to their essential role in processing, culturing, and preparing microbiome samples for sequencing.

Breakup by Application:

• Shotgun Sequencing

• Targeted Gene Sequencing

• RNA Sequencing

• Whole Genome Sequencing

• Others

Shotgun sequencing holds the majority of shares due to its comprehensive approach in analyzing whole microbial genomes, offering detailed insights.

Breakup by End User:

• Pharmaceutical and Biotechnology Companies

• Research and Academic Institutes

• Others

Pharmaceutical and biotechnology companies exhibit a clear dominance due to the increasing use of microbiome data in drug development and personalized medicine.

Market Breakup by Region:

o North America (United States, Canada)

o Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

o Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

o Latin America (Brazil, Mexico, Others)

o Middle East and Africa

North America holds the leading position owing to a large market for microbiome sequencing services driven by substantial research funding and advanced technological infrastructure.

Top Microbiome Sequencing Services Market Leaders:

o BaseClear B.V.

o Clinical-Microbiomics A/S

o Diversigen Inc (OraSure Technologies Inc.)

o Mérieux NutriSciences

o Metabiomics Corporation (BioSpherex LLC)

o Microbiome Insights Inc.

o Microbiome Therapeutics LLC

o Molecular Research LP

o Molzym GmbH & Co. KG

o Resphera Biosciences LLC

o Shanghai Realbio Technology (RBT) Co. Ltd.

o Zymo Research Corporation

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.