On-Page SEO Optimization – Fix Hidden Errors Killing Rankings!

On-Page SEO Optimization – Fix Hidden Errors Killing Rankings!

SIP Calculator: Dreams Might Look Like a Jackpot

Written by Pawan Sharma » Updated on: June 09th, 2025

Among the monthly SIP investments now far-reaching Rs. 26,000 crores, the Association of Mutual Funds in India (AMFI) claims that more and more small investors have turned to mutual funds as a long-term means of raising their financial status. A SIP calculator is an easy instrument that provides you with a figure of the opportunity return on your investment based on the amount you invest, the duration of time you create investments, and the expected rate of return.

By understanding how to use a SIP calculator to calculate wealth for the real scenario, you can set your investment goals more clearly and make better financial decisions.

In this article, we will explain how the SIP return calculator works and how you can use it for smart investment in jackpots.

What Is a SIP Calculator and Why Everyone’s Talking About It?

A SIP return calculator is an accessible instrument that offers you a figure of the opportunity return on your investment based on the amount you invest, the duration of time you create investments, and the expected rate of return through a Systematic Investment Plan (SIP).

- Think of it like a digital planner that helps you answer questions that you usually skip. Such as if I invest Rs 2,000 every month, how much will I have in 7 years? How much should I invest monthly to get Rs 1 crore?

- Everyone is talking about it because they love it. After all, it removes all the guesswork and pen-and-paper calculations. Instead of doing tough math, you just enter your monthly SIP amount, expected return rate (like 10–12%) & duration, and it shows the real result. You get a clear picture of how your money will grow.

- No need to be an expert to use this tool. It is helping millions of everyday people plan their future, from buying a house to visiting 51 new countries.

Now, go to the extra miles to your wealth with the SIP return calculator.

SIP Return Calculator - Benefits to Your Wealth

The Best SIP Calculator gives the following benefits to your wealth planning: estimating the total value with accurate results through manual calculations & helping you to achieve your financial goals.

Here are some key benefits of using a SIP return calculator:

- Easy to Use: You do not need to be a financial expert to use this. Just enter some values to get an idea of the future worth of the invested amount.

- Plan Better: By knowing how your money can grow, you can adjust your investment amount or duration to get better capital & It helps you see if your monthly investment is enough to reach your financial goals, such as buying a house, funding child education, or retirement.

- Stay Motivated: Watching your money grow over time encourages you to keep investing regularly.

- Saves Time: It is difficult to manually figure out which investment number, frequency, or duration is best for a particular investment when there are thousands of opportunities available, each different. Return. You can determine and compare different investments and change the requirements with the best SIP calculator.

Note: A systematic investment plan calculator makes sure that your savings portfolio is enhanced as per your requirements and financial needs.

How do SIP calculators work?

The SIP calculator work depends on a few simple inputs such as your monthly investment, the given rate of return for your investments & the time during which you invest. The tool then calculates how contributions might grow over time, considering the compounding effect.

A SIP plan calculator works on this formula –

FV = P x ( { [1 + r] ^ n – 1} / r) × (1 + r)

Where:

- FV is the future value of your investment after maturity.

- P is the major contribution of each month of investment.

- r is the expected rate of return after a tenure

- n is the total number of contributions you have made during the investment.

Note: Let Your SIP Be the Silent Jackpot Builder. Know some myth vs reality before using the SIP calculator

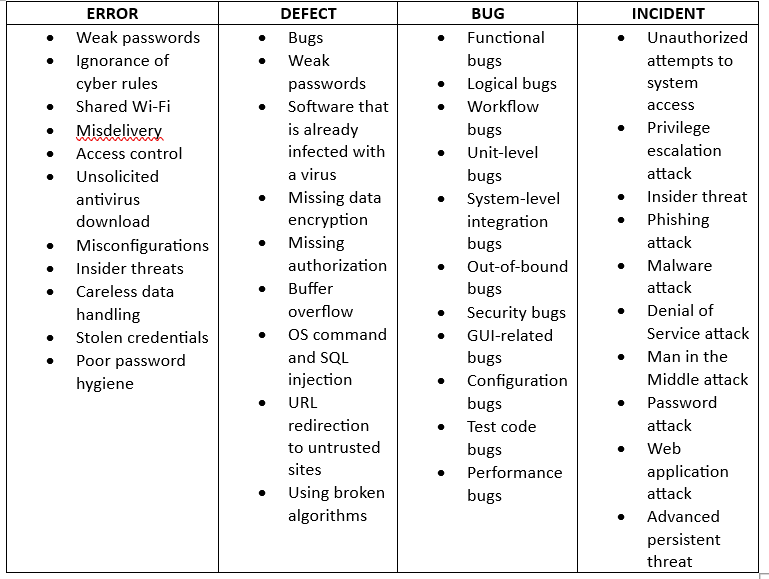

The Rs 1 Crore Dream: Is It Possible with SIP Myth Vs Reality

Yes, it became possible by investing through SIP, but before starting SIP, using the SIP return calculator, it is important to know some myths and realities that can hit you hard.

This table helps you to bust some myths, while reality opens your eyes:

After hitting some reality, let's understand real-life scenarios with SIP amounts & Timelines to Rs1 Crore.

Real-Life Scenarios: SIP Amounts and Timelines to Rs1 Crore

Let us imagine that Chirag is 25 years old and wants to retire at 50, which gives him 25 years to build a solid retirement fund. He chooses to invest monthly through a Best Systematic Investment Plan (SIP) in a mutual fund, expecting an average compounding return of 12% per year.

Here are how different SIP amounts can help him reach (or exceed) his Rs 1 crore target:

Chirag’s SIP Plan to Reach ₹1 Crore (12% Annual Return)

Key Takeaway from Chirag's SIP Plan:

Chirag does not need a huge salary or a financial miracle, He just needs a smart plan & the patience to stick with it. With consistent SIPs and the power of compounding, his Rs1 crore retirement dream is completely achievable. So simply it justifies that with the SIP Calculator- Dreams Might Look Like a Jackpot.

Mistakes to Avoid While Planning with SIP Calculators

There are some common mistakes you have to be careful of before calculating using the SIP return calculator:

- Using Unrealistic Return Rates: Do not expect super high returns; stay stuck to 10–12% for planning.

- Ignoring Inflation Impact: Remember, inflation reduces your capital buying power over time.

- Start now: Stop waiting for the perfect time. The longer you wait, the more you will need to invest monthly.

- Not Increasing SIP Over Time: Do not keep the SIP amount fixed for a long time; increase it as your income grows.

- Stopping SIP During Market Swings: This is the most common mistake many investors make, pausing your SIP just because the market is down. SIP gives the best return when consistent.

- Not Reviewing Your Plan Regularly: Use the calculator mostly to check and analyse if you are still on track.

Conclusion

A SIP return calculator shows you a clear picture of future returns. This calculator is a creative financial tool that allows you to see how your regular investments could grow over time. You can change the amount, period & expected returns to figure out a strategy that is effective for you.

Many investors use SIP calculators to manage their mutual fund investments systematically. It helps you stay on track & set realistic financial goals. This tool encourages you in your financial strategy if you are saving for retirement, college studies, or something precious as a gift for your mother.

“Make sure that Time vs Money aligns with your goals. The Earlier You Start, the Bigger the Jackpot will be”.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.

Copyright © 2019-2025 IndiBlogHub.com. All rights reserved. Hosted on DigitalOcean for fast, reliable performance.