The India Fintech Market Growth and Top Players Industry Analysis

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

The India Fintech Market is valued at USD 85.13 billion in 2023 and is undergoing rapid transformation driven by digital adoption, mobile-first consumers, and strong government-backed financial inclusion programs. With a tech-savvy population and increasing smartphone usage, India is fast becoming one of the world’s largest fintech ecosystems, housing digital wallets, insurtech platforms, lending apps, and neobanks.

Explore the in-depth industry analysis of India Fintech Market Report here.

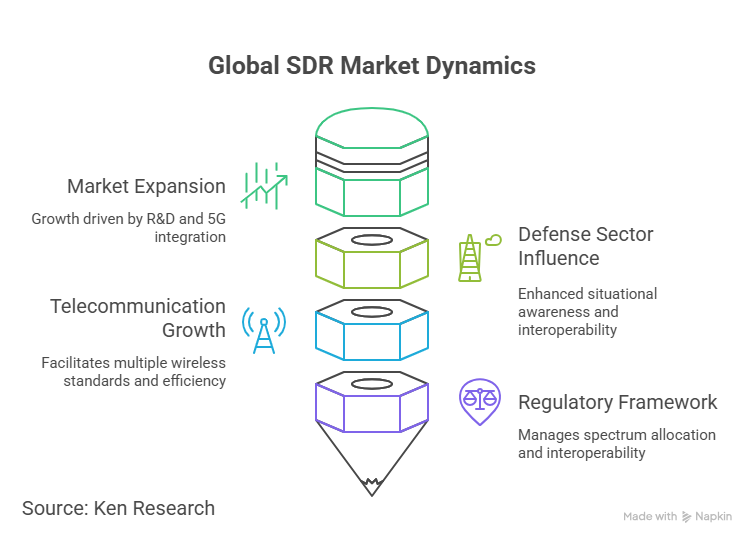

Growth Drivers of the India Fintech Market

- Explosive UPI Adoption: UPI processed over 100 billion transactions in FY 2023–24, totaling more than INR 180 trillion. This real-time payment system has become the cornerstone of India’s digital economy, used across P2P, merchant, and government transactions.

- Massive Smartphone and Internet Penetration: India crossed 800 million internet users and 750 million smartphone users in 2023, expanding fintech accessibility across rural and urban regions.

- Booming Digital Lending Ecosystem: Digital lending disbursals reached INR 2.5 trillion in FY23, driven by fintech platforms offering real-time loan approvals, BNPL options, and SME financing with minimal paperwork.

- Financial Inclusion Policies: Government initiatives like PMJDY and Aadhaar-enabled banking have brought 490+ million people into the formal financial system, enabling fintech services in underserved markets.

- Surge in Insurtech and WealthTech: Platforms like PolicyBazaar and Zerodha are driving growth in insurance and investment markets by offering simplified, transparent digital onboarding and instant policy or equity purchase options.

Top Players in the India Fintech Market (with Key Financials)

Paytm (One97 Communications Ltd.)

- FY23 Revenue: INR 7,990 Cr (USD 950 Mn)

- Focus Areas: Payments, Lending (Paytm Postpaid), Insurance, Wealth Management

- Notable: Over 350 million registered users and deep integration with retail networks

PhonePe (Walmart-backed)

- FY23 Revenue: INR 2,500 Cr (USD 300 Mn)

- Focus Areas: UPI payments, Mutual Funds, Gold Investments

- Notable: Leading UPI player with over 50% market share by volume

Razorpay

- FY23 Revenue: INR 1,485 Cr (USD 180 Mn)

- Focus Areas: B2B Payments, Payroll Automation, Lending (Razorpay Capital)

- Notable: Processes payments for over 10 million businesses

Pine Labs

- FY23 Revenue: INR 1,200 Cr (USD 145 Mn)+

- Focus Areas: POS Financing, BNPL, Merchant Lending

- Notable: Over 150,000 merchants on its platform, strong e-commerce integrations

PolicyBazaar

- FY23 Revenue: INR 2,555 Cr (USD 310 Mn)

- Focus Areas: Digital Insurance Aggregation, HealthTech, Insurtech SaaS

- Notable: Processes more than 25% of India's digital insurance volume

Key Trends Shaping India Fintech Market

- AI-Driven Financial Personalization: Robo-advisory tools, credit scoring, and predictive risk analytics are redefining customer experiences.

- Rise of Digital-Only Banks: Mobile-only banking for Gen Z and millennial users is gaining traction with no physical branches.

- BNPL and Embedded Finance: Retailers and fintech platforms are embedding lending, insurance, and savings options at checkout.

- Insurtech Integration: Bundled insurance solutions are gaining popularity, especially through mobile platforms and e-commerce.

Challenges to Address

- Regulatory Uncertainty: RBI's tightening of digital lending rules is impacting agility for fintech startups.

- Low Financial Literacy in Rural Areas: Despite account openings, there remains a lack of awareness about credit, insurance, and digital banking tools.

- Data Privacy and Cybersecurity: As platforms scale, ensuring user protection and system resilience is becoming critical.

Conclusion

India’s fintech market is on a steep upward trajectory. As technology evolves and financial access becomes more inclusive, the market is poised to surpass traditional banking paradigms. With increasing mobile-first engagement, deeper AI integration, and a favorable policy environment, India is set to become a global benchmark in fintech innovation by 2028.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.