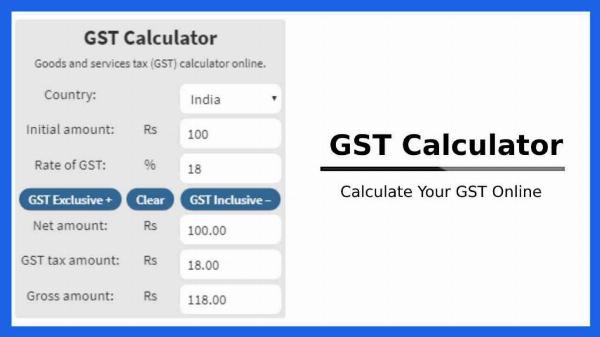

Simplify Your Finances with a GST Calculator in New Zealand

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Navigating the financial landscape in New Zealand can be a complex task, especially when it comes to managing taxes. One essential tool that can make this process easier is a GST Calculator. Whether you're a business owner, freelancer, or individual trying to stay on top of your finances, understanding how to use a GST Calculator Nz can save you time and ensure accuracy in your financial dealings.

What is GST?

Goods and Services Tax (GST) is a value-added tax levied on most goods and services sold in New Zealand. The current GST rate is 15%, and it's important for anyone involved in buying or selling goods and services to understand how to calculate this tax correctly. Failing to do so can lead to errors in pricing, invoicing, and financial reporting, which can have significant repercussions.

Why Use a GST Calculator?

A GST Calculator is designed to help you quickly and accurately calculate the GST component of any given amount. Here are a few reasons why using a GST Calculator is beneficial:

Time-Saving: Manually calculating GST can be time-consuming, especially when dealing with multiple transactions. A GST Calculator automates this process, giving you instant results.

Accuracy: Human error is always a possibility when performing manual calculations. A GST Calculator ensures precision, helping you avoid costly mistakes.

Compliance: Using a GST Calculator ensures that you comply with New Zealand's tax regulations. This is crucial for businesses to avoid penalties and ensure smooth operations.

Simplicity: Even if you're not a financial expert, a GST Calculator makes it easy to understand and manage GST. It's a user-friendly tool that simplifies complex calculations.

How to Use a GST Calculator

Using a GST Calculator is straightforward. Most calculators available online follow a simple process:

Input the Amount: Enter the amount you want to calculate the GST for. This can be the price of a product or service, either inclusive or exclusive of GST.

Select the Calculation Type:

If you want to find out the total amount including GST, select the option to add GST.

If you need to extract the GST from a total amount, choose the option to subtract GST.

View the Results: The calculator will display the GST amount and the total amount, either inclusive or exclusive of GST, depending on your selection.

Practical Applications for a GST Calculator

For Businesses

Businesses need to ensure that they are correctly adding GST to their products and services. A GST Calculator helps in pricing goods accurately, preparing invoices, and filing GST returns. It also aids in financial planning and budgeting by providing clear insights into the tax components of transactions.

For Freelancers

Freelancers and contractors who provide services need to include GST in their invoices. A GST Calculator makes it easy to calculate the correct amount to charge clients, ensuring compliance with tax laws and maintaining professional standards.

For Shoppers

Consumers can use a GST Calculator to understand the tax component of their purchases. This is particularly useful when budgeting or comparing prices of goods and services that include or exclude GST.

Choosing the Right GST Calculator

When selecting a GST Calculator, look for one that is reliable, easy to use, and provides accurate results. Many online calculators are available for free and offer additional features such as currency conversion and different tax rates for comprehensive financial management.

Conclusion

A GST Calculator is an indispensable tool for anyone dealing with financial transactions in New Zealand. By simplifying the process of calculating GST, it saves time, ensures accuracy, and helps maintain compliance with tax regulations. Whether you're a business owner, freelancer, or consumer, incorporating a GST Calculator into your financial toolkit can make managing your finances easier and more efficient.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.