Understanding Accounts Payable: Definition, Process, and Best Practices for Businesses

Strong 8k brings an ultra-HD IPTV experience to your living room and your pocket.

Stopping your finances is one of the most important parts of managing a successful company. Whether you’re managing a small shop or a large company, staying on top of accounts payable helps you pay your bills on time and maintain strong relationships with your suppliers. That’s why many businesses turn to bookkeeping services to make the process smoother and more accurate.

In this article, you will explore the definition, process, and best practices for managing accounts payable effectively.

What are Accounts Payable?

Accounts Payable refers to the amount a business needs to pay its suppliers for products or services received on credit. This represents a company's obligations and is usually listed as the current responsibility on the balance sheet.

In simple terms, when a business buys products or services and agrees to pay for them later, the amount owed is recorded as an account payable.As soon as payment is made, the remaining amount will be deleted. Managing this process correctly is important for cash flow, credit ratings, and maintaining good supplier relationships.

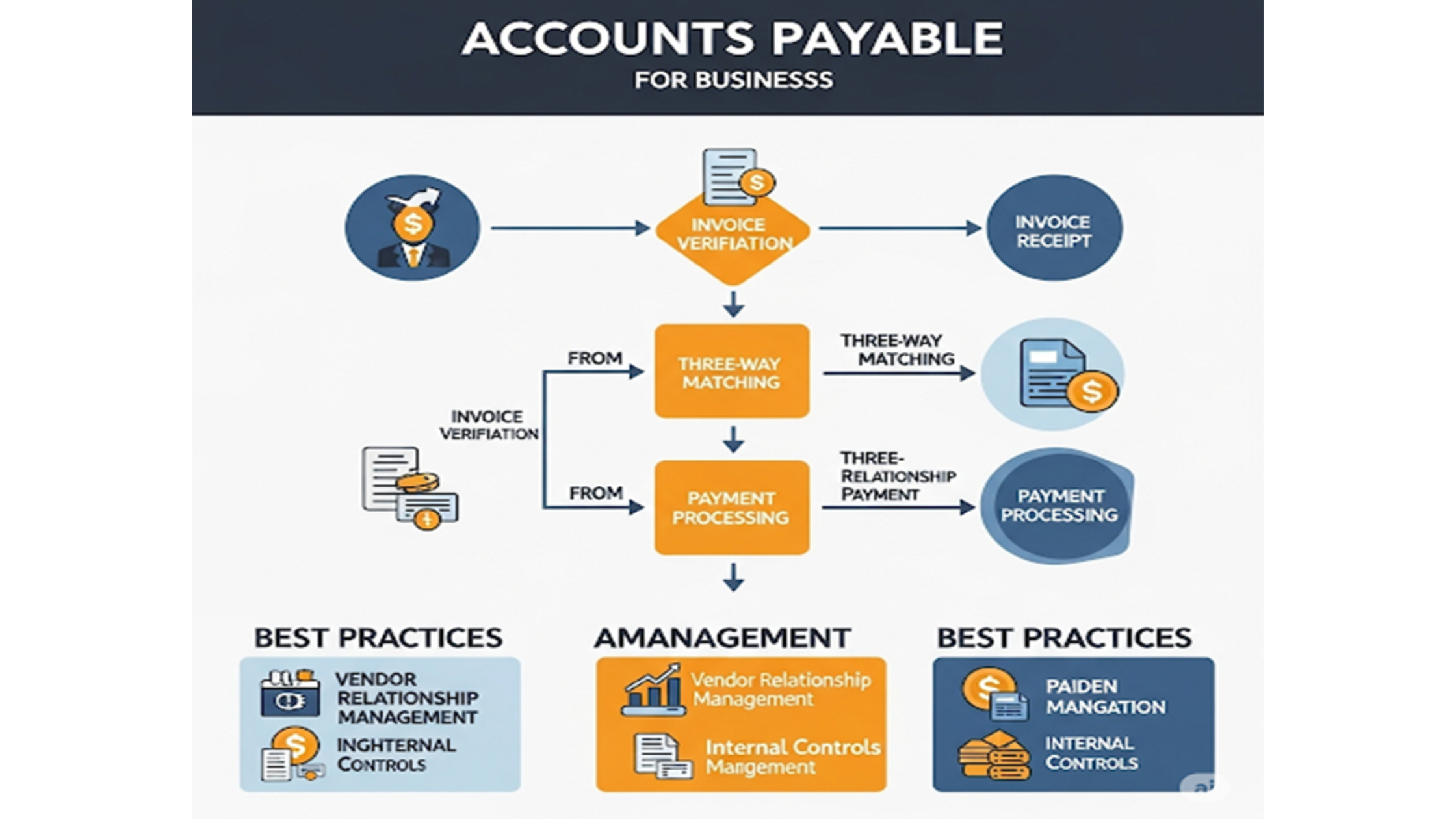

The Account Payable Process

The accounts payable process may seem complex, but breaking it down into simple steps can help you understand how it works.

1. Purchase Order

The process begins when a business places a purchase order (PO) to buy goods or services from a supplier. The PO contains details about what is being purchased, the price, delivery terms, and payment terms.

2. Receiving Goods or Services

As soon as the supplier offers an orderly product or service, the company receives and inspects the article. At this stage, the company may also receive an invoice from the supplier detailing the cost of the goods or services.

3. Invoice Matching

The accounts payable team matches the invoice with the purchase order and the goods receipt note to ensure everything is accurate. This is known as the three-way match. The invoice is prepared for processing if everything is in order.

4. Payment Authorization

Your invoice will be sent for payment processing as soon as it is approved. Depending on the company’s policies, approval from higher management may be required.

5. Payment Processing

After authorization, the company pays the supplier using the chosen method, like a check, bank transfer, or digital payment.

6. Keep Financial Record

The accounts payable team enters the payment into the business's accounting system after it has been made.

7. Reconciliation

Periodically, accounts payable needs to be reconciled with the general ledger to ensure that all payments are accounted for correctly.

Best Practices for Managing Accounts Payable

Managing accounts payable properly helps improve cash flow, avoid mistakes, and keep good relationships with suppliers.

1. Automate the Process

Manual tasks are time-consuming, so using automation and cloud tools makes approvals and payments faster and easier.

2. Build Good Relationships with Vendors

Stay punctual and stay in touch with your suppliers. This will help you generate trust and get better payment terms such as discounts and deadlines.

3. Set Clear Payment Terms

From the beginning, make sure that the terms of payment (such as Net 30 or early payment discounts) are clearly understood. Review and update them based on your business needs.

4. Have a Strong Approval System

Before making any payment, get proper approval. A systematic approval process helps prevent errors, fraud, and duplicate payments.

5. Check Aging Reports Regularly

Aging reports show unpaid invoices and how long they’ve been due. Reviewing them often helps you avoid late payments and plan cash flow better.

6. Use Early Payment Discounts

Some suppliers give discounts if you pay early. Track due dates and grab these offers to save money.

7. Keep Accurate Records

Store all invoices, receipts, and payment records neatly, either digitally or on paper. This supports accurate audits and maintains clear financial records.

Conclusion

Managing accounts payable involves more than paying bills. It helps in consistent cash flow and good relationships with suppliers. Whether a company is small or large, a strong accounts payable process supports long term success.

Businesses can avoid delays, save money, and maintain financial stability by using automation, setting clear payment terms, and checking reports regularly. You can also explore more on smart ways to handle business finances through our latest blogs covering budgeting, cash flow, and payment strategies.

Note: IndiBlogHub features both user-submitted and editorial content. We do not verify third-party contributions. Read our Disclaimer and Privacy Policyfor details.