Top Trends in Account Reconciliation Software: ERP Integration & Real-Time Finance

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Market Overview

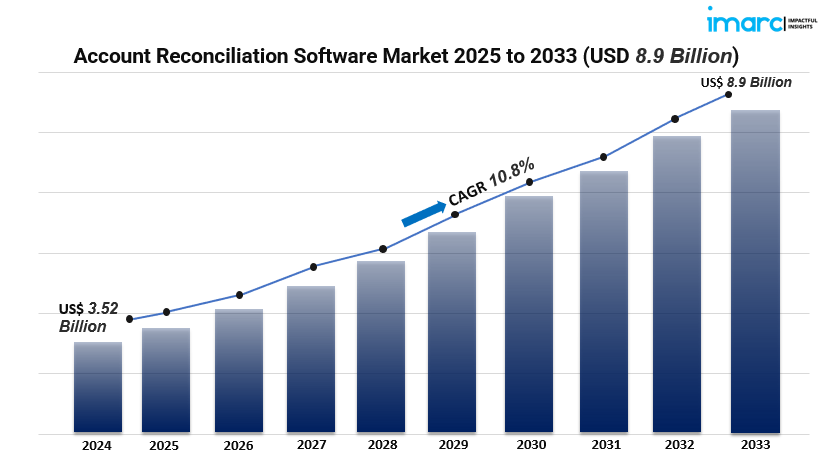

The global account reconciliation software market, valued at approximately USD 3.52 billion in 2024, is on a strong upward trajectory. Driven by rising demands for financial automation, enhanced compliance, and the need to minimize human errors, the sector is projected to nearly double to USD 8.9 billion by 2033. Cloud-based solutions, ERP integration, and AI-powered tools are further accelerating innovation and adoption.

Study Assumption Years

• BASE YEAR: 2024

• HISTORICAL YEAR: 2019–2024

• FORECAST YEAR: 2025–2033

Account Reconciliation Software Market Key Takeaways

• Market growth: Valued at USD 3.52 billion in 2024, expected to reach USD 8.9 billion by 2033 at a CAGR of 10.8%.

• Regional dominance: North America leads with over 35.6% market share in 2024, due to high automation demand.

• Component insights: Software constitutes the larger portion compared to services.

• Deployment trend: On-premises deployments currently dominate, though cloud-based uptake is increasing.

• Organization size: Large enterprises command the majority share, supported by complex financial needs.

• End users: BFSI is the largest segment, followed by manufacturing, retail/e commerce, healthcare, IT/telecom, energy/utilities, government, and others.

• Innovation driver: Integration of AI/ML and cloud for real-time transparency is key to fueling efficiency and growth.

Market Growth Factors

1. Technological Advancements: AI, ML & Automation

The push to automate financial processes is a key part of how the market is evolving. With AI and machine learning-driven reconciliation tools, discrepancies can be spotted automatically, anomalies flagged, and huge volumes of transactions matched accurately and in real time. This not only boosts productivity but also enhances compliance efforts and financial transparency. As ERP integration continues to improve, finance teams are equipped with smarter data retrieval tools, leading to quicker closing cycles and less dependence on manual work, which is driving widespread adoption across businesses.

2. Regulatory & Compliance Pressures

As global regulatory standards become more stringent, the need for accurate and timely financial reporting grows. Automated reconciliation tools help ensure that companies are audit-ready, maintain proper documentation of workflows, and produce error-free compliance reports. These systems are essential for managing high transaction volumes, strengthening internal control frameworks, and reducing the risk of human error. In regulated industries like banking, finance, healthcare, and the public sector, adopting software is crucial for meeting standards such as SOX, IFRS, and local legal requirements, which in turn accelerates market growth.

3. Growing Market Demand: Cloud & ERP Integration

The increasing volume of digital and online payments is creating complex reconciliation challenges. Organizations are turning to cloud-based solutions for their scalability, lower initial costs, and remote access. When integrated with ERP and financial systems, these platforms provide a seamless data flow, giving financial leaders real-time insights into treasury and cash operations. The growth of digital transactions in sectors like retail, fintech, and telecom is driving the demand for advanced tools, making reconciliation software an essential component of modern financial infrastructure.

Request for a sample copy of this report: https://www.imarcgroup.com/account-reconciliation-software-market/requestsample

Market Segmentation

Breakup by Component:

• Software

• Services

Breakup by Deployment Mode:

• On-premises

• Cloud-based

Breakup by Organization Size:

• Small and Medium-sized Enterprises

• Large Enterprises

Breakup by End User:

• BFSI

• Manufacturing

• Retail and E-Commerce

• Healthcare

• IT and Telecom

• Energy and Utilities

• Government and Public Sector

• Others

Breakup by Region:

• North America (United States, Canada)

• Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

• Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

• Latin America (Brazil, Mexico, Others)

• Middle East and Africa

Regional Insights

North America is leading the market, holding more than 35.6% of the share in 2024. The region's growth is fueled by high adoption rates of automation, strict compliance regulations, and comprehensive ERP integration. As finance teams seek greater accuracy and efficiency, ongoing innovations in cloud technology and AI-driven reconciliation are keeping the momentum strong.

Recent Developments & News

Recent trends highlight impressive advancements in the integration of AI and machine learning within reconciliation tools. Top vendors are stepping up their game by improving anomaly detection, transaction matching, and workflow automation features. The rise of cloud-based and SaaS solutions has made real-time collaboration and remote access more accessible than ever. Moreover, software providers are increasingly aligning with ERP platforms, enhancing data connectivity and financial visibility—particularly benefiting heavily regulated sectors like banking, financial services, insurance, and healthcare.

Key Players

• API Software Limited

• BlackLine Inc.

• Broadridge Financial Solutions Inc.

• Fiserv Inc.

• Intuit Inc.

• Oracle Corporation

• ReconArt Inc.

• Sage Group plc

• SmartStream Technologies ltd.

• Trintech Inc.

• Xero Limited

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=4891&flag=C

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include a thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape, and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No: +1-631-791-1145

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.