The Growth of Finland Insurance TPA Market: A Focus on Health and Wellness Insurance

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Introduction

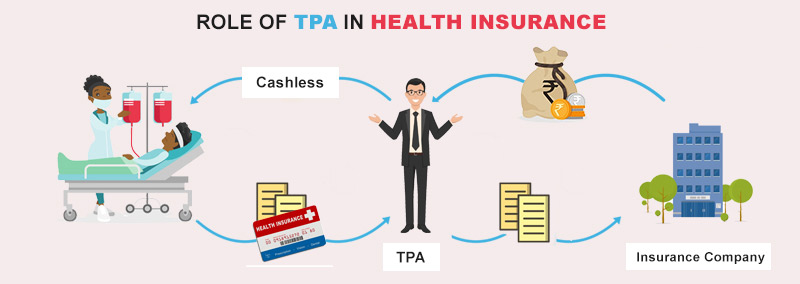

The Finland Insurance TPA Market has witnessed significant growth in recent years. A Third-Party Administrator is an organization that handles administrative tasks and claims management for insurance companies. These include processing claims, managing policies, and maintaining records, allowing insurers to streamline operations and improve customer service. One of the most notable factors contributing to the growth of the TPA market in Finland is the increasing focus on health and wellness insurance, as individuals and companies alike are placing greater importance on health and well-being. This article explores the key drivers of the TPA market in Finland, with a particular emphasis on the growing interest in health and wellness insurance.

Growth Drivers of the TPA Market in Finland

1. Increased Demand for Health and Wellness Insurance

The primary driver behind the expansion of the TPA market in Finland is the rising demand for health and wellness insurance. In recent years, both private individuals and companies have become more aware of the importance of health and wellness, leading to a surge in the uptake of health insurance products. Finland, with its high standard of living and strong public health system, has seen an increased trend of supplementary private health insurance coverage.

Consumers now expect more from their health insurance policies, seeking options that go beyond basic coverage to include preventive services, wellness programs, and mental health support. As a result, insurance companies are increasingly turning to TPAs to manage these complex policies efficiently. TPAs help insurers offer flexible plans while ensuring the smooth administration of claims and policyholder support.

2. Aging Population

Finland, like many European countries, is experiencing demographic changes, with a steadily aging population. Older individuals typically require more medical care, which increases the demand for comprehensive health insurance products. As the elderly population grows, so too does the need for a greater variety of health and wellness insurance offerings that cater to their specific needs, such as long-term care, chronic disease management, and rehabilitation services.

TPAs play a vital role in managing the more intricate aspects of these policies. Their expertise in claims processing, provider network management, and health service coordination makes them indispensable in the growing market for senior health and wellness products. As the demand for insurance grows in response to demographic shifts, TPAs are crucial for maintaining efficiency and cost-effectiveness.

3. Employer-Sponsored Health and Wellness Programs

Another key factor driving the growth of the TPA market is the rise in employer-sponsored health and wellness programs. Finnish companies are increasingly offering their employees insurance benefits that focus not only on covering healthcare costs but also on promoting overall wellness, including physical fitness, mental health services, and nutritional support. With an emphasis on wellness, companies are adopting strategies to keep employees healthy and reduce the long-term costs associated with absenteeism and healthcare.

In response to this trend, TPAs are playing a pivotal role in managing corporate wellness programs. They provide a range of services, including claims management, wellness program administration, and providing employees with easy access to health services. Employers benefit from these programs because TPAs can help them design tailored insurance solutions that improve employee health and, ultimately, productivity.

4. Advancements in Digital Health Solutions

The rise of digital health technologies is another major factor contributing to the growth of Finland’s TPA market. With the advent of telemedicine, health tracking devices, and online health platforms, consumers are increasingly seeking insurance plans that incorporate these innovations. TPAs are leveraging these technologies to streamline operations, such as offering digital claims processing, integrating telemedicine services into insurance packages, and providing real-time access to health data for customers.

Digital health solutions offer greater convenience for both insurers and policyholders. By embracing these technologies, TPAs are enhancing the customer experience, improving health outcomes, and reducing administrative costs. Additionally, these solutions can offer insights into population health trends, allowing insurers to better tailor their products to the evolving needs of their customers.

5. Shift Toward Preventive Care

In line with the growing demand for health and wellness insurance is the shift from a reactive healthcare model to a more proactive one, with an increased focus on prevention. Finland's government, along with private insurers, is promoting wellness initiatives aimed at preventing chronic conditions, reducing healthcare costs, and improving the overall quality of life for the population. These wellness initiatives often include regular health screenings, vaccinations, fitness programs, and mental health services.

Insurance TPAs are integral in facilitating these programs, helping insurers to manage preventive care offerings and ensuring the smooth administration of services. By focusing on prevention, TPAs not only help policyholders stay healthier but also contribute to lowering the overall cost burden on both insurers and the public healthcare system.

6. Regulatory Support and Government Initiatives

The Finnish government has long been supportive of private health insurance, offering various incentives for individuals and companies to invest in health and wellness coverage. Recent changes in healthcare policy, including a more favorable regulatory environment for private health insurance, have further encouraged the uptake of health-related insurance products.

TPAs benefit from these regulatory changes, as they help insurance companies navigate the complex landscape of healthcare laws and ensure compliance. By outsourcing administrative tasks to TPAs, insurers can focus on product innovation and customer service while adhering to the regulatory framework.

The Role of TPAs in Finland's Evolving Insurance Landscape

TPAs have become crucial players in the evolving insurance landscape of Finland, particularly in the context of health and wellness insurance. By outsourcing claims management, policy administration, and wellness program management to TPAs, insurance companies are better able to respond to the growing demands of the market. TPAs offer specialized services that help insurers stay competitive, ensuring that customers receive timely support, efficient claims processing, and access to the latest health technologies.

Moreover, as health insurance products become increasingly complex, TPAs are helping insurers design comprehensive plans that incorporate traditional health services with new wellness benefits. This creates a more attractive and holistic offering for policyholders and drives further growth in the market.

Challenges in the TPA Market

While the TPA market in Finland is experiencing growth, it also faces challenges. The increasing complexity of health insurance products and the growing demand for personalized services require TPAs to constantly innovate and adapt to changing market conditions. Furthermore, the competitive nature of the market and the need to offer high-quality services at competitive prices puts pressure on TPAs to maintain operational efficiency.

Data privacy and security also remain critical issues in the insurance industry, particularly as TPAs handle sensitive health data. Stricter regulations and the need for robust cybersecurity measures are paramount in ensuring the trust of both insurers and policyholders.

Conclusion

The TPA market in Finland is poised for continued growth, driven largely by the increasing demand for health and wellness insurance. As consumers and companies place greater emphasis on health and preventive care, the role of TPAs becomes even more critical in managing complex policies and administrative tasks. TPAs enable insurers to offer more comprehensive and personalized health insurance products, which will be vital for meeting the needs of a growing, aging population. Moreover, as digital health technologies and wellness programs gain momentum, TPAs are playing a vital role in delivering innovative solutions to the insurance market.

Despite the challenges, the future of Finland’s insurance TPA market looks promising, with a strong focus on health and wellness as the main catalyst for growth. By leveraging new technologies and adapting to changing consumer demands, TPAs will continue to be key players in shaping the future of Finland’s insurance landscape.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.