The Top Players in the Global Foreign Exchange (ForEx) Market- Strategies and Insights

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

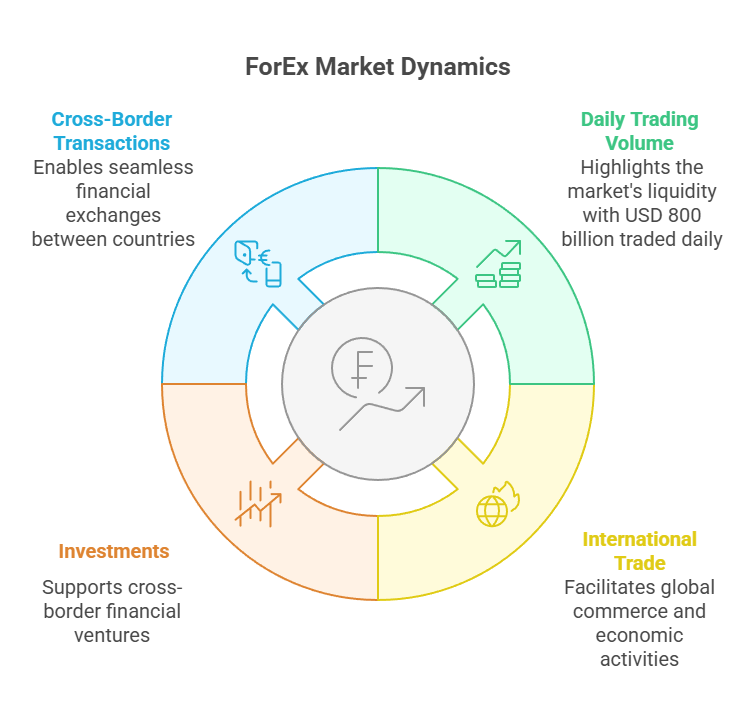

The Global Foreign Exchange (ForEx) market is the most liquid and dynamic financial system in the world. With over USD 800 billion in daily trading volume, according to Ken Research, it plays a vital role in facilitating international trade, investments, and cross-border transactions. From multinational banks to fintech-driven brokers, key players dominate this space with innovative technologies and strategic insights.

This article highlights the top companies in the global forex market, examining how they operate, what drives their success, and what businesses can learn from them to compete in the world's most active financial market.

Global ForEx Market Overview: Size, Structure, and Competitive Edge

The Foreign Exchange market is a decentralized, over-the-counter (OTC) ecosystem where currencies are traded 24/7 across major financial hubs like London, New York, Tokyo, and Sydney. It supports everything from international trade to tourism, investment, and speculative trading.

According to Ken Research, the global ForEx market is valued at around USD 800 billion in daily trading volume, driven by:

- High liquidity and low transaction costs

- Increased globalization and trade flows

- Technological advancements like algorithmic trading

- Diverse participants including banks, hedge funds, corporations, and retail investors

This competitive market thrives on precision, speed, and trust. Financial institutions that offer tighter spreads, faster execution, and smart tools stand out as leaders.

Top Players in the Global Foreign Exchange Market

JPMorgan Chase & Co.

JPMorgan ranks consistently as the largest foreign exchange trading bank worldwide. Leveraging its JPMorgan eXecute platform, the bank offers cutting-edge trading tools, deep liquidity, and global coverage.

Key Forex Strategies:

- Investment in AI-driven predictive models

- Seamless cross-asset platforms

- Focused institutional client service

Citi (Citigroup Inc.)

Citi is renowned for its dominance in emerging market currencies and institutional FX trading. Its CitiFX Pulse and Velocity platforms deliver advanced analytics and rapid execution.

Recent Innovations:

- Expansion in Asia-Pacific FX markets

- Real-time trade optimization

- ESG-aligned financial instruments

Deutsche Bank

A leader in e-FX, Deutsche Bank continues to enhance its digital capabilities through platforms like Autobahn, catering to high-frequency trading and FX prime brokerage clients.

Performance Insights:

- Blockchain-based FX settlement

- Strong APAC growth

- Streamlined institutional services

Goldman Sachs

Goldman Sachs has transitioned from traditional trading desks to AI-optimized forex trading and smart risk management. It offers extensive access to both G10 and exotic currency pairs.

Core Strategies:

- AI for risk analytics

- Multi-asset liquidity solutions

- Integration of digital currencies into FX

Download Free Sample Report Get exclusive access to expert-curated analysis and data to stay ahead in the Global Foreign Exchange (ForEx) Market.

HSBC

With a strong presence in Asia and the Middle East, HSBC offers FX risk management, trade finance, and blockchain-based solutions tailored for multinational corporates and SMEs.

Key Developments:

- Smart hedging tools

- Real-time FX settlement via blockchain

- Focus on Belt and Road currency corridors

UBS Group AG

UBS excels in integrating forex trading with wealth management, offering specialized advisory and execution services to HNWIs and institutional clients.

Highlights:

- AI-powered decision engines

- European market leadership

- Focus on sustainable finance in FX

Barclays

Barclays provides retail and institutional FX solutions through its BARX platform, with strengths in liquidity provision and ESG-linked FX products.

Strategic Moves:

- Customizable FX derivatives

- AI-enhanced pricing engines

- Expansion in ESG currency pairs

Key Lessons from Leading Forex Companies

What sets these top forex trading firms apart? Here's what aspiring players and analysts can learn:

- Technology is king: AI, blockchain, and cloud-based systems are now essential in FX strategy.

- Client-first approach: Custom solutions for hedge funds, corporates, and individuals create loyalty.

- Global reach: Operating across multiple markets ensures liquidity and diversified risk.

- Innovation in products: From ESG-linked FX to real-time analytics, product evolution drives growth.

Smaller or mid-size businesses aiming to compete in the ForEx industry should prioritize building tech ecosystems, regulatory compliance, and user-focused service platforms.

Conclusion:

The global foreign exchange market remains one of the most vital components of the global financial system. The leaders in this space—JPMorgan, Citi, Deutsche Bank, and others—combine advanced technologies, regulatory foresight, and strategic adaptability to maintain their dominance.

As trends shift toward automation, sustainability, and real-time trading, these firms are setting new benchmarks. For businesses and traders alike, understanding the strategies of top ForEx companies offers a blueprint for growth and resilience in the future of finance.

Read my other blogs in KSA Herbal Medicine Market Trends and Opportunities

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.