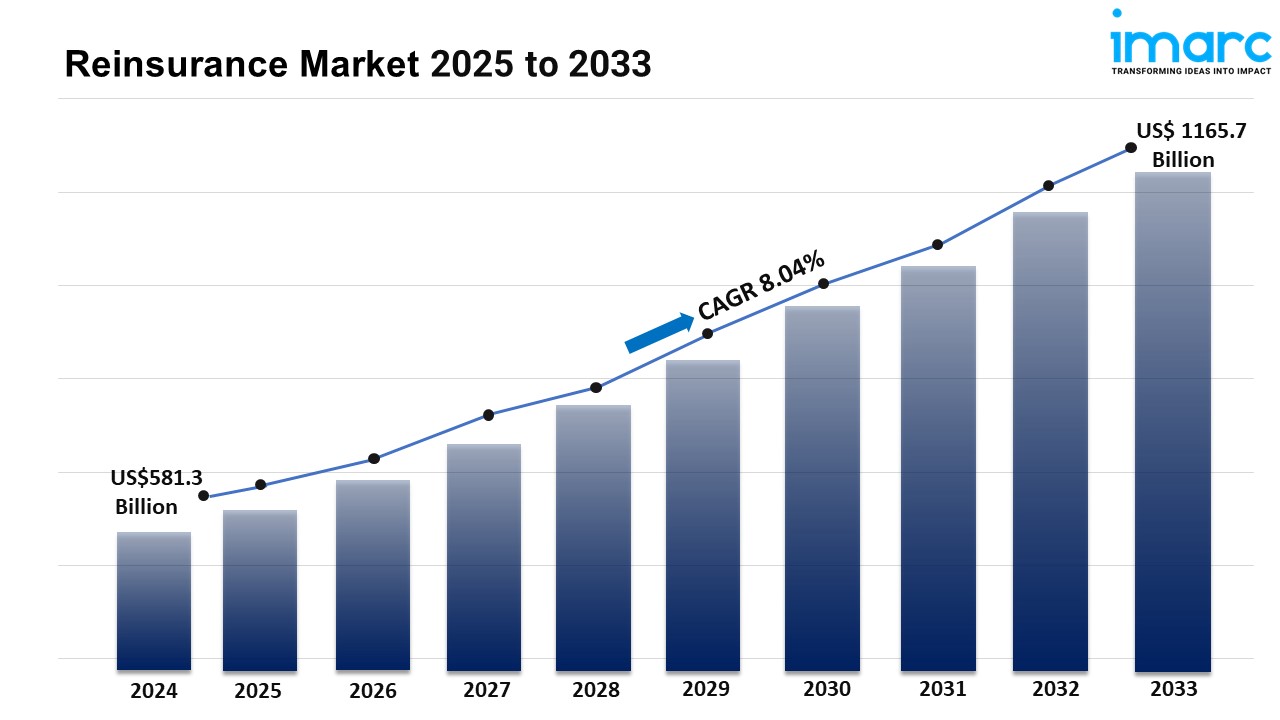

Reinsurance Market Report 2025, Industry Trends, Growth, Size and Forecast Till 2033

The latest report by IMARC Group, titled “Reinsurance Market Report by Type (Facultative Reinsurance, Treaty Reinsurance), Mode (Online, Offline), Distribution Channel (Direct Writing, Broker), Application (Property and Casualty Reinsurance, Life and Health Reinsurance), and Region 2025-2033, The global reinsurance market size reached USD 581.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1,165.7 Billion by 2033, exhibiting a growth rate (CAGR) of 8.04% during 2025-2033.

Industry Trends and Drivers:

• Increasing frequency of natural disasters:

The growth of the reinsurance market is primarily driven by the rising incidence of natural disasters, such as hurricanes, floods, and wildfires. As climate change intensifies, the frequency and severity of catastrophic events have grown, leading to significant financial losses for insurers. These insurers rely on reinsurance companies to share the financial burden of large claims resulting from such disasters. With more extreme weather events occurring worldwide, insurers face heightened risks, making reinsurance a vital component in managing potential losses. This trend has heightened the demand for reinsurance services as insurance companies seek to protect themselves against the unpredictability and high costs associated with natural catastrophes.

• Growing complexity of risk:

The growing complexity of risks across various sectors is significantly influencing the growth of the reinsurance market. Modern industries are facing evolving challenges, such as cybersecurity threats, global supply chain disruptions, and geopolitical tensions. These risks are difficult to predict and carry high financial implications when they materialize. Insurers alone may struggle to cover the losses associated with these complex risks, turning to reinsurers for additional support. Reinsurance companies provide essential risk management solutions that help insurers diversify and mitigate their exposure to large, unpredictable losses. As industries become more interconnected and risks more complicated, the need for reinsurance as a safeguard is steadily rising.

• Regulatory requirements and capital relief:

Regulatory frameworks are contributing substantially to the growth of the reinsurance market. Numerous countries have stringent capital requirements that force insurers to hold a certain amount of capital to cover potential claims. Reinsurance allows insurers to transfer a portion of their risk to reinsurance companies, thereby reducing the amount of capital they need to hold. This provides insurers with capital relief, enabling them to expand their business while staying within regulatory guidelines. Furthermore, as regulatory bodies continue to tighten capital requirements to ensure the solvency of insurers, reinsurance is becoming a valuable tool to manage their capital more efficiently. This need for capital optimization, driven by regulatory pressures, is propelling the demand for reinsurance solutions across the insurance sector.

Request Sample For PDF Report: https://www.imarcgroup.com/reinsurance-market/requestsample

Report Segmentation:

The report has segmented the market into the following categories:

Type Insights:

• Facultative Reinsurance

• Treaty Reinsurance

o Proportional Reinsurance

o Non-proportional Reinsurance

Treaty reinsurance accounts for the majority of shares as it provides insurers with a way to mitigate risk by transferring a portion of their liabilities to another insurer.

Mode Insights:

• Online

• Offline

Offline dominates the market as large, complex deals often require personal negotiations to build trust and tailor agreements.

Distribution Channels Insights:

• Direct Writing

• Broker

Direct writing holds the majority of shares as it offers greater control and transparency over underwriting and pricing decisions.

Application Insights:

• Property and Casualty Reinsurance

• Life and Health Reinsurance

o Disease Insurance

o Medical Insurance

Life and health reinsurance exhibit a clear dominance as they help insurers manage long-term risks, particularly with rising healthcare costs and life expectancy.

Market Breakup by Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

North America holds the leading position owing to a large market for reinsurance driven by its large insurance industry, advanced regulatory framework, and concentration of global reinsurance companies.

Top Reinsurance Market Leaders:

• Axa S.A.

• Barents Re Reinsurance Company Inc.

• BMS Group Limited

• Everest Re Group Ltd.

• Hannover Re (Talanx)

• Lloyd's of London

• Markel Corporation

• Munich RE

• RGA Reinsurance Company

• SCOR SE

• Swiss Re

• Tokio Marine Holdings Inc.

Note: If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us.

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.