Thin Wall Packaging Market Global Reports, Opportunities, Trends & Forecast 2032

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

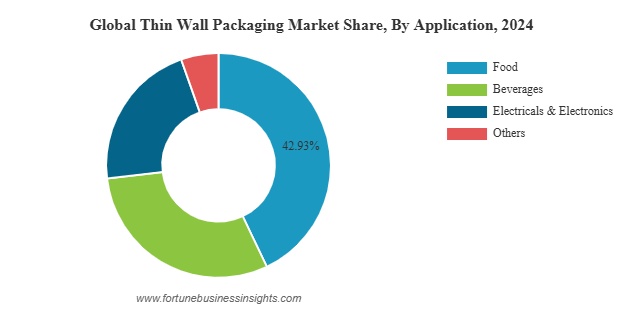

The global thin-wall packaging market has witnessed significant growth in recent years and is projected to continue expanding steadily. Valued at USD 41.60 billion in 2024, the market is expected to grow from USD 43.94 billion in 2025 to USD 67.26 billion by 2032, registering a Compound Annual Growth Rate (CAGR) of 6.27% during the forecast period (2025–2032).

Thin-wall packaging is widely used across various industries due to its lightweight, cost-effective, and durable properties. It includes containers like cups, tubs, trays, jars, and lids used in food packaging and other applications. The technology used enables the production of thinner plastic packaging walls without compromising strength or functionality, helping reduce material usage and improve sustainability.

Key Market Drivers

Increasing Demand from the Food Industry

The food segment holds a dominant share of the thin-wall packaging market, accounting for more than half of the global revenue in 2024. The rise in demand for convenience food, ready-to-eat meals, and packaged snacks is significantly driving this growth. Urban consumers are leaning more toward single-serve and microwavable containers, which has led to increased demand for thin-wall plastic packaging that offers both durability and convenience.

Urbanization and Lifestyle Changes

Urbanization has fueled a shift in lifestyles, with consumers demanding quick, hygienic, and easy-to-handle food solutions. As a result, thin-wall packaging has become a go-to option due to its user-friendly design and ability to preserve food quality for longer durations.

Growth in the Beverage Segment

The beverage segment is also growing at a notable pace due to rising consumption of packaged drinks. Thin-wall packaging offers excellent sealing properties and compatibility with automated filling systems, making it ideal for beverage manufacturers looking to improve shelf-life and logistics efficiency.

Material Trends

Polypropylene (PP) is the most widely used material in thin-wall packaging due to its excellent durability, moisture resistance, and cost-effectiveness. It is favored in the food and beverage industry for manufacturing containers, tubs, and trays. Other materials include polystyrene (PS), polyethylene terephthalate (PET), and polyethylene (PE), but PP leads due to its ability to provide lightweight yet robust packaging.

Read More : https://www.fortunebusinessinsights.com/thin-wall-packaging-market-109389

Manufacturing Process Insights

Injection molding is the dominant manufacturing process used in the production of thin-wall packaging. This method offers shorter cycle times, lower costs, and higher output compared to other molding techniques. Thermoforming is another process used, especially for shallow containers, but it generally has a slower production rate compared to injection molding.

Regional Analysis

North America held the largest market share in 2024, with growing adoption of sustainable packaging and high consumption of packaged food products. The region’s technological advancements and strict food safety regulations have further boosted the demand for thin-wall solutions.

Asia-Pacific is expected to witness the fastest growth over the forecast period, driven by rising disposable incomes, expanding urban populations, and increased adoption of modern packaging practices in countries like China and India.

Europe also remains a key market due to increasing environmental concerns and regulatory support for recyclable and lightweight packaging.

List of Key Thin Wall Packaging Companies Profiled:

Berry Global Inc. (U.S.)

Dahl-Tech, Inc. (U.S.)

BEWI (Norway)

Otto Männer GmbH (Germany)

Mold-Tek Packaging (India)

Greiner Packaging International (Austria)

PACCOR (Germany)

Groupe Guillin (France)

Takween Advanced Industries (Saudi Arabia)

Plastipak Industries Inc. (U.S.)

Double H Plastics, Inc. (U.S.)

KEY INDUSTRY DEVELOPMENTS

In November 2023, ITC Packaging worked with BMB SPA and Novapet to launch TWI-PET. The new technology develops thin walls and flexible PET packaging in a one-step injection molded process. Containers developed with TWI-PET feature IML decoration with labels designed with PET or PP, which are both recyclable.

In October 2023, Netstal launched a lightweight ICM thin wall cup designed with 100 % PP at Fakuma. The thin wall packaging is optimized for the circular economy utilizing the injection compression molding process. The packaging is produced in 4 cavities at a cycle time of 2.7 seconds in an Elion 1750 with a hybrid injection unit and is majorly suitable for dairy products.

Challenges and Opportunities

Despite its benefits, the thin-wall packaging market faces challenges such as environmental concerns regarding plastic waste. However, manufacturers are increasingly investing in recyclable and biodegradable alternatives to align with global sustainability goals.

Moreover, the growing trend toward e-commerce and online food delivery offers new opportunities for thin-wall packaging. These containers provide a lightweight, tamper-resistant, and visually appealing solution that meets the logistics needs of digital food retail.

The global thin-wall packaging market is poised for sustained growth, fueled by demand for convenient, lightweight, and sustainable packaging solutions. With innovation in materials, manufacturing processes, and a strong push toward eco-friendly practices, the market is set to evolve significantly over the coming years. As industries continue to adapt to changing consumer behaviors and regulatory pressures, thin-wall packaging will remain a critical component of modern packaging strategies.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.