Semiconductors in India: How Policy, Investment, and Talent Are Building a Tech Superpower

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

- The forces driving India’s semiconductor acceleration

- Key players shaping the landscape

- Groundbreaking developments and what they mean for the future

- The road ahead—from policy to production and global positioning

- Let’s dive into India’s semiconductor strategy—and why the world is watching it unfold.

- Lam Research recently committed over US $1 billion in Karnataka to build critical chip‐manufacturing tooling capacity and infrastructure.

- A $10 billion fab is under development by L&T Semiconductor Technologies, aimed to begin production by the end of 2025 or early 2026.

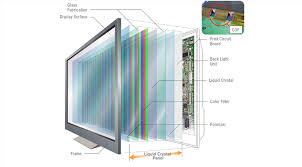

- A joint HCL–Foxconn plant in Uttar Pradesh (Jewar) will produce 36 million monthly display‑driver chips, destined for mobile, laptop, and automotive applications by 2027.

- Tata’s chip assembly & testing hub in Jagiroad, Assam—a ₹27,000 crore (~US $3.6 billion) project—is slated to create over 25,000 jobs and bolster India’s ATP (assembly, test, packaging) prowess by mid‑2025.

- Japanese equipment leader TEL (Tokyo Electron Limited) is exploring a semiconductor global capability center in Uttar Pradesh, further signaling global confidence in India's ecosystem.

Government Policies & Strategic Schemes

- The India Semiconductor Mission (ISM), backed by a $10 billion incentive program since 2021, aims to build a self‑sustaining industry across chip design, fabrication, and ATP.

- The Production‑Linked Incentive (PLI) scheme, paired with other schemes like SPECS and M‑SIPS, attracts major manufacturers, accelerates local supply chains, and supports thousands of job opportunities.

- States like Punjab, Gujarat, and Karnataka are launching state‑level semiconductor policies, committing land, subsidies, and industry clusters to expedite deployment.

Homegrown Innovation & Talent Enablers

- The Semi‑Conductor Laboratory (SCL) in Mohali—the only integrated device fabrication plant in India—is being modernized with a $2 billion investment and will form the basis for advanced domestic R&D and prototyping.

- The Bharat Semiconductor Research Centre (BSRC), co‑located with IIT Madras, is modeled on global innovation hubs like IMEC and will drive cutting‑edge research from 2024–2025 onward.

- Indian engineers now design 3 nm chips in‑country, showcasing growing capabilities in low‑power, high‑efficiency chip design.

- AICTE and industry bodies are training over 85,000 students in VLSI and IC design technologies, providing essential skill pipelines.

- Open‑source projects like SHAKTI (IIT Madras) and SHKTI‑based RISC‑V processors further advance India’s design innovation space.

Current Launches & Market Momentum

- Minister Ashwini Vaishnaw has confirmed the imminent launch of India’s first domestically produced semiconductor chip in 2025.

- By 2026, the home market is expected to be worth US $63 billion, supported by these initiatives.

- NXP Semiconductors, now investing over $1 billion in Indian R&D, expects India to deliver 8–10 % of its global revenues by 2030.

Challenges to Navigate

- India still relies heavily on imports especially for high‑end fabrication technology, raw materials (specialty gases, chemicals), and EDA tools

- R&D spending remains modest, with global competitors outpacing India in process node innovation.

- Integrated manufacturing infrastructure is still nascent, and catching up is a multiyear journey.

- Isolated controversies (e.g., the Kairali Chip) underline the need for greater transparency, peer-reviewed validation, and established IP protocols.

Fresh Value‑Adds & Strategic Perspectives

Additional Insights

- Supply‑chain Localization: India is accelerating development of ancillary industries—chemical processing, wafer substrates, packaging materials—to capture up to 10 % of the global $420 billion semiconductor supply market by 2030.

- ESDM Ecosystem Expansion: Electronics system design & manufacturing (ESDM) now enjoys 100 % FDI and streamlined clusters—critical for chip design, ASICs, and systems integration.

- Cross‑border Collaborations: Multilateral frameworks like iCET (India‑US Initiative on Critical & Emerging Tech) enhance co‑innovations in quantum, AI, and chip technologies.

- M&A Strategy: Indian firms are acquiring overseas IP and capabilities to fast‑track their path to integrated chip production.

- Jobs & Socioeconomic Impact: The sector is forecast to deliver 1 million jobs by 2026, from production to R&D and services—a major driver of up‑skilling and economic uplift.

Looking Ahead: 2025–2030 Roadmap

| Timeline | Key Focus Areas |

| 2025 | Launch domestic chip, commission TSAT and L&T fab beginnings, scale skill training and startup incubation. |

| 2026 | Achieve $63 billion market, hit 1 million semiconductor jobs, expand export-ready R&D centers and fabs. |

| By 2030 | Target US $100–110 billion domestic market, aim for $40 billion in ancillary manufacturing outputs, and be a global exporter in ATP and IP-intensive design. |

India’s semiconductor ascendancy is no longer aspirational it’s underway. What began as a series of policy initiatives has turned into real manufacturing projects, R&D breakthroughs, and global partnerships. From chip design to packaging, India is transforming itself into a comprehensive semiconductor ecosystem. Challenges remain—but momentum is relentless, and the future looks crystal clear: India is speeding ahead to become a global semiconductor powerhouse.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.